Economic Announcements:

- 4:00 PM: Michigan Index

Earnings Reports:

- Toyota Motor… (TM)

- Philip Morris (PM)

- Tokyo Electron Ltd PK (TOELY)

- Itochu ADR (ITOCY)

- KDDI Corp PK (KDDIY)

- Societe Generale ADR (SCGLY)

- Constellation Software Inc (CNSWF)

- Ubiquiti (UI)

Analysis:

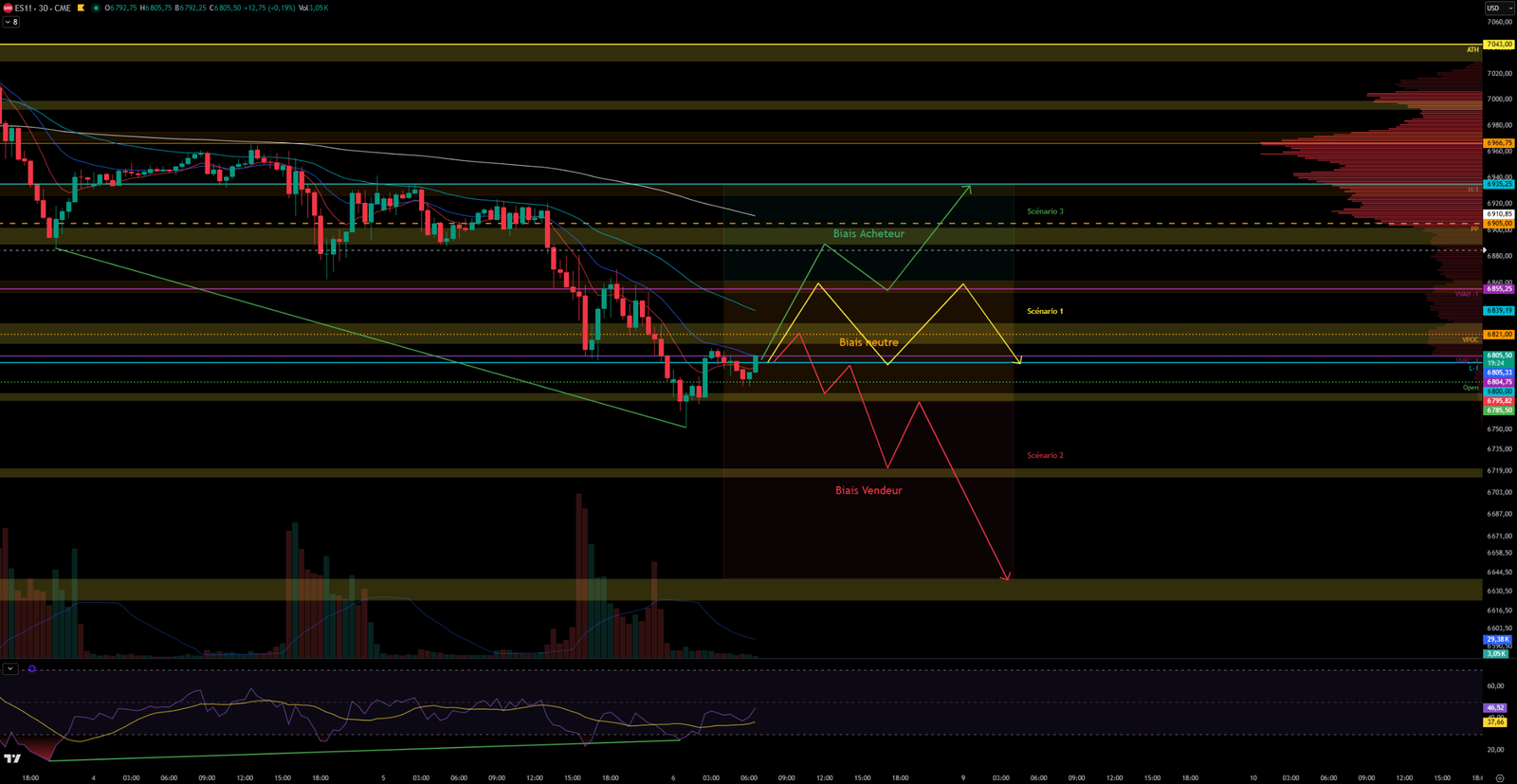

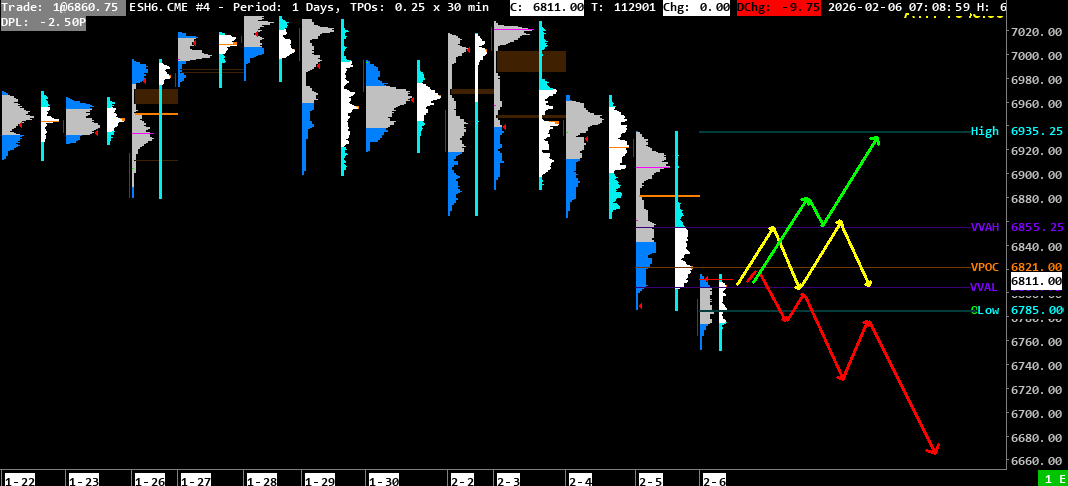

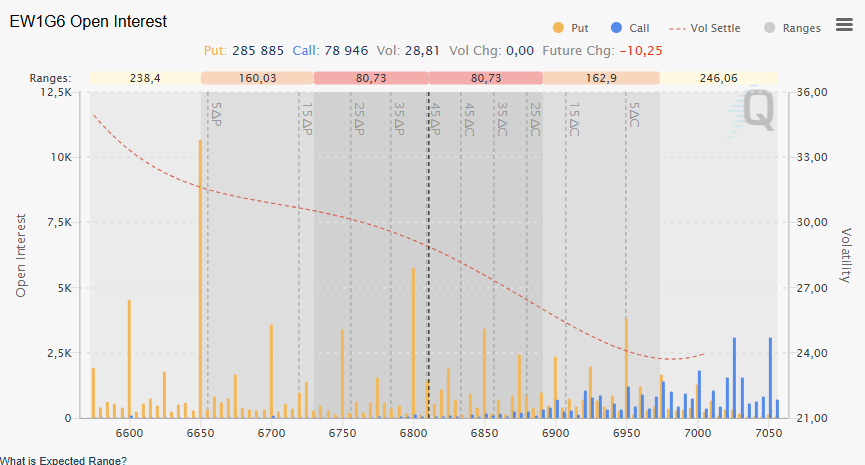

VPOC: 6821

VVA: 6804.75 – 6855.25

PP: 6810

Opening: 6785.50 (Zone 2)

Vix: 21.78

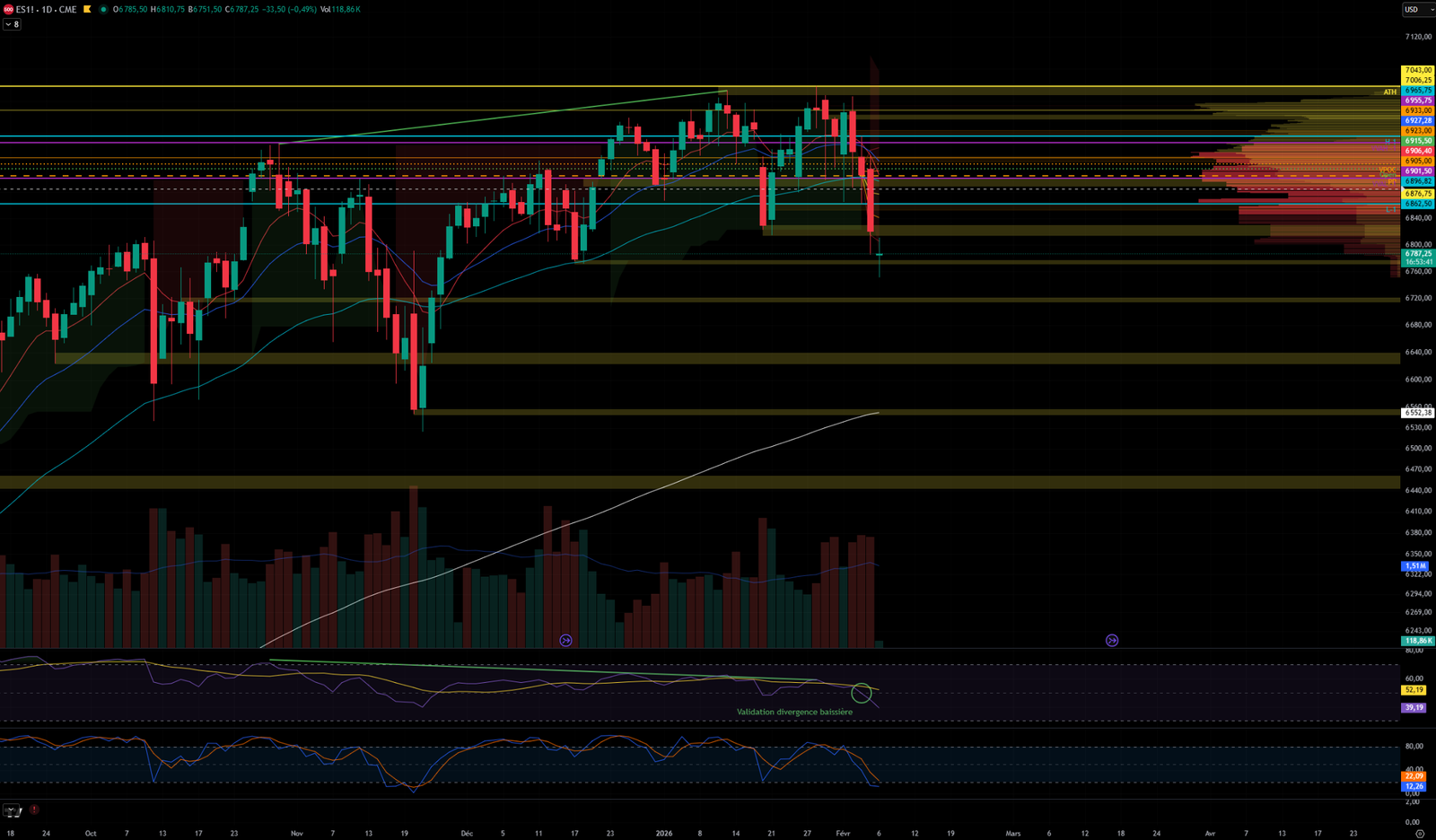

SP500 Trend: Overall neutral sentiment 🟠

Yesterday, the S&P 500 opened in Zone 1 and remained quite stable in the morning, with a test of the VVAL-1 breakout followed by a reintegration. The price moved sideways between VVAL-1 and the resistance zone of 6926-6935 + VPOC-1. At 1:20 PM, sellers attacked, pushing the price down to the lower support zone of 6853-6862 before the US open.

At the Wall Street open, buyers attempted to take control, but more aggressive sellers broke the 6853-6862 zone to test the 6815-6830 support zone. Despite a break, a buyer response brought the price back between 6815-6830 with an attempt to break above 6853-6862. Sellers rejected the price, and an agreement seemed to be found between these two zones. At 9:15 PM, sellers attempted a new attack with a break of the 6815-6830 support, leading to the index closing around 6815. Massive sell-offs in technology stocks heavily weighed on the market, notably with declines in Microsoft, Amazon, and Google shares.

This morning, the S&P 500 opens at 6785.50 in a bearish imbalance. The price is attempting to reintegrate VVA-1 at 6804.75 after trying to break the 6770-6777 support zone before being rejected by buyers. The price could take a small breather today after yesterday’s heavy fall, as a bullish divergence has formed on the 30-minute chart, although it is not yet validated. If confirmed, the price could rebound slightly to return towards 6900. However, the bearish sentiment remains favored in the long term, with the bearish divergence on the Daily chart being validated. The price could return to end-of-2025 levels.

Today, we will not have major macroeconomic data, except for the Michigan Index, which is not expected to greatly influence the markets, as well as some S&P 500 company earnings. Volatility is expected to be high with the VIX perched at 21.78, so caution will be necessary.

Scenario 1 🟡: Upon reintegration of VVA-1 at 6804.75, the price could consolidate around VVA-1 between 6804.75 and 6860

Scenario 2 🔴: Upon breaking yesterday’s low at 6785 and confirmation by breaking the support zone of 6771-6777, the price could resume its decline and target 6720, then the support zone of 6620-6640.

Scenario 3 🟢: Upon breaking VVAH-1 at 6855 and confirmation by breaking the resistance zone at 6853-6862, the price could take a breather and target yesterday’s highs at 6935

Zones of Interest:

- 6968-6975 (Resistance Zone)

- 6926-6935 (Resistance Zone + Yesterday’s High 6935)

- 6883-6895 (Resistance Zone)

- 6853-6860 (Resistance Zone + VVAH-1 6855)

- 6814-6830 (Resistance Zone)

- 6804.75 (VVAL-1)

- 6785 (Yesterday’s Low)

- 6771-6777 (Support Zone)

- 6715-6720 (Support Zone)

- 6624-6640 (Major Support Zone)

60-second Chrono

Wall Street Collapse

Stocks fell, particularly those of tech giants Microsoft, Amazon, and Alphabet, due to a massive sell-off in the technology sector. The Nasdaq reached its lowest level since November.

Labor Market

Treasury yields declined following data showing a weaker-than-expected labor market, with an increase in unemployment claims.

Commodity Markets

Gold and silver prices fell, pressured by a strong dollar, and oil prices also dropped due to negotiations between the United States and Iran.

Upcoming Company Earnings

Several companies, including Philip Morris and Centene, are set to release their earnings, and investors will closely monitor their 2026 forecasts.

Sectoral Trends

The technology sector is experiencing a rotation towards more traditional sectors, while concerns about artificial intelligence (AI) spending are affecting investor confidence.

Market Analysis

Investors must exercise discernment regarding artificial intelligence, as market trends are changing rapidly, and companies once considered winners may now face challenges.

Macro

Employment and Unemployment (Weekly)

Weekly Unemployment Claims: The First Sign of Weakness

- Current: 231K

- Forecast: 212K

- Previous: 209K

-> This is a disappointing figure. There were more new unemployment claims than expected. The number also increased compared to the previous week. This is a very reactive indicator. Seeing this figure rise suggests that layoffs are starting to accelerate slightly. For the dollar, this is a bearish signal as it shows an economy beginning to suffer.

Regular Beneficiaries: Persistence

- Current: 1844K

- Forecast: 1850K

- Previous: 1819K

-> A mixed result, but the figure is slightly better than the forecast. However, note that compared to the Previous figure, the trend is upward. Even if it’s not worse than expected, the total stock of unemployed people is slowly increasing. It is becoming a bit more difficult to find a job quickly.

Labor Demand (Monthly)

JOLTS Report – New Job Openings: Demand Collapse

- Current: 6.542M

- Forecast: 7.200M

- Previous: 6.928M

-> This is the shocking news from the report. The number of available job openings missed forecasts by nearly 700,000 positions! This is a huge discrepancy. Companies are withdrawing their job offers at a rapid pace. Before mass layoffs, companies first stop hiring. This is exactly what we are seeing here. This is a strong signal of an impending economic slowdown.

0 Comments