Economic Announcements:

- 2:30 PM : Non-farm Payrolls

- 2:30 PM : Unemployment

- 4:30 PM : Crude Oil Inventories

Earnings Reports:

- Cisco (CSCO)

- McDonald’s (MCD)

- T-Mobile US (TMUS)

- Shopify Inc (SHOP)

- Applovin (APP)

- Equinix (EQIX)

- Hilton Worldwide (HLT)

- Motorola Solutions (MSI)

- Martin Marietta Materials (MLM)

- Westinghouse Air Brake (WAB)

- Rollins (ROL)

Analysis:

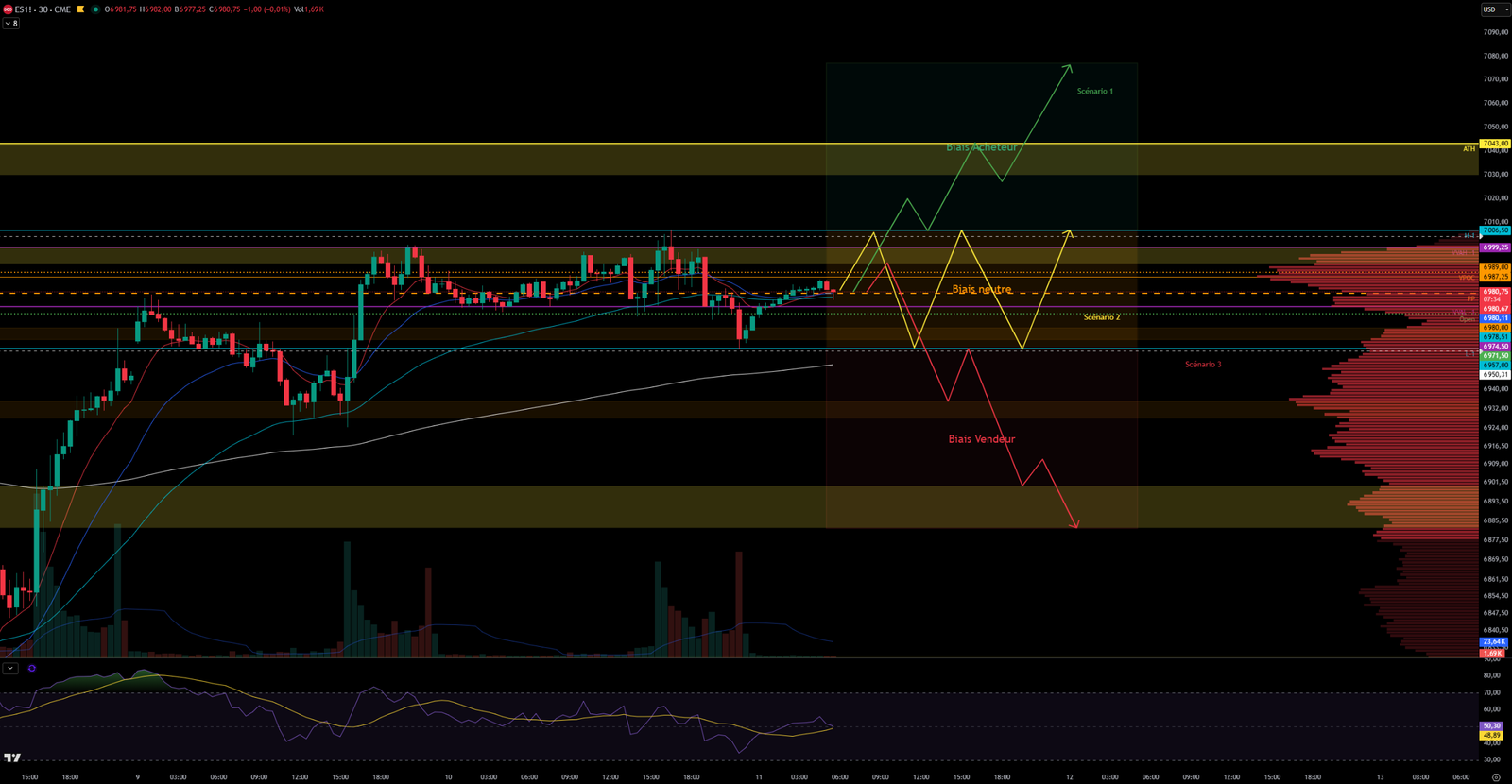

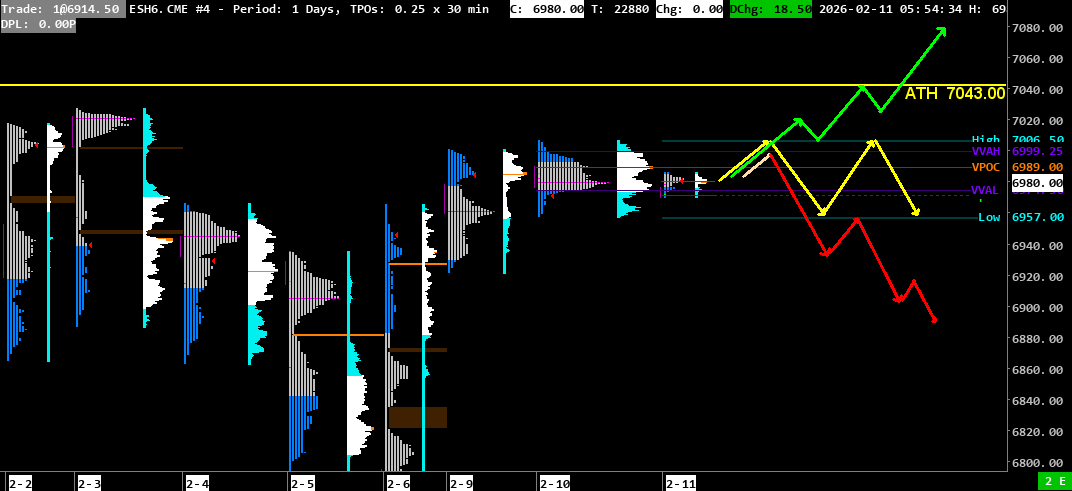

VPOC: 6989

VVA: 6974.50 – 6999.25

PP: 6980

Open: 6971.50 (Zone 2)

Vix: 17.80

SP500 Trend: Overall neutral sentiment 🟠

Yesterday, the SP500 formed a wide range between 6970 and 7000 with a resistance at 7005, ultimately losing 0.33%. In the morning, the price opened at 6985 and remained stable in the 6970-6985 zone during the Asian session. In the European session, the price attempted two breakouts of the 6993-7000 resistance zone but failed to reach 7000. On the second attempt, the price was rejected and moved downwards, returning to around 6970, to the 6970-6973 support zone, before rising back to 6990 prior to the US open.

At the US open, sellers attempted to take control but met resistance slightly above the 6970-6973 support. Buyers then regained control and pushed the price up to 7000, but sellers halted the price at 7005, causing it to fall back to the 6984-6986 support. Buyers attempted a second breakthrough late in the day around 6:00 PM but were rejected once again. This time, the price dropped to the 6970-6973 support, breaking it before the close. The SP500 sought the VVAL-1 at 6957 before closing at 6966. Trading volumes for the day were quite low, and movements remained rather subdued throughout the day.

Disappointing retail sales data weighed on the market, and investors are awaiting employment figures this afternoon, which may explain the lack of commitment.

Today, the SP500 opens at 6971.50 in Zone 2, just below the VVAL-1. The index has already re-entered yesterday’s value area. Buyers have encountered resistance at the 6984-6986 zone, and the price is consolidating between the VVAL-1 and this resistance zone. Indicators are rather neutral for now. A waiting stance might be appropriate before the employment data at 2:30 PM, especially given previous days that showed no clear direction.

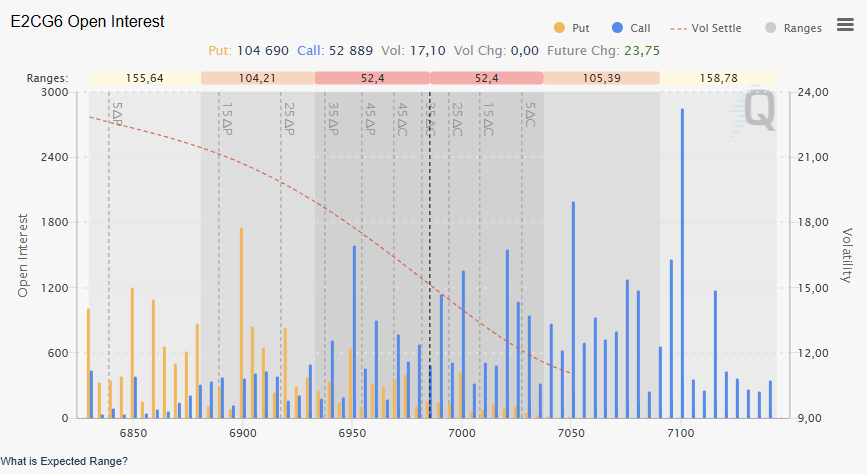

The options market shows significant Call interest at 7000 and 7100, and still the Put zone at 6900, which could create two major barriers for the potential evolution of the SP500. The 7000 barrier will once again be crucial for any potential upward movement. This barrier played its role as expected yesterday.

This Wednesday, we will have the employment data at 2:30 PM, which had been postponed due to the shutdown, as well as crude oil inventories at 4:00 PM.

Scenario 1 🟡: Upon rejection at 7000, 7005, and awaiting employment data, the price could consolidate in the 6960 and 7000 zone.

Scenario 2 🟢: Upon breaking 7000 and confirmation by breaking 7006, the price could target the 7030-7043 resistance zone and potentially the ATH at 7043.

Scenario 3 🔴: Upon breaking yesterday’s low at 6957 or a negative surprise from employment figures, the price could move downwards and target 6900.

Zones of Interest:

- 7100 (Major Call Zone)

- 7030-7043 (Major Resistance Zone)

- 7006.50 (Yesterday’s High)

- 6993-7000 (Resistance Zone + VVAH-1 6999)

- 6988-6989 (Yesterday’s VPOC Zone and Weekly VPOC)

- 6984-6986 (Resistance Zone)

- 6970-6973 (Support Zone + Open)

- 6960-6966 (Support Zone)

- 6957 (Yesterday’s Low)

- 6928-6935 (Support Zone)

- 6883-6900 (Major Support Zone + 6900 Put Zone)

- 6857-6866 (Support Zone)

- 6814-6830 (Major Support Zone)

60-second Chrono

Market Trends

The S&P 500 and Nasdaq experienced a decline, influenced by disappointing retail sales figures. Treasury yields decreased, which could pave the way for interest rate cuts by the Federal Reserve (Fed).

Economic Forecasts

Expectations for the January employment report indicate an increase in non-farm payrolls of 70,000, with a stable unemployment rate at 4.4%. However, a moderation in hourly earnings is anticipated.

Corporate Performance

- McDonald’s: Anticipates a rise in fourth-quarter sales due to promotions.

- Cisco Systems: Forecasts an 8% increase in revenue, supported by high spending on network equipment.

- Kraft Heinz: Expects a decline in revenue, affected by demand for more expensive products.

- Datadog: Exceeded earnings forecasts, fueled by demand for artificial intelligence.

Technology Sector

Technology companies are under close scrutiny due to concerns about their high valuations and massive investments in artificial intelligence. Alphabet, Google’s parent company, announced a 100-year bond issuance to finance its cloud and AI projects.

Commodities Market

Oil rebounded, with prices rising, linked to tensions between Washington and Tehran. Gold and silver prices also recorded increases.

Impact of AI

Technology companies, such as Alphabet, are turning to long-term bonds to finance their artificial intelligence projects, illustrating a trend of increased borrowing in the sector.

Interest Rate Expectations

Investors anticipate three rate cuts this year, although some Fed officials call for caution due to persistent inflation. The Cleveland Fed President expressed the need to ensure inflation is declining before considering further cuts.

Macro

Consumption and Demand

Retail Sales (Monthly): The Sharp Deceleration

- Current: 0.0%

- Forecast: 0.4%

- Previous: 0.6%

-> This is a very disappointing result. The figure is flat, while 0.4% growth was anticipated. This is the most significant figure on this list. It indicates that the American consumer, the primary driver of GDP, has stopped spending compared to the previous month.

Core Retail Sales: Confirmation of the Slowdown

- Current: 0.0%

- Forecast: 0.3%

- Previous: 0.4%

-> Same observation as above. This indicator excludes automotive sales. The fact that it is also at 0% confirms that the weakness is widespread and not due to a single sector. Consumers are tightening their belts.

Inflation and Wages

Employment Cost Index (Quarterly): Good News for the FED

- Current: 0.7%

- Forecast: 0.8%

- Previous: 0.8%

-> This is a reassuring figure. Wage costs are increasing slower than expected. The FED monitors this index very closely, as rising wages fuel inflation.

Industry and Production

Import and Export Price Index: Relative Stability

- Import – Current: 0.1% (In line with expectations)

- Export – Current: 0.3% (Higher than expectations of 0.1%)

-> Mixed but low-impact result. Export prices are rising slightly, suggesting decent external demand for US products, but the market impact is minor compared to retail sales. Notably, there is no inflationary shock via imports.

Business Inventories (Monthly): Managerial Caution

- Current: 0.1%

- Forecast: 0.2%

-> Slightly below expectations. Businesses are stocking fewer goods. This corroborates retail sales: if companies anticipate fewer sales, they reduce their inventories to avoid unsold items. This is a sign of an economic cycle slowdown.

Summary

The US economy is stalling, but so is inflation.

- Consumers are no longer spending, raising fears of an economic slowdown (recession).

- Inflation is calming down: Wages are rising slower than expected, which reassures the FED.

0 Comments