Macro

Last week, macroeconomic data revealed a robust US economy, characterized by resilient employment and increased productivity, alongside a reduction in labor costs. This suggests non-inflationary growth. Durable goods orders surged by 5.3%, driven by significant bookings, signaling strong business confidence in long-term investment.

The week’s negative highlight was the sharp decline in consumer confidence figures (84.5 instead of the expected 90). This suggests that Americans are concerned about their financial future, posing a significant signal for consumption, a key driver of the US economy.

PPI figures, which increased by 0.5%, indicated persistent inflation, likely a consequence of Trump’s tariffs.

Following Donald Trump’s nomination of Kevin Warsh to succeed Jerome Powell as head of the Fed, gold experienced a significant drop, after briefly surpassing $5,000 an ounce for the first time earlier in the week, to close around $4,907. Silver also fell after reaching its previous record. The dollar, meanwhile, saw a slight rebound, as did bond yields.

Bitcoin also saw a sharp decline, reaching its lowest point since April 2025 at $75,800.

This week, the most anticipated data will be employment figures, including the JOLTS report on Tuesday, the ADP private employment report on Wednesday, unemployment figures on Thursday, and most notably, Friday’s Non-Farm Payrolls (NFP) report. Should these figures align with last week’s trends, it would strengthen the dollar but might disincentivize the Fed from implementing rapid rate cuts.

Additionally, we will have the ISM Manufacturing report on Monday and the ISM Services report on Wednesday.

Summary

- Donald Trump’s Nomination of Kevin Warsh to Replace Jerome Powell as Fed Chair

- Resilient Employment Market

- Strong US Productivity

- Gold, Silver, and Bitcoin Decline

- Deteriorating Consumer Sentiment

News

The week’s primary news was Trump’s nomination of Kevin Warsh to replace Jerome Powell as Fed Chair. Following this announcement, US markets reacted with significant declines, driven by fears of a stricter monetary policy.

Last week also featured corporate earnings reports from major S&P 500 companies, including Meta, Tesla, Apple, and Microsoft. While Meta and Tesla’s results were well-received, Apple’s performance was less impressive, and Microsoft’s earnings notably triggered a sharp decline in the S&P 500. This downturn was fueled by concerns regarding the impact of AI expenditures on the profitability of large technology firms.

Regarding the US government, the likelihood of a partial government shutdown is increasing due to funding impasses in the Senate.

Rumors also circulated regarding a potential merger between SpaceX, Tesla, and xAI, leading to a more than 3% increase in Tesla’s stock price. Close monitoring of Musk’s empire will be necessary, as this news could serve as a significant bullish catalyst for the markets if it materializes.

On the geopolitical front, an agreement reached concerning Greenland has de-escalated tensions with NATO. However, ongoing tensions between the United States and Iran persist, providing support for oil prices.

This week, corporate earnings reports continue, notably featuring Alphabet (Google), Amazon, Walt Disney, Palantir, AMD, and Qualcomm.

Summary

- Significant Disappointment from Microsoft Amid AI Bubble Concerns

- Continued Earnings Reports from Major S&P 500 Companies

Market

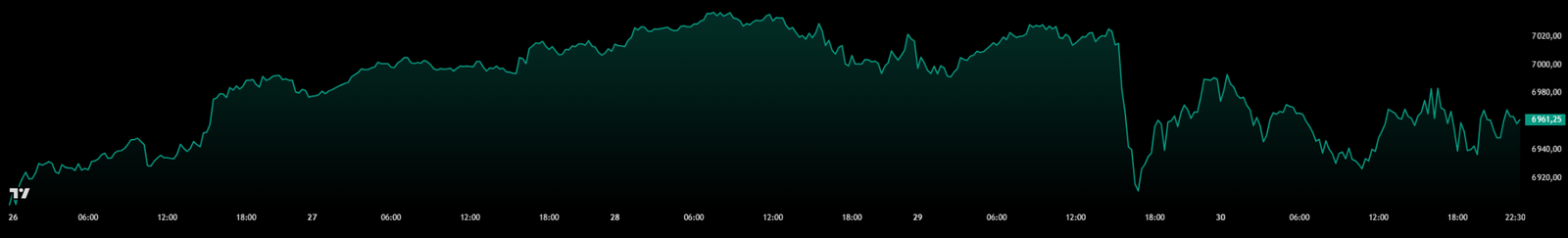

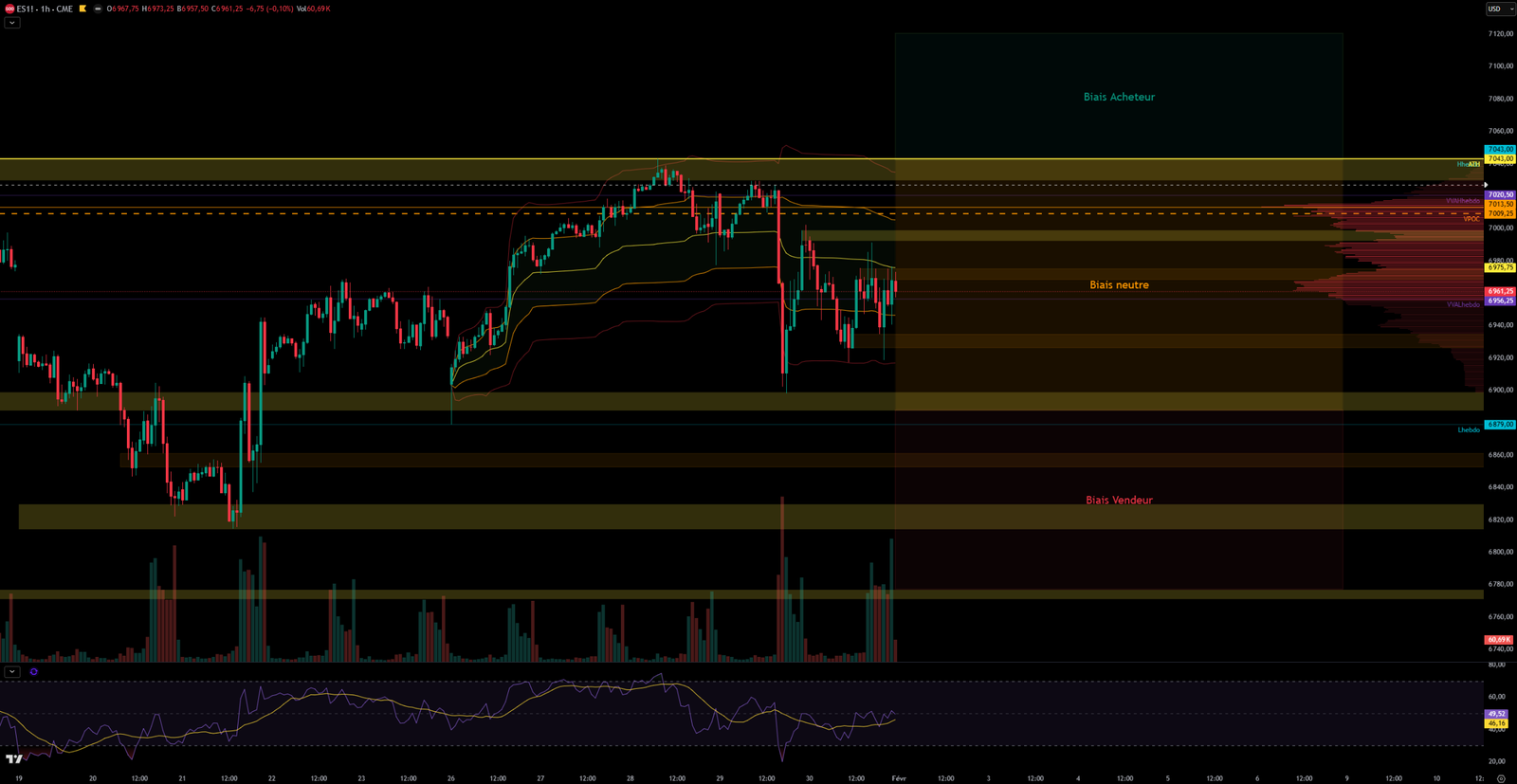

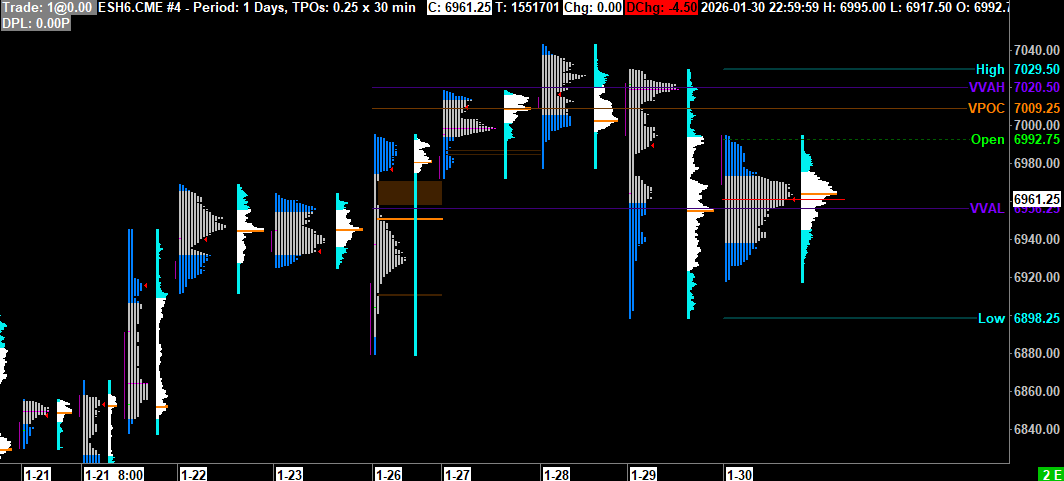

This week was characterized by sharp movements and spikes in volatility (the VIX peaked above 19). The S&P 500 opened the week with a bearish gap, which was quickly filled, suggesting that the price was undervalued.

The index climbed until Wednesday, even establishing a new All-Time High (ATH) at 7,043. The price repeatedly tested the 7,026-7,036 resistance zone for an extended period, particularly on Thursday just before the US market open. At that point, the S&P 500 experienced a significant decline following Microsoft’s previous day’s earnings, which reignited investor concerns about a potential AI bubble.

The price retreated to the week’s early lows at 6,898 before recovering to trade around 6,950 and 7,000, ultimately closing near 6,961. The 7,025-7,036 resistance zone proved to be a formidable barrier that buyers must decisively breach to propel the S&P 500 higher. The 6,982-6,988 zone also significantly constrained the index, reacting to each price approach.

This week, we will observe the repercussions of Trump’s decision regarding Kevin Warsh’s nomination to lead the Fed, replacing Jerome Powell. Monday’s US market open is likely to be volatile. The RSI appears neutral to bearish on the 1-hour chart, and moving averages are closely clustered and relatively flat. Furthermore, the price has fallen below the 200-period moving average on the 1-hour timeframe, which typically signals a bearish outlook.

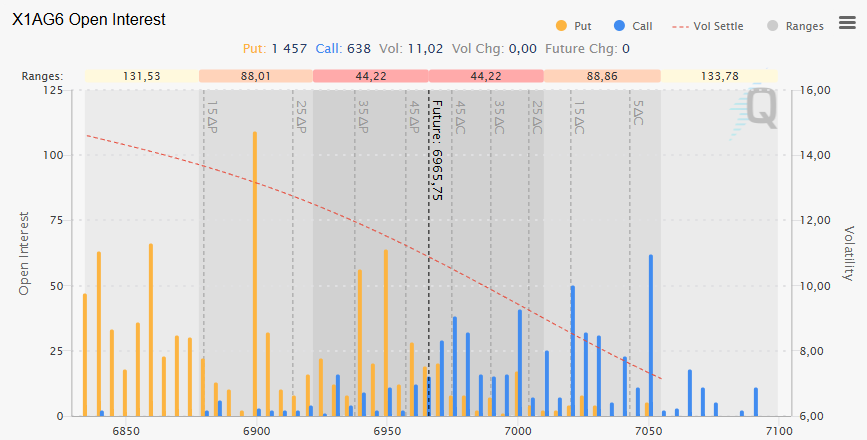

Significant Put option levels are observed at 6,900; this level will be crucial and warrants close monitoring. The 6,900 mark is expected to act as a strong barrier, and a breach could lead to a sustained downward price movement.

My sentiment leans neutral to bearish, despite the lack of a clear trend. The market will need to assimilate these recent movements before establishing a definitive direction. Furthermore, the week-end news is expected to influence the index’s performance starting Monday.

Summary

- High Volatility and Significant Decline at Week’s End

- New ATH at 7,043

Points of Interest

- 7,025-7,043 (Major Resistance Zone + ATH 7,043)

- 6,992-6,998 (Resistance Zone)

- 6,968-6,976 (Support Zone)

- 6,926-6,935 (Support Zone)

- 6,888-6,900 (Support Zone + Significant Put Levels at 6,900)

- 6,879 (Last Week’s Low)

- 6,814-6,830 (Support Zone)

- 6,770-6,777 (Support Zone)

Overall Sentiment: Neutral to Bearish

0 Comments