It’s back to business after President’s Day!

Economic Announcements:

- 2:30 PM : New York Empire State Manufacturing Index

Earnings Reports:

- Medtronic (MDT)

- Palo Alto Networks (PANW)

- Cadence Design (CDNS)

- Republic Services (RSG)

- Coca-Cola European (CCEP)

- Vulcan Materials (VMC)

- EQT (EQT)

- Kenvue (KVUE)

- DTE Energy (DTE)

Analysis:

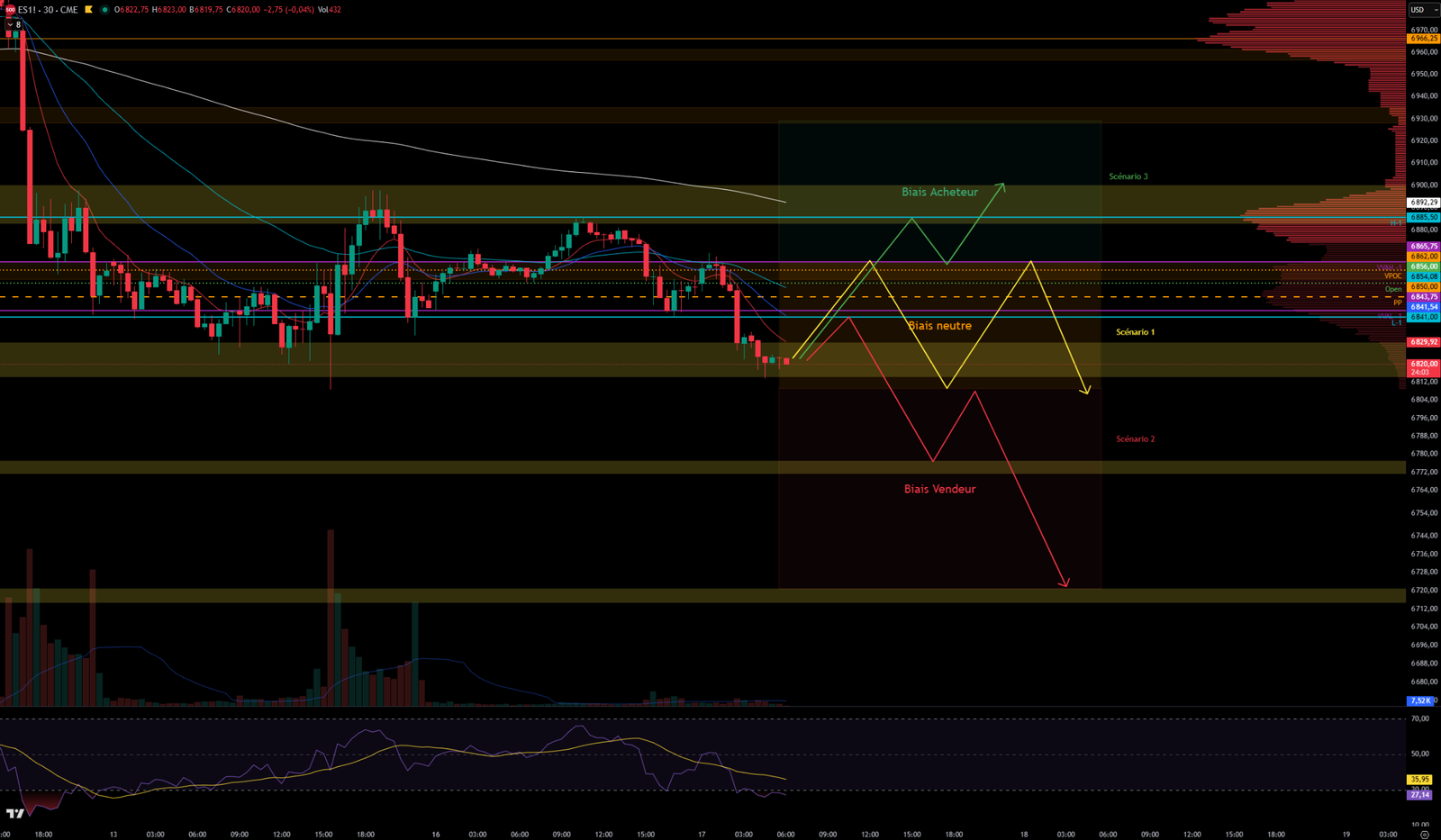

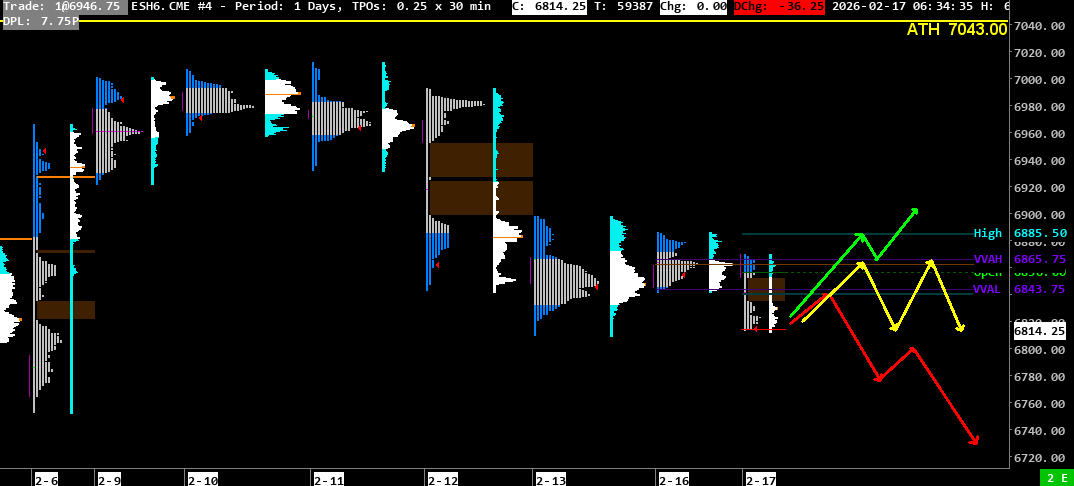

VPOC: 6862

VVA: 6843.75 – 6865.75

PP: 6850

Open: 6856

Vix: 21.19

S&P 500 Trend: Overall Bearish Sentiment 🔴

Yesterday, the S&P 500 experienced a very low-volume day due to President’s Day, a public holiday in the United States. Buyers nevertheless tried to take control to push the price out of VVA-1 by breaking VVAH-1 to test the 6883-6900 resistance zone in the morning. Unsurprisingly, the zone was defended, and the price re-entered VVA-1 in the afternoon after consolidating in the 6872-6883 zone. At the US open, sellers took control to bring the price back to the day’s Open level around 6852.50, a level at which it closed prematurely at 7:00 PM.

Today, the S&P 500 opens in zone 1 at 6856. Buyers attempted to take control and broke VVAH-1, but sellers defended the zone and regained control by re-entering it. After a strong selling push, the price dropped sharply to settle on the 6815-6830 support zone, which it tried to cross. However, 6815 was defended. During its rapid decline, the index created a Single Print at 6835-6852. This zone will form a resistance area. But if it breaks, the price could rise quickly.

The price is currently working the 6815-6830 support zone. Volumes are abnormally high, likely due to the previous day’s holiday. The VIX index, meanwhile, has risen further and stands at 21.19; caution will be needed regarding volatility, especially at the US open.

On the 1-hour chart, we can see a validated bearish divergence on the RSI. The price could start to decline and settle there if it breaks 6815 and the US open follows the trend.

Today, we will not have a lot of macro data, apart from the New York Fed’s Empire State Manufacturing Index, but this should not significantly influence the markets.

Scenario 1 🔴: If the 6815-6830 support zone is broken, the price could continue to fall and target 6800, and if those are broken, the 6771-6777 support zone, then 6715-6720.

Scenario 2 🟡: If rejected at the 6815-6830 support zone, the price could consolidate between this support and the 6857-6866 resistance zone.

Scenario 3 🟢: If the 6857-6866 resistance zone is broken, the price could retest the 6883-6900 resistance zone. 6900 will again be a key level if buyers want to take control.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance Zone)

- 6900-6925 and 6928-6953 (Single prints)

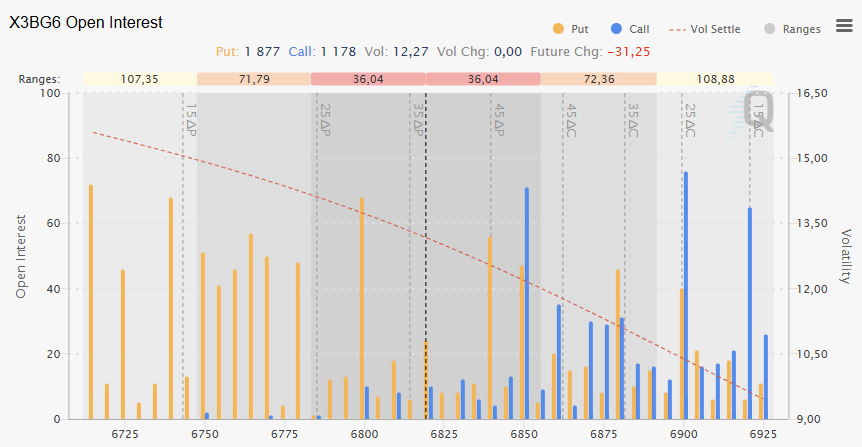

- 6883-6900 (Major resistance zone + Previous day’s high 6885 + Large Call options zone)

- 6857-6866 (Resistance zone)

- 6850 (Major Call options zone)

- 6835-6852 (Single print)

- 6815-6830 (Support zone)

- 6800 (Major Put options zone)

- 6771-6777 (Support Zone)

- 6740 (Major Put zone)

- 6715-6720 (Support zone)

60-second Chrono

Market performance

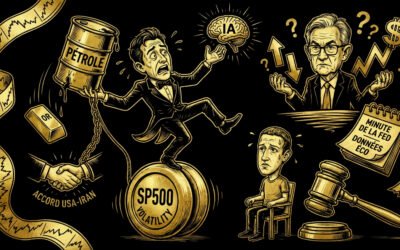

US index futures, particularly the S&P 500 and Nasdaq 100, recorded declines, signaling risk aversion ahead of Wall Street’s reopening after Presidents’ Day. Asian and European equities are also trending lower on reduced volumes. 10-year Treasury yields fell, while the dollar remained little changed.

Commodities

Oil prices rose, supported by an assessment of increased geopolitical risk in the Middle East. Conversely, precious metals retreated, with a notable drop in gold prices.

Economic Expectations and Artificial Intelligence

Market sentiment is disturbed by emerging fears related to artificial intelligence, prompting players like JPMorgan to warn of cannibalization risks in the software and services sectors. In response, Goldman Sachs launched a stock basket to bet on the upside for AI beneficiaries and the downside for threatened companies. Corporate earnings resilience will remain crucial in the face of these disruptions.

Upcoming Events

Investors will monitor ADP private employment figures and the minutes from the Fed’s January meeting to assess the economy. Several Federal Reserve officials, including Michael Barr and Mary Daly, will speak on the labor market, the economy, and the impact of artificial intelligence.

Tech Company News

Apple plans to launch new products at an event on March 4. Meanwhile, Alibaba has updated its flagship AI model to compete with DeepSeek’s upcoming model. AMD is partnering with Tata Consultancy Services to deploy its AI data centers in India, challenging Nvidia in one of the world’s fastest-growing markets.

Mergers, Acquisitions, and Results

Danaher is reportedly close to acquiring Masimo for approximately $10 billion. Additionally, mining group BHP saw its shares climb following a more than one-fifth increase in its half-year profits, driven by soaring copper prices.

Geopolitical Tensions in the Middle East

Geopolitical risks are escalating as Iran conducted naval exercises near a strategic maritime corridor ahead of nuclear talks with the United States in Geneva. Donald Trump threatened to strike the Islamic Republic in the absence of a nuclear deal and mobilized warships in response to the Iranian regime’s recent crackdown.

0 Comments