Same again… ?

Economic Announcements:

- 2:30 PM: Core PCE

- 2:30 PM: GDP

- 3:45 PM : PMI (manufacturing and services)

- 4:00 PM : New home sales (December)

- 4:00 PM: Michigan Index

Earnings Reports:

- Constellation Energy (CEG)

- Warner Bros. Discovery (WBD)

- PPL Corporation (PPL)

Analysis:

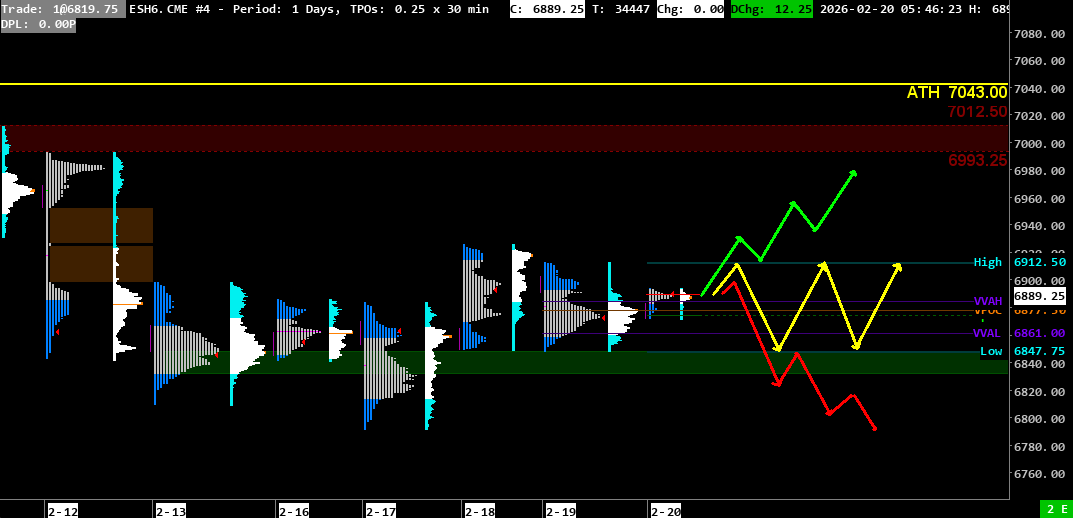

VPOC : 6877.50

VVA : 6861-6884.50

High-Low : 6847.75-6912.50

PP: 6885

Open: 6874.25

VIX: 20.22

SP500 Trend: Overall neutral sentiment 🟠

Yesterday, the S 500 started the day calmly, opening in the prior day’s value area at 6891.7. Price moved sideways around the critical 6900 area, with an attempted upside breakout rejected around 9:30, which pushed price back below the 6883–6900 resistance. Price then consolidated between the 6857–6866 support zone (the boundary of our bearish scenario) and the 6883–6900 resistance.

At the US open, price attempted another breakout of the 6883–6900 resistance zone but came back to test the 6857–6866 support. Overall, it did not move much, with rather erratic swings that still remained contained within the neutral zone, with a brief dip into bearish territory down to the prior day’s low, resting on the weekly VWAP and VPOC. Price ultimately closed around 6880.

Today, the S 500 opens in Zone 1 and is slightly higher. Price has returned to the 6883–6900 resistance zone, breaking above the VVAH-1. It is currently moving sideways in this area. The index shows the same setup as yesterday, with a wait-and-see stance. The 6900 level remains crucial and levels are almost unchanged. For price to finally move higher, it will need to break and hold above 6900 and then fill the single print from Thursday, February 12 at 6928–6952.

Investors appear to have found a price acceptance area for the time being, while awaiting the many data releases this afternoon. We will have Core PCE, GDP, PMI, new home sales, and the Michigan index.

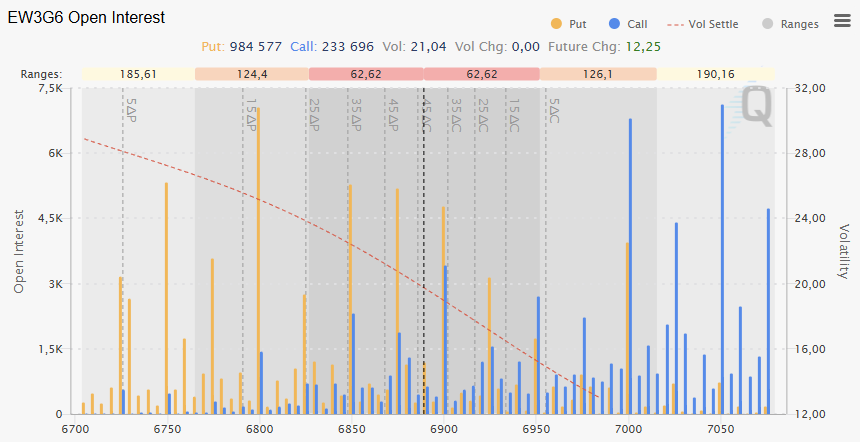

The situation remains rather indecisive for now. The options board confirms this, with puts and calls fairly dispersed. The boundaries nevertheless appear to be 6800 and 7000, with significant puts and calls.

Scenario 1 🟡: On a rejection at yesterday’s high at 6912, price could consolidate in the 6847-6912 zone.

Scenario 2 🔴: On a break below yesterday’s low at 6847, price could move down to the 6815-6830 support, then to 6800.

Scenario 3 🟢: On a break above 6900 and confirmation via a break above 6912, price could move to the single print at 6928-6952, then to the 6993-7000 resistance zone.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance Zone)

- 6928-6935 (Resistance zone + 6928-6953 (Single prints)

- 6883-6900 (Major resistance zone)

- 6862, 6865 (Weekly VPOC and VWAP zone)

- 6857-6866 (Support Zone)

- 6815-6830 (Support zone)

- 6771-6777 (Support Zone)

60-second Chrono

Market situation

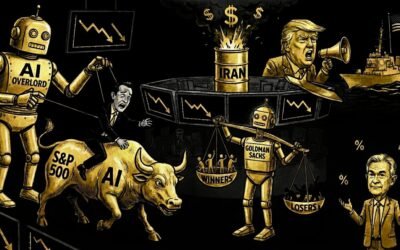

Wall Street ended the day lower, influenced by mixed economic data and disappointing guidance from Walmart. The Nasdaq fell 0.31%, the SP 500 0.28%, and the Dow Jones also posted a decline.

Economy and outlook

The Bureau of Economic Analysis (BEA) is set to release fourth-quarter GDP data, expected at around 3%, down from 4.4% in the previous quarter. Consumer spending is also expected to rise by 0.4% in December.

Commodities Market

Oil prices hit a six-month high, supported by geopolitical tensions between the United States and Iran. The dollar strengthened, while gold prices stabilized.

Corporate Performance

Walmart posted a 4.6% increase in US sales but remains cautious about the economic outlook. Deere Co raised its annual profit forecast thanks to a rebound in its business segments. By contrast, Southern Co expects earnings below expectations.

Upcoming Events

The market is awaiting the release of retail sales and consumer sentiment data, which are expected to influence short-term economic forecasts.

Impact of AI

Concerns were raised about the impact of artificial intelligence across various sectors, highlighting a shift in market expectations.

Unveils Gemini 3.1 Pro with enhanced reasoning capabilities.

The United States puts pressure on Iran

The US military is deploying a broad range of forces to the Middle East, including two aircraft carriers, fighter jets, and refueling aircraft, giving President Donald Trump the option of a major strike against Iran.

Macro

US Economy: Activity remains strong, employment is not weakening

Labor Market: Resilience across the board

- Weekly jobless claims:

Current: 206K

Forecast: 223K

Previous: 229K

-> This is a massive number. Fewer Americans than expected are filing for unemployment, and the figure is sharply down from the previous week. This shows that the labor market remains extremely tight. Companies are laying off very little and still need labor, which supports consumption but keeps pressure on wages and therefore on inflation.

Manufacturing Sector: Industry accelerates sharply

- Philadelphia Fed Manufacturing Index (Feb.):

Current: 16.3

Forecast: 7.5

Previous: 12.6

-> The index far exceeds expectations and confirms the strong health of industry that we had already observed with January Industrial Production. A positive reading indicates an expansion in manufacturing activity in this key region. Factories are running and purchasing managers are optimistic.

Energy: Pressure on crude oil

- Crude oil inventories:

Current: -9.014M

Forecast: 1.700M

Previous: 8.530M

-> This is a major surprise. While analysts were expecting a slight increase in inventories, we are seeing a massive draw. This indicates very strong energy demand or supply disruptions. Mechanically, this pushes oil prices higher, which complicates the Fed’s task because expensive oil fuels headline inflation.

Growth and Housing: A slight, targeted cooling

Atlanta Fed GDPNow (Q4):

Current: 3.0%

Forecast: 3.6%

Previous: 3.6%

Pending home sales (MoM) (Jan.):

Current: -0.8%

Forecast: 1.4%

Previous: -7.4%

-> Growth is slightly revised down to 3.0%, but note: 3% growth remains an objectively excellent and robust figure for the US economy. On the housing side, unlike building permits, pending home sales are falling, proving that today’s high interest rates are still weighing on end buyers in day-to-day activity.

Summary

This new batch of data reinforces the previous conclusion: the US economy is a machine that refuses to slow down.

- Employment and industry as key drivers: Unemployment remains at its lowest and factories are running at full capacity. Recession is off the table.

- The Fed’s hands are tied: With a labor market this tight and oil prices that could rebound following the inventory draw, inflation risk is very real. The Federal Reserve now has absolute confirmation that it should not rush to cut rates. Keeping rates high is more relevant than ever.

0 Comments