Economic Announcements:

- 7:30 PM: Waller FED Speech

Earnings Reports:

- Becton Dickinson (BDX)

- Arch Capital (ACGL)

- Cincinnati Financial (CINF)

- ON Semiconductor (ON)

- Loews (L)

- Waters (WAT)

- Principal Financial (PFG)

- UDR (UDR)

- Amentum Holdings (AMTM)

Analysis:

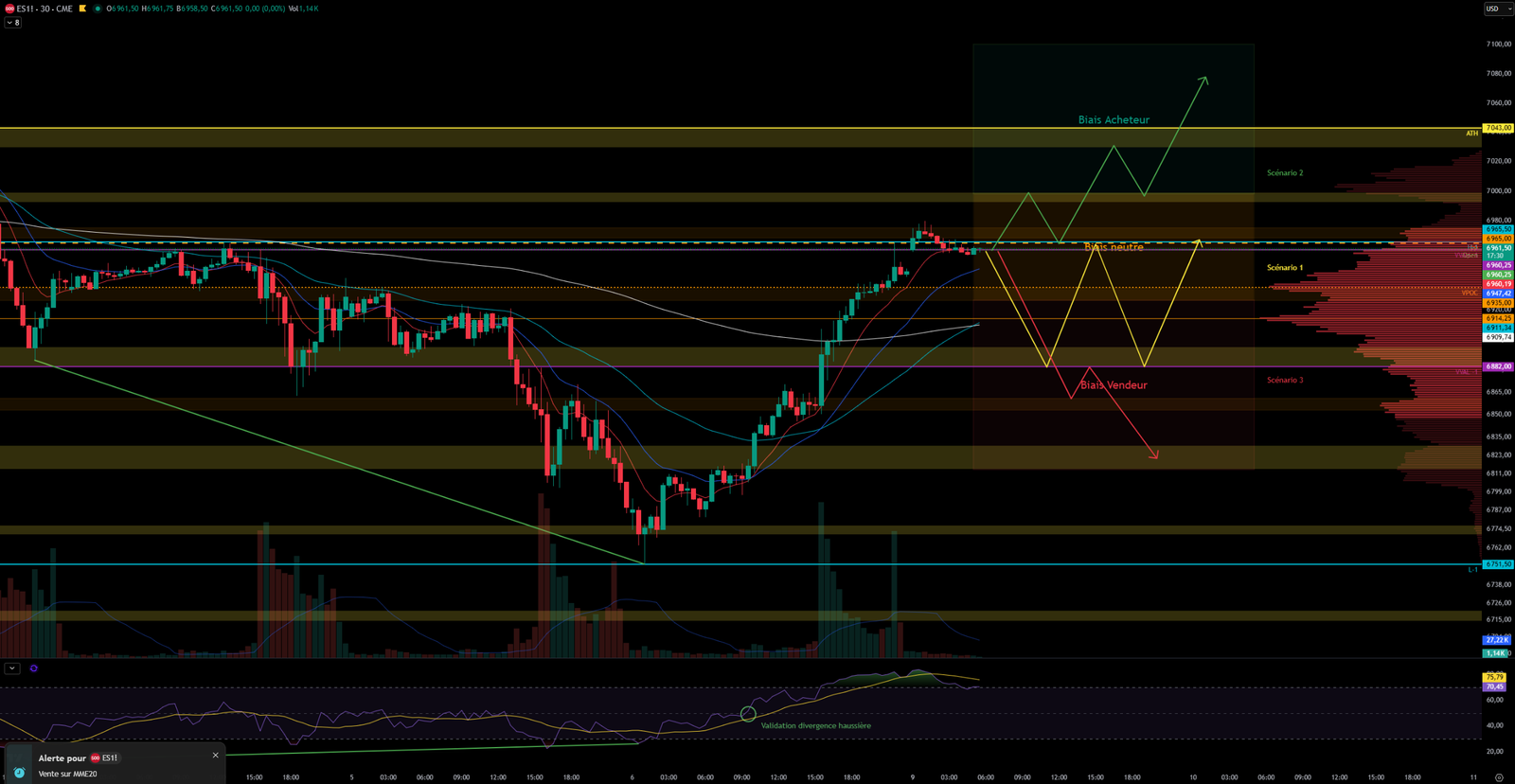

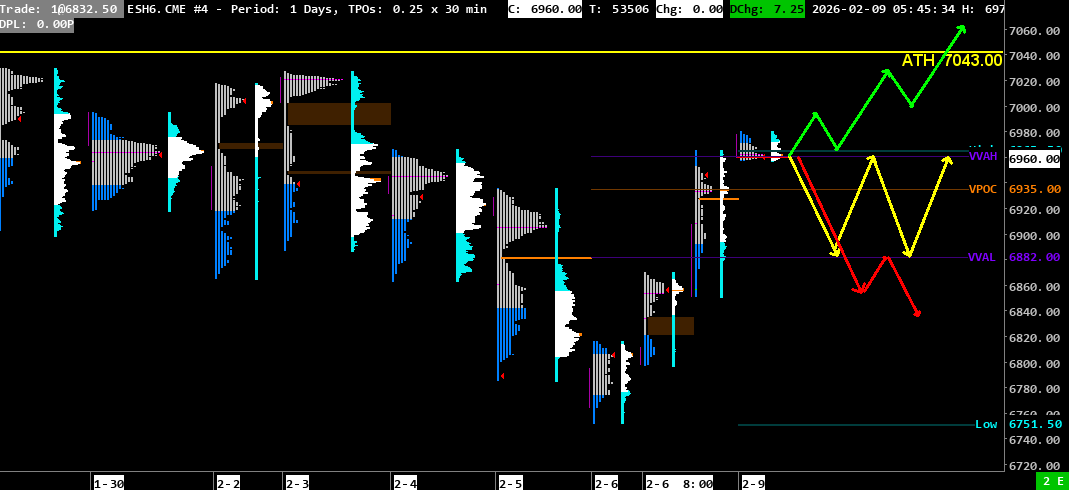

VPOC: 6935

VVA: 6882-6960.25

PP: 6965

Open: 6960.25 (Zone 1)

Vix: 17.77

SP500 Trend: Neutral 🟠 to Bullish 🟢 overall sentiment

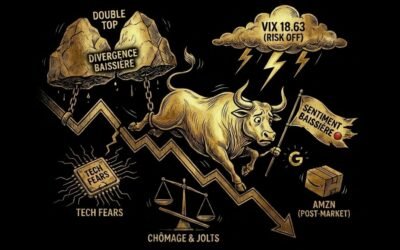

On Friday, the SP500 experienced a significant upward day after a sharp drop earlier in the week due to fears in the tech sector. In a single day, the index recovered almost all of its losses and closed around 6945, gaining 2.26%. It also formed two single prints during its ascent: one at 6820-6835 and a shorter one from 6870 to 6873.

The Dow Jones set a new record above 50,000, and gold surpassed $5,000 an ounce. Bitcoin moved back above $70,000.

This morning, the SP500 opens with a bullish gap at 6960, above the VVAH-1. The SP500 is currently working this level, which will act as a strong magnet, containing the VVAH-1, the open, and Friday’s high. The divergence on the daily chart has been invalidated by the RSI returning to the buying zone, and the bullish divergence on the 30-minute chart remains valid. Bullish sentiment dominates this morning, and there should be no major changes today as there will be no macro data. However, we will have to wait for the US open to see if this trend is sustainable.

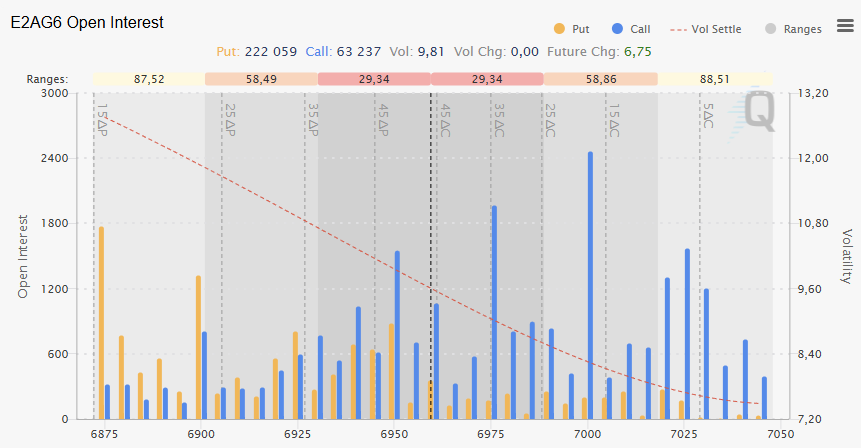

Options open interest shows strong call interest at 7000, a zone that could be difficult to break.

Scenario 1 🟡: Upon rejection above 6965 and reintegration of VVA-1 at 6960, the price could consolidate within VVA-1 between 6960 and 6882

Scenario 2 🟢: Upon breaking Friday’s high at 6965 and confirmation with the break of the resistance zone at 6993-7000, the price could continue its rise and target the major resistance zone at 7030-7045, which has previously halted the price.

Scenario 3 🔴: Upon breaking VVAL-1 at 6882, the price could decline and target the support zone at 6815-6830, thus filling the single print at 6820-6835.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance Zone)

- 6960-6965 (Resistance Zone + VVAH-1 + Open)

- 6927-6935 (Support Zone + Weekly VPOC)

- 6883-6900 (Support Zone + VVAL-1)

- 6857-6865 (Support Zone)

- 6814-6832 (Support Zone)

- 6751 (Friday’s Low)

- 6715-6722 (Support Zone)

- 6625-6640 (Major Support Zone)

60-second Chrono

Market Performance

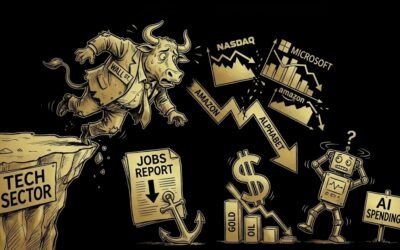

- The Dow Jones reached a record 50,000 points, supported by the rise in Nvidia and other chipmaker stocks.

- Treasury yields showed mixed signals ahead of an upcoming jobs report.

- Gold prices increased, favored by a weaker US dollar.

Nikkei Record

The Nikkei index reached a new high of 57,337.07, with a 5.6% increase, thanks to political clarity provided by Takaichi’s victory. The broader index also recorded a 3.4% rise.

Upcoming Events

- Several Federal Reserve members will participate in discussions on economic topics, including digital assets and monetary policy.

- Important economic data, including employment and inflation reports, are expected in the coming days.

Company Reports

- Companies like Ford, Cisco, DuPont, and Spotify are preparing to release their earnings, with varied expectations regarding profits and revenues.

- Investors will closely monitor annual forecasts and the impacts of economic trends on company performance.

Economic Trends

- The artificial intelligence market is raising concerns among investors, particularly regarding increased competition and profit margins.

- Concerns about large companies’ spending on AI have emerged, affecting stock valuations.

Consumer Sentiment

- Consumer sentiment in the United States reached its highest level in six months, although concerns persist regarding the labor market and inflation.

Inflation and Employment

- Upcoming employment and inflation data will be crucial in determining the direction of the Fed’s future monetary policies.

Iran-US Nuclear Talks

Iranian President Masoud Pezeshkian described recent nuclear talks with the United States as a “step forward,” while rejecting any form of intimidation.

Macro

Consumer Confidence and Sentiment (Monthly)

Michigan Index – Consumer Expectations: Increased Caution

- Current: 56.6

- Forecast: 56.7

- Previous: 57.0

-> This is a slightly disappointing result. The figure narrowly missed the forecast and marks a decline from the previous month. This means that when consumers are asked how they view their economic future, they are more pessimistic. This is often a leading indicator: if people are worried about the future, they may reduce their spending later.

Michigan Consumer Confidence Index: Unexpected Resilience

- Current: 57.3

- Forecast: 55.0

- Previous: 56.4

-> This is the good surprise of the report. Overall sentiment significantly beat forecasts and surpassed the previous level. This shows that despite pessimism about the future, the perception of the current situation is clearly improving. Higher confidence supports immediate consumption.

Michigan Index – 5-Year Inflation Expectations: Persistent Concerns

- Current: 3.4%

- Previous: 3.3%

-> A slight increase to be closely monitored. Consumers expect inflation to remain high in the long term, up from the previous month. For the FED, this is a signal that inflation expectations are not falling fast enough. This justifies maintaining high interest rates.

0 Comments