The Calm Before the Fed?

Economic Announcements:

- 2:30 PM : Building Permits

- 2:30 PM : Durable Goods Orders

- 3:15 PM : Industrial Production

- 8:00 PM: Fed Minutes

Earnings Reports:

- Analog Devices (ADI)

- Booking (BKNG)

- Moody’s (MCO)

- DoorDash (DASH)

- Occidental (OXY)

- Garmin (GRMN)

- American Water Works (AWK)

- Verisk (VRSK)

- Omnicom (OMC)

- Global Payments (GPN)

Analysis:

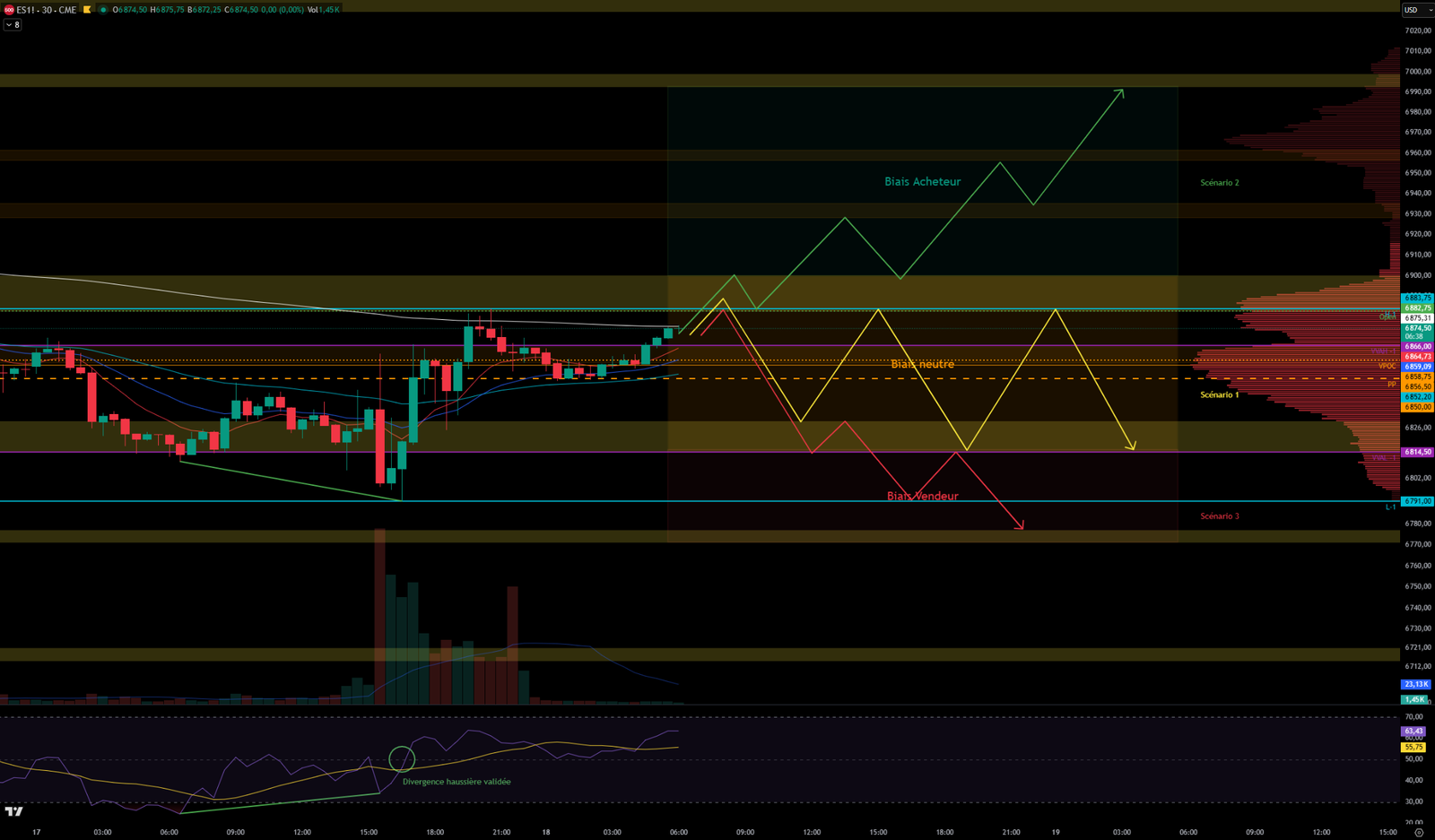

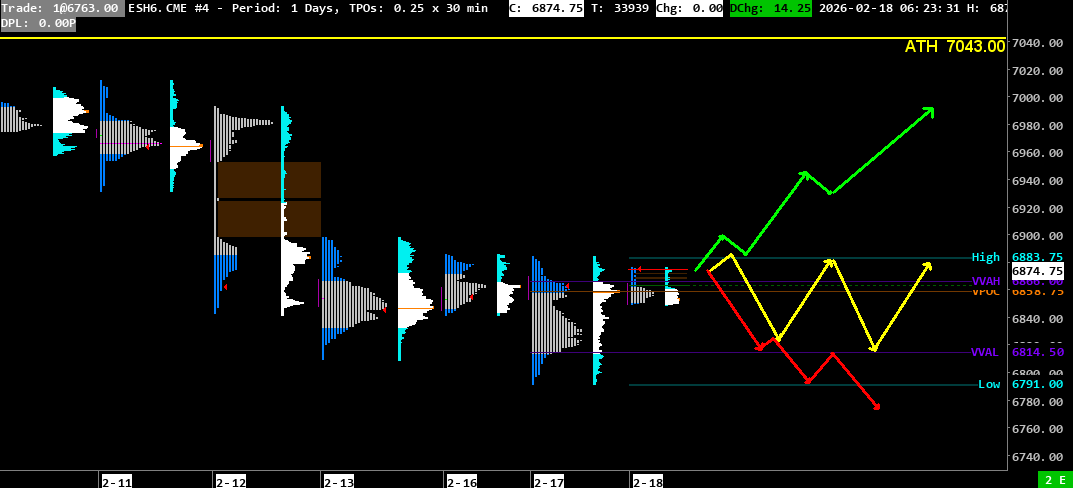

VPOC: 6858.75

VVA: 6814.50 – 6866

High-Low: 6791 – 6883.75

PP: 6850

Open: 6862.75 (Zone 1)

Vix: 20.30

SP500 Trend: Overall Sentiment Neutral 🟠 to Bullish 🟢

Yesterday, the SP500 opened in the previous day’s value area at 6856, on the resistance zone of 6857-6866. Buyers took control and tested the 6883-6900 resistance zone around 10:00 AM but were immediately countered by sellers who pushed the price back into the previous day’s VVA down to VVAL-1 and then to the 6815-6830 support. The price then moved sideways between supports and resistances before the US open.

At the US open, buyers regained control but were once again blocked by sellers at the 6857-6866 resistance. Sellers managed to break the 6815-6830 support zone, stopping at the 6790-6795 support. Throughout the day, we saw rejected buying and selling attempts at the extremes. By the end of the day, the price re-entered the previous day’s value area to close around VVAH-1 at 6860.

Volatility was high yesterday, and the price swung wildly with very rapid movements. The VIX is still above 20, so caution is advised.

Today, the SP500 opens in Zone 1 at 6862, very close to VVAH-1, which it has already broken. The price is heading towards the 6883-6900 resistance zone, which must be broken for any hope of an uptrend. If it succeeds, it could quickly rise, filling the two single print zones at 6900-6925 and 6928-6953. This morning, the price also formed a small single print at 6868-6869.

On the 30-minute RSI chart, we can observe a confirmed bullish divergence, which could confirm an upcoming uptrend, at least in the short term. However, for this to happen, it is imperative to break 6900 and fill the single prints mentioned above. In the meantime, as long as the 6883-6900 zone is not breached, we will remain neutral.

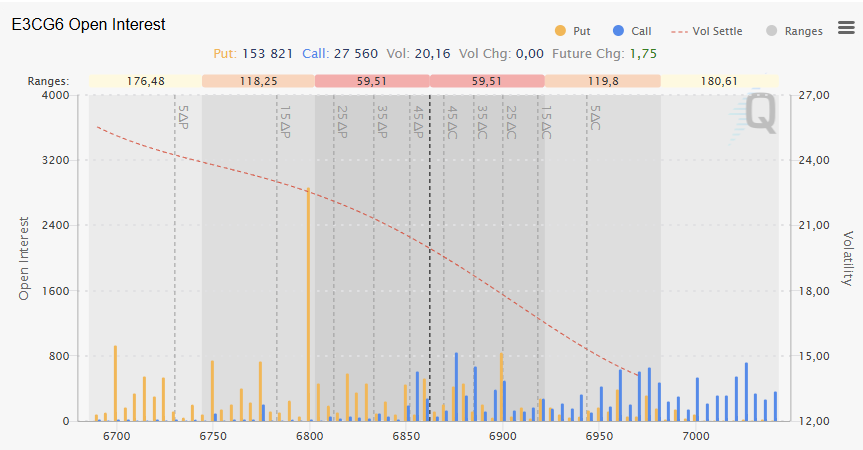

Regarding option interest zones, we can see a large Put coverage zone at 6800, which could form a solid support.

This Wednesday, we will have macro data on building permits, durable goods orders, and industrial production, and most importantly, the Fed Minutes at the end of the day.

Scenario 1 🟡: Upon rejection at the 6883-6900 resistance zone, the price could consolidate within the 6883-6815 zone.

Scenario 2 🟢: Upon breaking the 6900 resistance zone and filling the Single Prints, the price will move upwards and target Thursday’s levels around 7000.

Scenario 3 🔴: Upon breaking the 6830-6815 support zone, the price could resume its decline and target the Puts at 6800, and if broken, aim for the 6770-6777 support zone.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance Zone)

- 6900-6925 and 6928-6953 (Single prints)

- 6883-6900 (Strong resistance zone + Previous day’s high 6883)

- 6857-6866 (Resistance zone)

- 6815-6830 (Support zone)

- 6800 (Major Put options zone)

- 6771-6777 (Support Zone)

- 6740 (Major Put zone)

- 6715-6720 (Support zone)

60-second Chrono

Market Trends

Analysts note increased volatility and market movements influenced by geopolitical and economic factors, with growing interest in artificial intelligence.

Commodities Market

- Oil and gold prices fell, influenced by signs of progress in negotiations between the United States and Iran, which reduced demand for safe havens like gold.

- Brent crude oil fell by 1.84 to reach $67.39 per barrel.

Bond Market

- Treasury yields showed mixed trends, with speculation about a potential rate cut by the Federal Reserve (Fed).

- The dollar index rose, strengthened by geopolitical uncertainty and nuclear negotiations.

Upcoming Economic Data

Release of Fed meeting minutes and durable goods data, with a forecast for a decline in new orders for manufactured goods in the United States.

Corporate Events

- Meta CEO Mark Zuckerberg is scheduled to testify in a case concerning the impact of platforms on children’s mental health.

- Several companies, including Microsoft and DoorDash, are planning major announcements, particularly regarding energy strategy and financial results.

- Warner Bros rejected an offer from Paramount but remains open to a better proposal.

Company Outlook

Companies like Molson Coors and Texas Pacific Land Corp will report results with expectations of declining or stagnant revenues.

Diplomatic Agreement

The Iranian Foreign Minister: We have reached an agreement on the broad principles with the United States.

Macro

Manufacturing Sector: Activity Remains in Expansion in New York

Empire State Manufacturing Index: Strong Resilience

- Current: 7.10

- Forecast: 6.40

- Previous: 7.70

-> This figure is a pleasant surprise compared to analysts’ expectations. Although it is slightly down from the previous month, it confirms that activity remains solid.

Summary

- Activity is maintained, the New York manufacturing sector remains in a growth zone.

- Reassuring signal for the economy: This reinforces the idea that the US industry is not showing significant signs of recession, supporting the scenario of a still resilient economy.

0 Comments