Economic Announcements:

- 4:00 PM: JOLTS Report (Apparently postponed due to US government shutdown)

Earnings Reports:

- AMD (AMD)

- Merck&Co (MRK)

- PepsiCo (PEP)

- Amgen (AMGN)

- Pfizer (PFE)

Analysis:

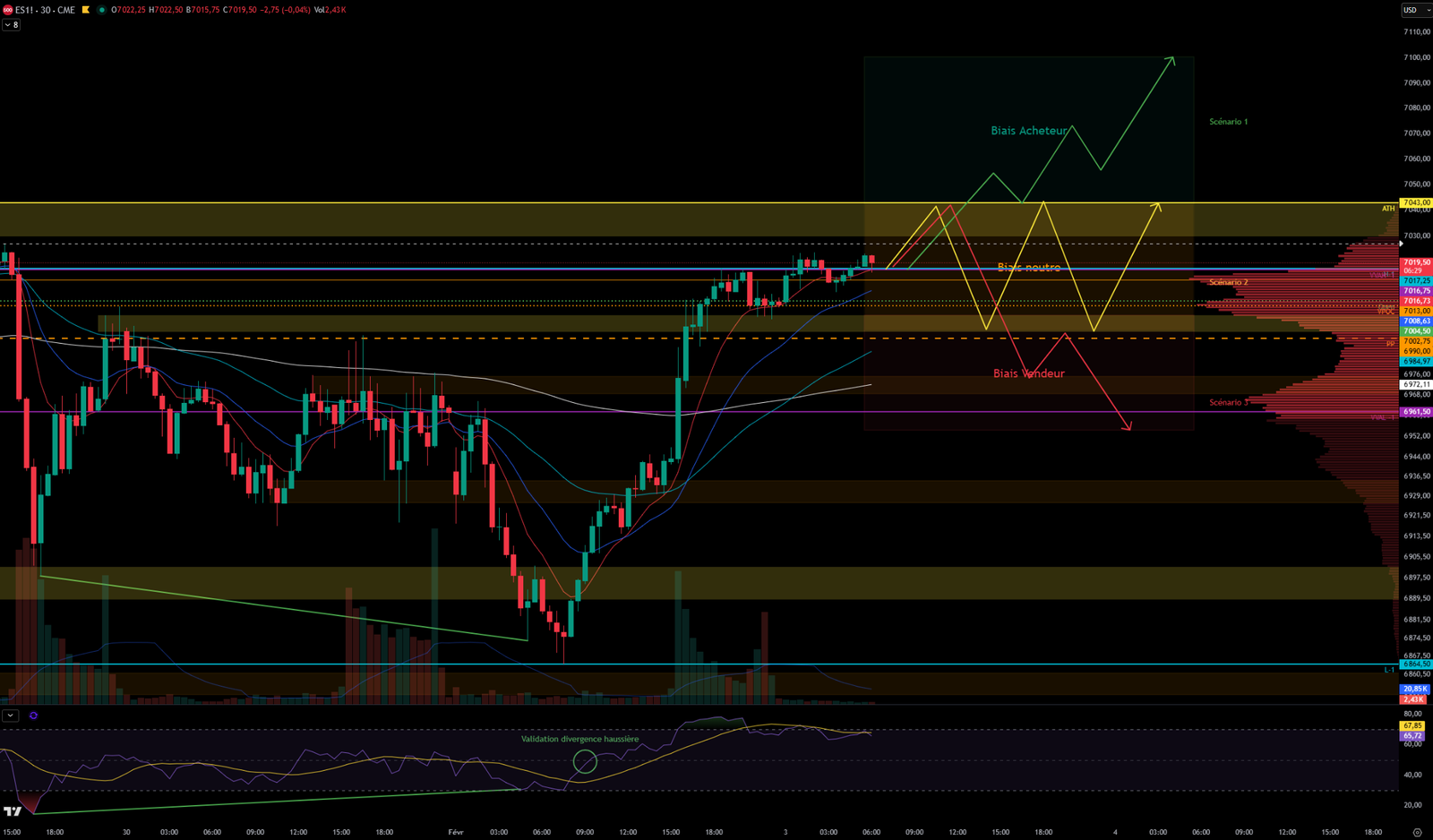

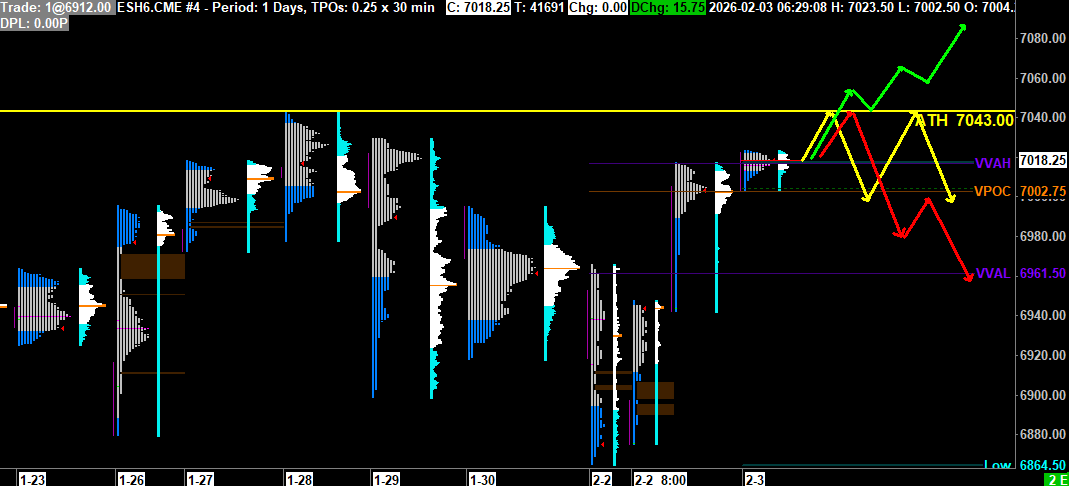

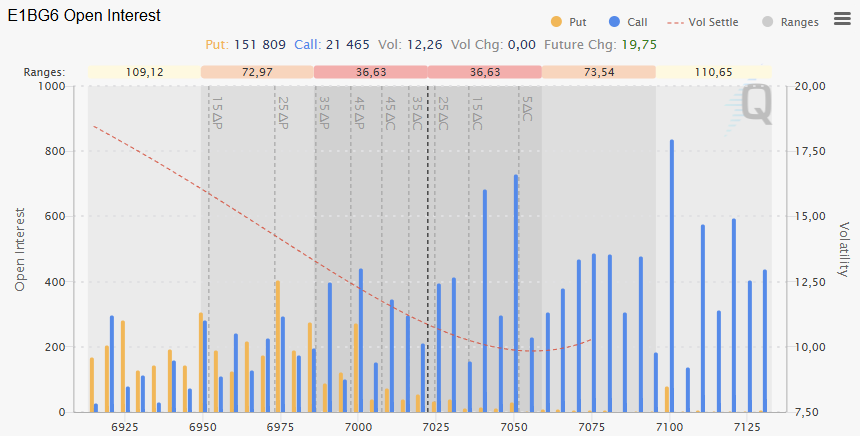

VPOC: 7002.75

VVA: 6961.50 – 7016.75

PP: 6990

Open: 7004.50 (Zone 1)

Vix: 16.35

SP500 Trend : Overall bullish sentiment 🟢

Yesterday, the S&P 500 opened with a bearish gap. This gap was filled, but sellers then took control, driving the index to last Wednesday’s lows around 6860 in a sharp decline, with abnormally high volatility during the Asian session indicating significant profit-taking. At this level, buyers regained control and pushed the price back up.

At 9:00 AM, the bullish divergence identified on the 30-min chart was confirmed, thus validating a bullish reversal that pushed the price back up to the day’s open around 6938 before the US open.

At the Wall Street open, the price surged significantly, simultaneously validating the bullish scenario. The various levels were broken almost instantly. Only the 6992-7000 resistance zone (also including Friday’s high) slightly slowed the price. The price then consolidated above this resistance, which had become support, and up to the 7012-7015 resistance zone. The price then closed around 7005.

The very strong PMI figures showed a recovery in the US economy, reaching 52.6 in January, indicating growth after a period of contraction. However, inflation is still present.

This morning, the S&P 500 opens in Zone 1 at 7004.75, not far from VVAH-1 at 7016.75. After the bullish divergence was confirmed, the price resumed its upward trend, and the S&P 500 is heading towards the 7030-7043 resistance (ATH at 7043), where it has been rejected multiple times. Currently, it is testing VVAH-1, which is also located at yesterday’s high, around 7017.

Indicators are bullish, but the RSI is near the overbought zone. We will need to monitor the price’s reaction to the next resistance at 7030-7045.

Today, we should have received the JOLTS report data, but it might be canceled due to the US government shutdown (no longer mentioned on Financial Juice).

Today, we continue with S&P 500 company earnings, including AMD, Merck & Co, PepsiCo, and Pfizer. Investors are monitoring AMD, still concerned about the tech sector.

Scenario 1 🟢: Upon a break of the 7030-7043 resistance zone and confirmation of a break above 7050, the price could move higher and target 7100.

Scenario 2 🟡: Upon rejection at the 7030-7043 resistance zone, the price could consolidate between 7000 and the 7030-7043 resistance zone.

Scenario 3 🔴: Upon rejection at the 7030-7043 resistance zone and a break of the 6992-7000 support zone, the price could resume its decline and target 6950, towards VVAL-1.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 7016-7017 (Previous day’s high + VVAH-1)

- 6992-7000 (Support zone)

- 6969-6975 (Support zone)

- 6,926-6,935 (Support Zone)

- 6890-6902 (Support zone)

- 6864 (Previous day’s low)

60-second Chrono

Financial Markets

- Wall Street experienced gains, driven notably by chipmakers and artificial intelligence-related companies.

- Treasury yields rose, amid expectations of favorable monetary policy prospects under Kevin Warsh, former Fed governor.

- The dollar strengthened due to a sell-off in precious metals, leading to a flight to safer assets.

US January Employment Report Delayed Due to Partial Government Shutdown

- The U.S. Bureau of Labor Statistics stated that the closely watched January employment report will not be released on Friday due to a partial federal government shutdown.

Corporate Performance

- Pfizer is set to release its fourth-quarter earnings, with a focus on its COVID-related revenues and a pricing agreement with the Trump administration.

- AMD anticipates a significant increase in sales, while Chipotle and Mondelez International also expect revenue increases.

- Disney’s shares declined due to a decrease in international visitors to its parks.

Economic Indicators

- The US Manufacturing PMI showed a recovery, reaching 52.6 in January, indicating growth after a period of contraction.

- In Canada, the Manufacturing PMI also increased, signaling an improvement in the sector.

Mergers and Acquisitions

- Devon Energy and Coterra Energy announce a $58 billion merger to create a leader in the shale sector.

- Other notable acquisitions include Eldorado Gold purchasing Foran Mining and Brookfield Asset Management acquiring Peakstone Realty.

Geopolitical Trends

- Trade tensions and economic policies, including nuclear negotiations with Iran, continue to influence markets.

Macro

PMI ISM

Manufacturing PMI: Confirmation of Growth

- Current: 52.4

- Forecast: 51.9

- Previous: 51.9

-> This figure, released just before the ISM, provided the first indication. We are comfortably above 50 (the boundary between recession and growth). Activity is not just holding steady; it is accelerating slightly.

ISM PMI Index: The Major Surprise

- Current: 52.6

- Forecast: 48.5

- Previous: 47.9

-> This is THE shock figure of the day. The market expected the industry to remain in contraction, but the index exploded upwards. A jump from 47.9 to 52.6 is substantial. This completely invalidates the scenario of an imminent economic slowdown. The American industry is taking off again. For stock indices, it’s a double-edged sword: it’s good for corporate profits, but it raises concerns that rates will remain high for longer.

ISM Employment: End of the Bleeding?

- Current: 48.1

- Forecast: 46.0

- Previous: 44.8

-> Even though we remain below 50, the improvement is clear. Companies are stopping mass layoffs as they see demand returning. This is a reassuring figure for overall economic health.

ISM Prices Paid: Inflation Persists

- Current: 59.0

- Forecast: 59.3

- Previous: 58.5

-> This is the dark spot of the report, even if the figures are lower than expected. This means that factories are paying increasingly more for their raw materials. This is upstream inflation. If production costs increase, consumer prices will also rise later. This figure prevents bonds from easing today and maintains pressure on the FED.

0 Comments