President’s Day:

Investors on holiday?

Economic Announcements:

- US public holiday : President’s Day

Earnings Reports:

No update

Analysis:

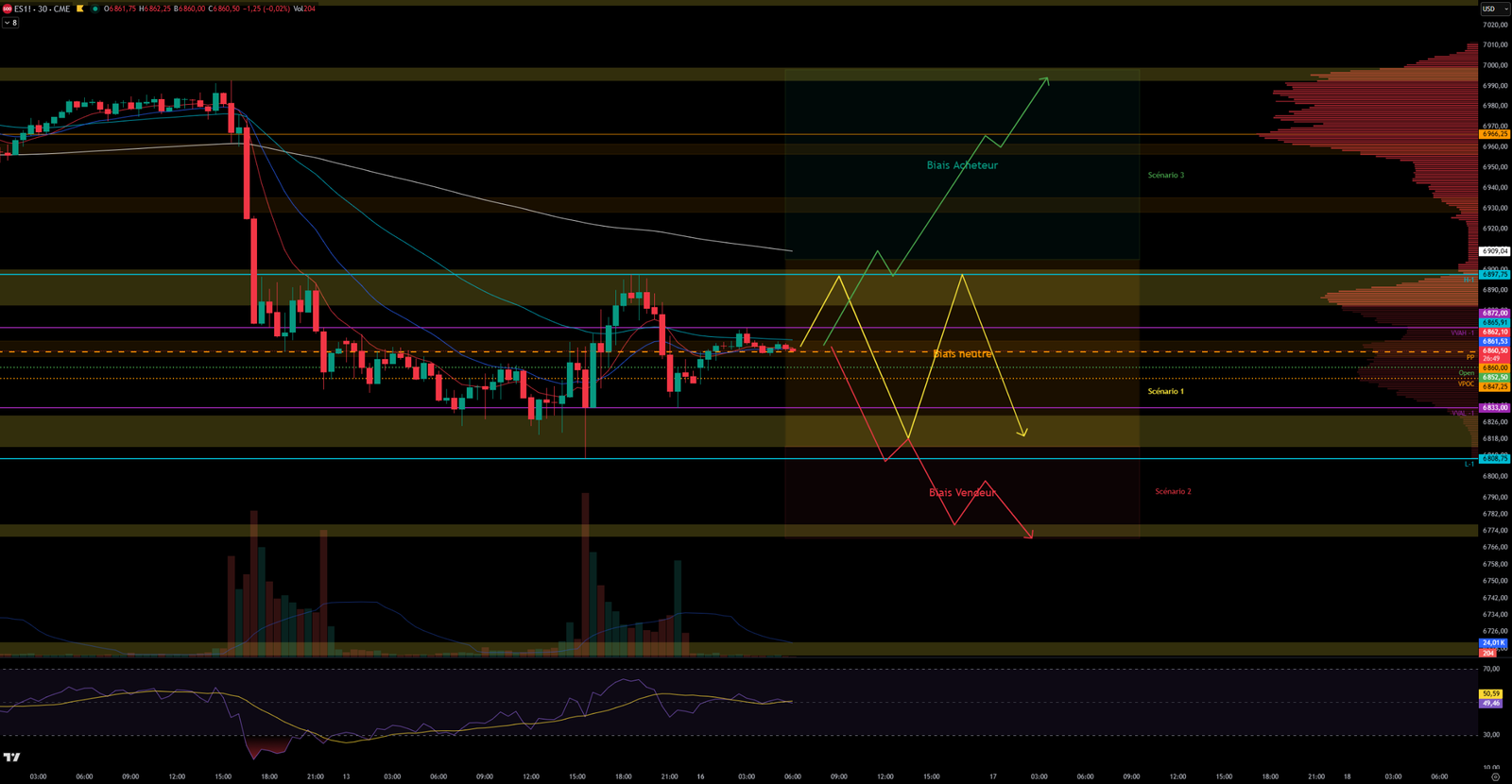

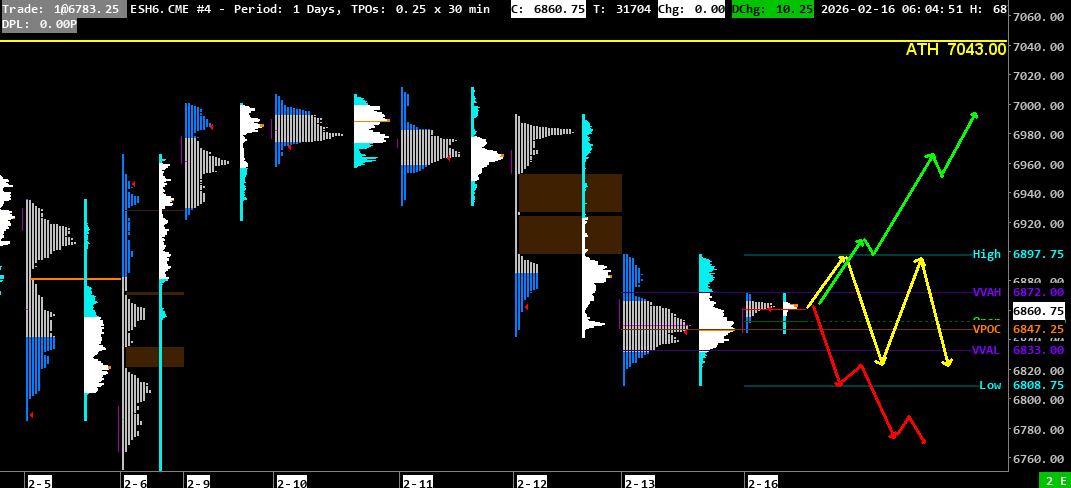

VPOC : 6847.25

VVA : 6833 – 6872

PP: 6860

Open: 6852.50 (Zone 1)

VIX: 20.59

SP500 Trend: Overall neutral sentiment 🟠

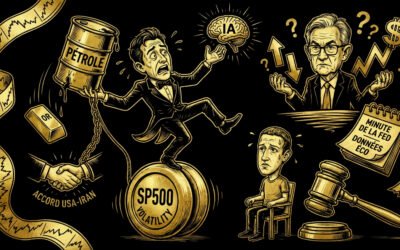

On Friday, the S&P 500 opened between the 6815-6830 support zone and the 6857-6866 resistance zone. The market was waiting for the US inflation data at 2:30 PM. When the data was released, price reacted only slightly, despite a push from buyers that was rejected at the 6857-6866 resistance zone.

At the US open, buyers took control and managed to break above the 6857-6866 zone, but failed to push through 6900, which was still well defended by sellers. After two attempts and the formation of a double top at 6900 that held, sellers regained control and brought price back into the morning range, with the S&P 500 closing around 6850.

The strong inflation figures were not enough to drive a sustained rebound, as conflicting data on US consumer spending and housing, along with fears around the tech and AI sectors, cooled the markets.

Today is a US public holiday for President’s Day. The market is likely to lack volume and could be tricky. Caution is required—or simply do not trade—especially as the VIX (fear index) remains elevated at 20.59.

This morning, the S&P 500 is opening in Zone 1 (within Friday’s value area) at 6852 and is currently working the 6857-6866 area. Price tested the VVAH-1 but was rejected without any real breakout attempt. Price is stable for now and should remain so this morning as long as it stays within VVA-1 between 6833 and 6872.

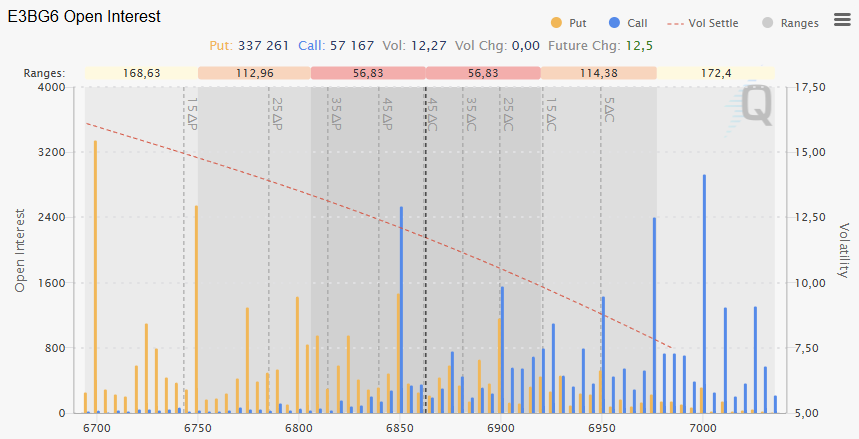

The options market is showing Put zones at 6800, as well as 6750 and 6700, with investors hedging against a potential further decline. Calls are also present at 6850, 6900, and 7000. This highlights market indecision, with delta also fairly neutral this morning.

Scenario 1 🟡: On a rejection at the 6883-6900 resistance zone, price could spend the day ranging between 6900 and the 6815-6830 support.

Scenario 2 🔴: On a break below the 6815-6830 zone, price could break Friday’s low at 6808 and move toward the 6771-6777 support zone.

Scenario 3 🟢: On a break above 6900 and confirmation above 6910, price could quickly fill the single prints at 6900-6925, and possibly the one at 6928-6953.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance zone + major 7000 Call option zone)

- 6956-6963 (Resistance zone)

- 6900-6925 and 6928-6953 (Single prints)

- 6883-6900 (Major resistance zone + Friday’s high 6897.75)

- 6815-6830 (Support zone)

- 6808.75 (Friday’s low)

- 6,770-6,777 (Support Zone)

- 6750 (Major Put options interest)

- 6715-6720 (Support zone)

- 6700 (Major Put options interest)

60-second Chrono

Market performance

The S&P 500 and Dow Jones indices posted gains, supported by inflation data that came in below expectations, reinforcing expectations of an interest-rate cut by the Federal Reserve. Treasury yields fell, and the dollar showed little change.

Commodities

Gold prices rose, while oil prices declined. This move is being driven by expectations around interest rates and inflation.

Economic expectations

Investors are awaiting Walmart’s earnings, with forecasts pointing to above-consensus profit for the fourth quarter. Data on inflation and economic growth are also expected, including the Personal Consumption Expenditures (PCE) Price Index.

Upcoming Events

The New York Fed is set to publish a manufacturing survey, and several Fed officials will speak on various economic topics, including artificial intelligence and its impact on the labor market.

Moderna and Applied Materials

Moderna is looking to expand internationally after an FDA rejection for its flu vaccine, while Applied Materials expects solid results driven by rising AI-related demand.

Easing of sanctions

The United States has eased sanctions against Venezuela, allowing oil companies to engage in production projects.

Technology and patents

Apple and Google lost an appeal regarding a patent review, which could have implications for the technology industry.

Ukraine – Russia

A Russian Black Sea port was targeted by a drone strike ahead of peace talks. Ukraine’s General Staff confirmed the attack on the port of Taman in a statement on Telegram, without providing details on the extent of the damage.

Warner Bros

Warner Bros Discovery Inc. is considering reopening sale talks with Paramount Skydance Corp after receiving its new revised offer, which could trigger a second bidding war with Netflix Inc. Paramount submitted revised terms addressing several concerns, including covering compensation owed to Netflix (estimated at $2.8 billion) and committing to secure a refinancing of Warner Bros’ debt.

Macro

Inflation (CPI): Disinflation is confirmed

Headline CPI (overall inflation): A positive surprise

- Actual: 0.2% (Monthly) / 2.4% (Year-over-year)

- Forecast: 0.3% (Monthly) / 2.5% (Year-over-year)

- Previous: 0.3% (Monthly) / 2.7% (Year-over-year)

-> This is excellent news for the economy. The figures show up in “red” on the calendar because they are below expectations, but in economics, lower-than-expected inflation is positive for consumers. Year-over-year inflation falls to 2.4%, getting very close to the Fed’s ultimate 2% target. This suggests that price increases are slowing faster than analysts expected. This is generally bearish for the US dollar (USD) but bullish for equity indices (S&P500, Nasdaq).

Core CPI (underlying inflation): Resistance persists

- Actual: 0.3% (Monthly) / 2.5% (Year-over-year)

- Forecast: 0.3% (Monthly) / 2.5% (Year-over-year)

- Previous: 0.2% (Monthly) / 2.6% (Year-over-year)

-> Core CPI (which excludes energy and food, considered too volatile) is perfectly in line with expectations. While the year-over-year figure ticks down slightly, the monthly figure edges up. This shows the Fed that the fight is not completely over: the “core” of inflation remains somewhat sticky. This tempers the enthusiasm from the headline number.

Summary

An overall reassuring release that supports the soft-landing scenario.

- Headline inflation declines: The drop to 2.4% is a strong signal that prices are cooling.

- The Fed can breathe: These figures do not justify raising rates, and they open the door to future rate cuts if the trend continues.

- Trading impact: In theory, this weakens the US dollar because rates will remain stable or decline, and it supports risk assets as monetary pressure eases.

0 Comments