Economic Announcements:

- 4:00 PM : Consumer Confidence

- 8:00 PM: Trump Speech

Earnings Reports:

- UnitedHealth (UNH)

- Rtx Corp (RTX)

- Boeing (BA)

- Texas Instruments (TXN)

- NextEra Energy (NEE)

- HCA (HCA)

- Northrop Grumman (NOC)

- United Parcel Service (UPS)

- Seagate (STX)

- General Motors (GM)

- PACCAR (PCAR)

- Roper Technologies (ROP)

- Sysco (SYY)

- LVMH (LVMH) (EU)

- …

Analysis:

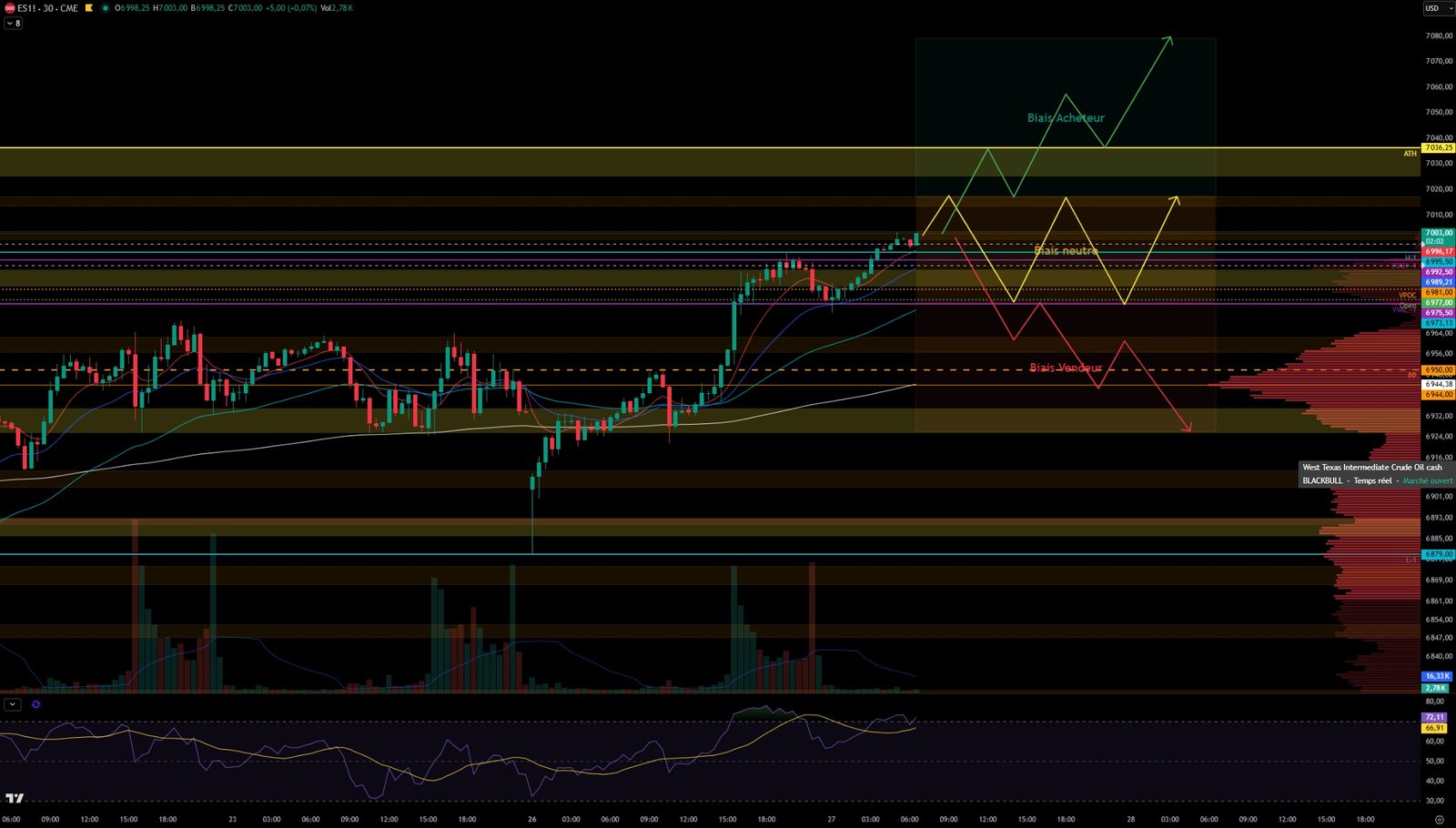

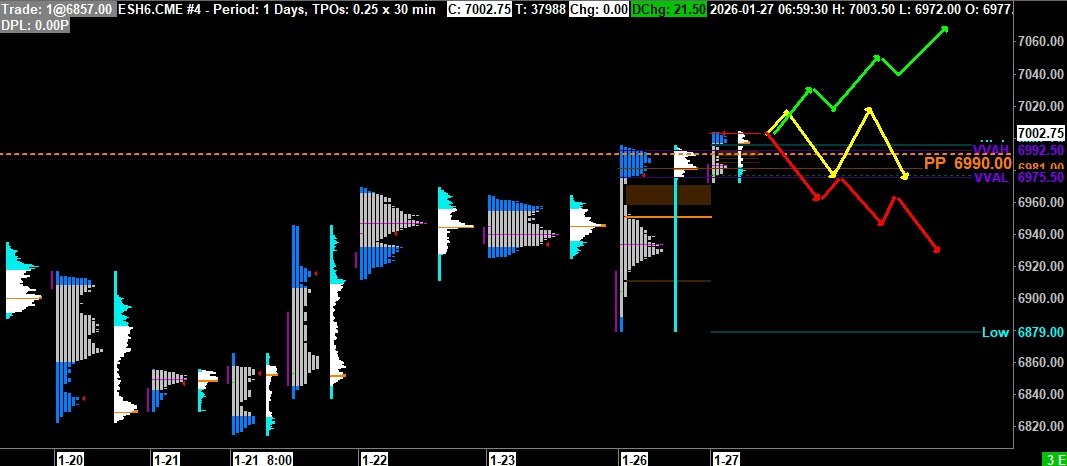

VPOC : 6981

VVA : 6975.50 – 6992.50

PP: 6990

Open: 6977

Vix: 16.14

SP500 Trend : Overall bullish sentiment 🟢

Yesterday, the S&P 500 opened with a large bearish gap at 6904. However, buyers reacted quickly and rejected the price below the 6890-6896 support zone with a large wick, indicating the price was too low. Buyers brought the price back between last week’s support and resistance zones, specifically 6925-6930 and 6944-6950, where the index consolidated throughout the morning.

At the US open, buyers maintained control and drove the price to fill the remaining bearish gap that persisted after last week’s early decline. During its ascent, the index created a single print from 6955 to 6970 which could act as support.

For the rest of the day, the price tested the major resistance zone at 6982-6988, breaking it at the end of the day, but without reaching 7000 as might have been expected. The price closed below this resistance zone after a slight selling reaction at the close (6980).

This morning, the S&P 500 opened in zone 1 at 6977, and buyers are already in control with bullish cumulative delta and RSI. The price broke out of VVA-1, reached the symbolic 7000 level, and is currently testing the 7000-7003 resistance zone. If the price establishes itself above this level, there is a strong chance that the S&P 500 will target its ATH at 7036.

Today, we will have quite a few company earnings reports, including S&P 500 companies like Boeing and UnitedHealth, before the earnings of several members of the Magnificent 7 tomorrow. Donald Trump is also scheduled to deliver a speech at 8 PM; therefore, attention should be paid to volatility at that time.

Scenario 1 🟢 : Upon a break of the 7000-7003 resistance zone and confirmation by a break of the 7014-7017 zone, the price could target the ATH at 7036 and establish a new one.

Scenario 2 🟡 : Upon rejection at the 7014-7017 zone, the price could consolidate within the 6975 and 7014 zone.

Scenario 3 🔴 : Upon a break of VVAL-1 at 6975 and confirmation by a break of yesterday’s VPOC at 6981 and filling the single print from 6970 to 6955, the price could target 6924.

Zones of Interest:

- 7025-7036 (major Resistance Zone + ATH 7036.25)

- 7014-7018 (Resistance Zone)

- 7000-7003 (Resistance Zone)

- 6982-6988 (Support Zone)

- 6975 (VVAL-1)

- 6956-6963 (Support Zone)

- 6944 Weekly VPOC

- 6925-6935 (Major Support Zone)

60-second Chrono

Commodities Market

- Gold : The yellow metal reached record highs of over $5,100, attracting investors seeking safety amid rising geopolitical tensions.

- Oil : Prices fell after a previous rally, as traders consolidated their gains.

Corporate Performance

- Boeing : Is set to announce its fourth-quarter results, following a recovery year marked by increased production and sales. However, the company continues to face financial challenges.

- General Motors and UnitedHealth Group : Are also expected to release their earnings, with expectations of losses for GM due to electric vehicle-related impairments.

US Economy

- Consumer Confidence : The index in the United States may have increased, suggesting a positive perception of the economy despite uncertainties.

- Capital Goods Orders : Non-defense orders continue to increase, indicating growth in investment spending.

Geopolitical Events

- Weather : A winter storm caused massive flight cancellations in the United States, disrupting transportation.

- Tensions : Geopolitical tensions, particularly between the United States and Iran, are influencing markets, especially the oil sector.

Technology and Regulation

- Regulation (X) : The European Commission has launched an investigation into Elon Musk’s X platform regarding consumer safety concerns.

- Microsoft : The firm unveiled a new generation of artificial intelligence chips, aiming to compete with Nvidia.

Future Outlook

- Federal Reserve : Investors are monitoring the FED’s announcements regarding interest rates, with potentially significant implications for financial markets.

Macro

Industry and Investment: A Spectacular Industrial Rebound

Core Durable Goods Orders (Excluding Transportation)

-

Current: 0.5%

-

Forecast: 0.3%

-

Previous: 0.2%

-> The “Core” figure is the most closely watched as it excludes volatile sectors such as aerospace. A 0.5% increase (versus 0.3% expected) shows that core business investment in machinery and equipment remains strong. This is a sign of long-term business confidence in the economy.

Durable Goods Orders (Overall Index)

-

Current: 5.3%

-

Forecast: 3.1%

-

Previous: -2.1%

-> The jump is massive. Moving from a contraction of -2.1% to an expansion of 5.3% far exceeds all forecasts. This surge is often due to large orders in the defense or aviation sector. Even if volatile, this injects a significant amount of liquidity into the industrial production chain.

Summary:

These figures indicate a solid US economy and do not prompt the FED to lower its rates quickly.

0 Comments