Economic Announcements:

- 2:30 PM : Unemployment

- 4:00 PM: Existing home sales

Earnings Reports:

- Applied Materials (AMAT)

- Arista Networks (ANET)

- Vertex (VRTX)

- Howmet (HWM)

- Airbnb (ABNB)

- American Electric Power (AEP)

- Zoetis Inc (ZTS)

- Public Storage (PSA)

- Entergy (ETR)

- CBRE A (CBRE)

- Alnylam (ALNY)

- Ingersoll Rand (IR)

- Iron Mountain (IRM)

- Expedia (EXPE)

Analysis:

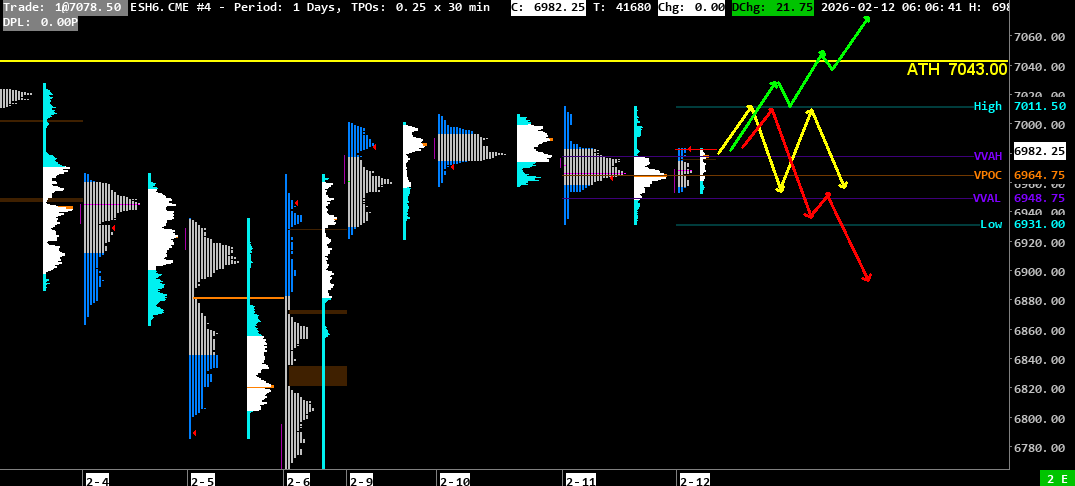

VPOC : 6964.75

VVA : 6948.75 – 6977.75

PP: 6970

Open: 6964.50 (Zone 1)

VIX: 17.64

SP500 Trend: Overall neutral sentiment 🟠

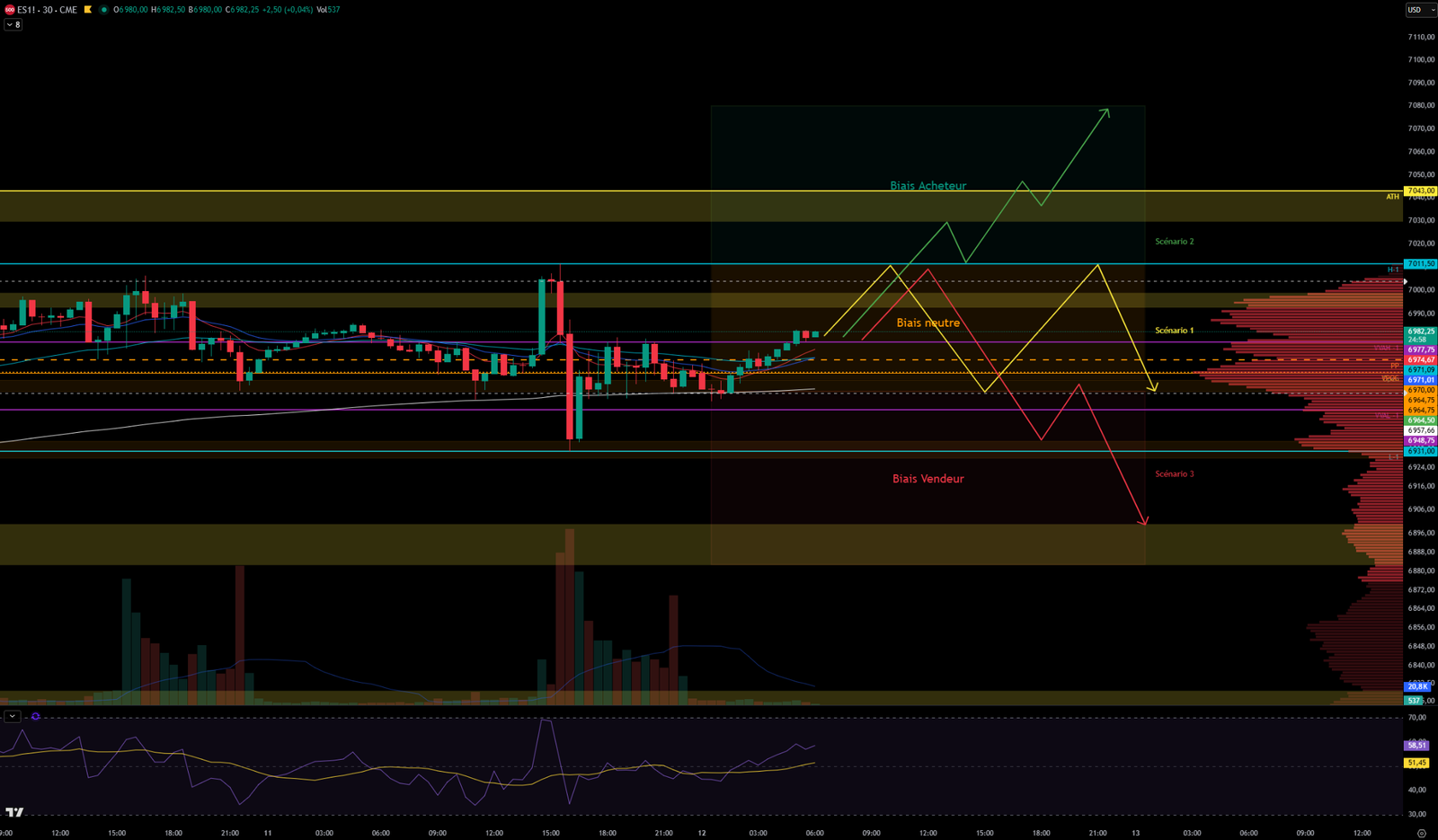

Yesterday, the S 500 continued to trade sideways between the 6960–6966 and 6992–7000 support/resistance zones. A reaction was expected on the release of the employment numbers, which indeed occurred after the strong data: price attempted another breakout above 7000 (stopped at 7011) but then fell back to the 6929–6935 support. After that, price returned to the early-week range to finish quietly on the 6960–6966 support and below VVAL-1. The index therefore followed the range scenario, with the 7000 wall still refusing to give way entirely.

Today, the S 500 opened at 6964.50 in the middle of yesterday’s value area, but has just broken below VVAH-1. The index tested the 6956–6962 support zone and is now heading toward the well-known 6993–7000 area. The 7000 zone has been tested three times since the start of the week and, even though each attempt has pushed slightly higher, the area is still being defended by sellers. This level remains the key for any potential upside. The 6960–6966 support level has been slightly lowered to 6956–6962, slightly widening the range established after Wednesday’s employment announcement.

Since the start of the week, there have been quite a few spikes in selling volume, which could indicate that sellers are being absorbed on each attempt at a sharp drop.

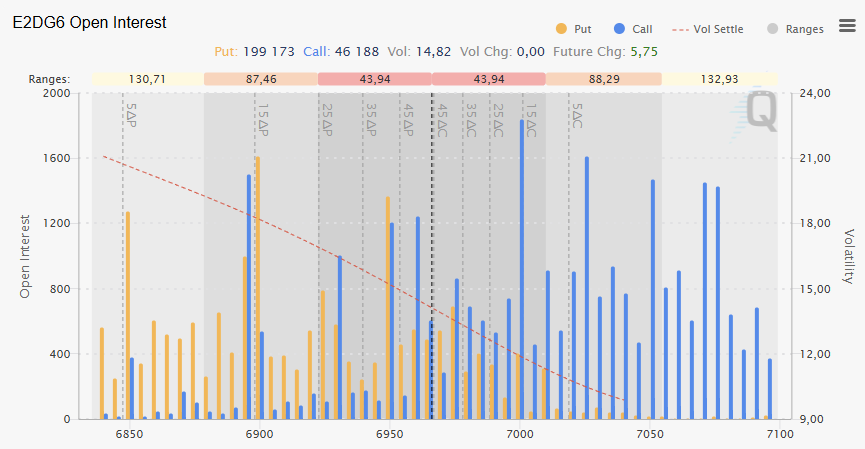

In the options market, we can see a huge volume of puts around 6900, showing that investors are hedging against a potential decline. This level therefore forms a wall that would need to be broken if price is to move lower.

It is very likely that investors are waiting for Friday’s inflation data before taking meaningful positions. Inflation remains the Fed’s primary concern in the face of such a strong labor market.

Today, we will get the unemployment data as well as the existing home sales figures.

Scenario 1 🟡: On another rejection at 7000, price could continue to consolidate in the 6956-7000 area

Scenario 2 🟢: On a clean break above 7000 and confirmation with a break above 7011, price could move toward the 7030-7043 resistance zone

Scenario 3 🔴: On a break below the 6956-6962 support zone and confirmation by a break below VVAL-1, price could pull back and target 6930, then 6900.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 7011 (Yesterday’s high)

- 6993-7000 (Resistance Zone)

- 6956-6962 (Support zone)

- 6930-6935 (Support zone + Yesterday’s low)

- 6882-6900 (Support zone)

- 6857-6866 (Support Zone)

- 6814-6830 (Major Support Zone)

60-second Chrono

Market context

Wall Street closed slightly lower, with Treasury yields higher and the dollar index also higher, following robust jobs reports.

Employment data

The Department of Labor released figures on jobless claims, with a slight decline in initial claims expected.

Sectoral Trends

- Kraft Heinz has suspended its breakup plans due to challenging conditions in the food industry.

- T-Mobile raised its 2027 revenue outlook, supported by strong adoption of its premium plans.

- Hilton expects room-revenue growth to come in below expectations, due to reduced spending by budget-conscious travelers.

Market Reactions

Markets reacted to the employment data, with analysts noting that strong job growth could influence the Federal Reserve’s interest-rate decisions.

Company performance

Roku and GlobalFoundries expect solid results, while Generac missed expectations due to lower demand for generators. Lyft saw its shares fall, raising questions about its ability to meet long-term profitability targets.

Consumer economy

The article highlights a growing split in consumption, with premium brands thriving while value-focused companies struggle.

Economic Outlook

Analysts expect the Federal Reserve to keep interest rates steady in the short term, but they are considering possible cuts in the future.

Canadian tariffs

The U.S. House of Representatives, led by Republicans, passed a bill aimed at ending President Donald Trump’s tariffs on Canada, signaling growing concern over the White House’s economic agenda ahead of a midterm election focused on affordability.

Macro

Employment and Activity (Last week’s delayed NFP report)

Nonfarm payrolls (NFP): The positive surprise

- Actual: 130K

- Forecast: 66K

- Previous: 48K (revised from 48K or prior headline figure)

-> The result crushes expectations. The U.S. economy created twice as many jobs as forecast. This shows incredible resilience in the labor market. For a trader, it means a recession is not imminent. The dollar could appreciate sharply on this news.

Unemployment rate: Full employment persists

- Actual: 4.3%

- Forecast: 4.4%

- Previous: 4.4%

-> Unemployment is falling, which is very positive for the real economy but makes the central bank’s job harder. With a rate this low, employees have more leverage to negotiate wages. It is a clear signal of pure economic strength.

Private-sector job creation: Trend confirmation

- Actual: 172K

- Forecast: 70K

-> This figure validates the NFP. With 172K private-sector job gains, we can clearly see that businesses are hiring aggressively. The economic engine is running at full speed.

Inflation and Wages (The Fed’s warning signal)

Average hourly earnings (Monthly): Inflation pressure

- Actual: 0.4%

- Forecast: 0.3%

- Previous: 0.1%

-> This is the negative number in the report for equity markets. Wages are rising faster than expected (0.4% vs. 0.3%). If people earn more, they spend more, which fuels inflation. The Fed hates that. It could force them to keep interest rates higher for longer.

Average hourly earnings (Year over year): A sustained increase

- Actual: 3.7%

- Forecast: 3.6%

-> Same conclusion year over year: it is above expectations. As long as this figure does not fall back toward 3% or lower, inflation will remain “sticky.”

Participation rate: More workers

- Actual: 62.5%

- Previous: 62.4%

-> A slight increase. This is healthy. It means people who were inactive are returning to the labor market. The fact that unemployment is falling even as more people are looking for work shows very robust labor demand.

Summary

The U.S. economy is overheating (for better and for worse).

- Activity is strong: Businesses are hiring aggressively (explosive NFP), sweeping away fears of an immediate recession.

- Inflation is a threat: Wages are rising too quickly (0.4% monthly), which will worry the Fed.

Energy and Commodities

Crude oil inventories: A cold shower for buyers

- Actual: 8.530M

- Forecast: -0.200M

- Previous: -3.455M

-> This is an extremely bearish result for oil prices. It is a huge surprise. While the market expected inventories to decline slightly, they surged by more than 8.5 million barrels! This means there is suddenly far more supply available than anticipated. Under the law of supply and demand: if supply rises sharply and demand does not keep up, prices must fall.

Cushing, Oklahoma crude inventories: The hub is filling up

- Actual: 1.071M

- Previous: -0.743M

-> This figure confirms the first. Cushing is a key location in the U.S.: it is the physical delivery point for WTI crude futures. Seeing inventories rise at this specific location indicates that oil is physically building up in storage tanks. It is not being consumed by refineries. This is an additional negative technical signal that supports the downside move.

Summary

The oil market is suddenly flooded with black gold.

- Massive surplus: The gap between the forecast (inventory draw) and reality (massive build) is striking.

- Expected reaction: The barrel price (WTI) should drop immediately after this release.

- Economic interpretation: Either U.S. production was very strong, or demand (refineries turning crude into gasoline) slowed more than expected.

0 Comments