Economic Announcements:

- 2:30 PM : PPI

- 3:45 PM : Chicago PMI

Earnings Reports:

- Exxon Mobil (XOM)

- Chevron (CVX)

- American Express (AXP)

- Verizon (VZ)

- Sumitomo Mitsui Financial Group (SMFG)

- Grupo Mexico (GMBXF)

- Regeneron Pharmaceuticals (REGN)

- Aon (AON)

- Colgate-Palmolive (CL)

Analysis:

VPOC: 6955.50

VA: 6923.75 – 6994

PP: 6970

Open: 6992.75

Vix: 16.87

SP500 Trend: Overall neutral sentiment 🟠

Yesterday, the S 500 started the day consolidating within VVA-1, similar to the previous day, with a test of the major resistance zone at 7025-7036 and an even clearer rejection than yesterday, marked by buyers stalled at 7029.

The price remained stable until the US open, where the index corrected sharply with two attempts at a bullish recovery at the support zones of 6982-6988 and 6944-6950. The price fell back to Monday’s levels, below the bearish gap.

The decline stopped at 6900, and the price rebounded after a bullish divergence formed on the RSI, signaling a return of buyers. They then pushed the price back up to the resistance zone of 6982-6988 after a pause at 6944-6950. These two zones remain active and have been very important for several weeks. The price closed at 6990, just below 7000, around the weekly VWAP. We faced very high volatility due to investor concerns about the impact of AI spending on the earnings of large tech companies. The VIX rose to around 19 points during the US session but has currently returned to 16.87.

This morning, the S 500 opened at 6992 and already tested 7000, where it was rejected. The price worked the support zone of 6982-6988, then broke it to lean on our support zone of 6944-6950. The price was rejected below 7000 and at 6960; a balance seems to have been found this morning around the VWAP, with a cumulative delta close to equilibrium.

Today, we will monitor the Chicago PMI data as well as the PPI index. We are also awaiting earnings reports from S 500 companies such as Exxon Mobil, Chevron, Amex, and Verizon. The market needs to catch its breath after yesterday’s sharp correction before resuming a clear direction. Option levels indicate a certain balance for now.

Scenario 1 🟡: Upon rejection at the resistance zone of 6982-6988 and rejection at the zone of 6944-6950, the SP 500 could consolidate between these zones, at least until the US open.

Scenario 2 🔵: Upon a break of the support zone of 6944-6950, the price could move lower.

Scenario 3 🔴: Upon a break of the resistance zone of 6982-6988, and confirmation on a break of VVAH-1, the price could rise and target 7000, then yesterday’s highs at 7029.

Zones of Interest:

- 7025-7036 (Major resistance zone)

- 6994 (VVAH-1)

- 6982-6988 (Important resistance zone)

- 6969-6970 (Resistance zone)

- 6944-6950 (Important support zone)

- 6924-6930 (Support zone + VVAL-1)

- 6898 (Yesterday’s low)

- 6866-6973 (Resistance zone)

60-second Chrono

Market Performance

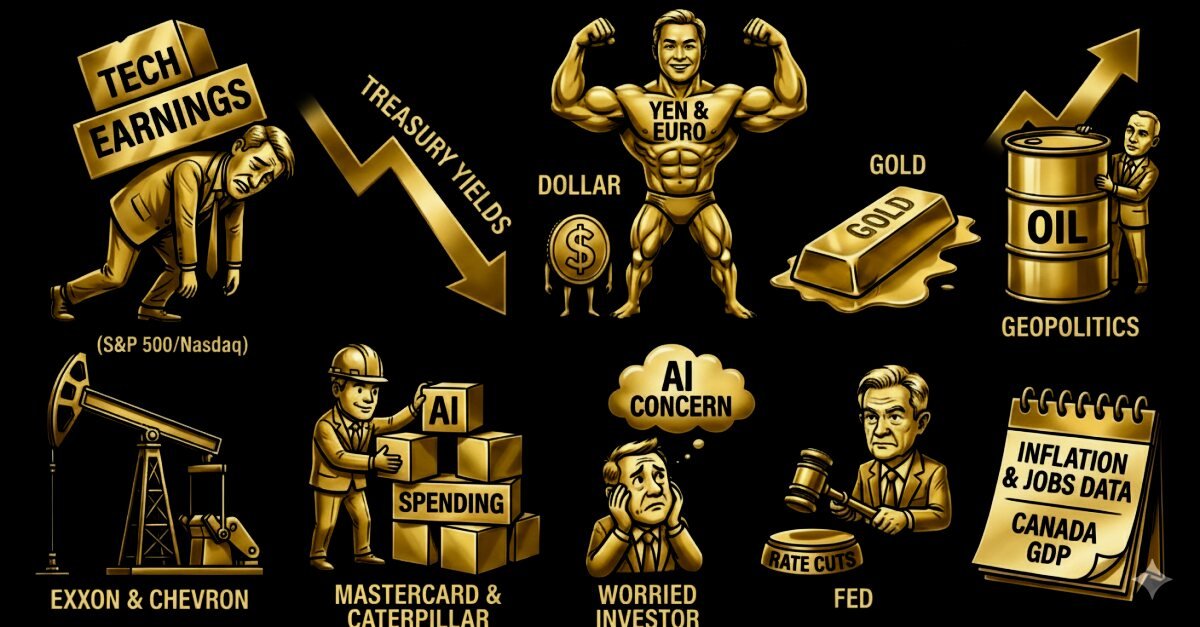

- The SP 500 and Nasdaq indices recorded a decline, influenced by weak earnings from large technology companies.

- Treasury yields fell, with investors remaining attentive to upcoming employment reports.

Economy and Currency

- The dollar declined against the yen and the euro, reflecting uncertainties regarding the Federal Reserve’s (Fed) policy.

- Gold prices fell following profit-taking after historical highs, while oil rose due to geopolitical fears related to a potential conflict with Iran.

Corporate Earnings

- ExxonMobil and Chevron are set to release their fourth-quarter results, with expectations of stable earnings.

- Companies like Mastercard and Caterpillar announced positive results, partly due to artificial intelligence-related spending.

Trends and Expectations

- Investors are concerned about the impact of AI spending on the earnings of large technology companies, with concerns about future profitability.

- The Fed is expected to discuss monetary policy, with speculation about a pause in interest rate reductions.

Macroeconomic Data:

- In the United States, December producer prices are expected, with a 0.2% month-over-month increase and a slight deceleration in year-over-year inflation (2.8% for headline data and 2.9% excluding food and energy).

- The MNI Chicago Purchasing Managers’ Index will also be released, which could provide indications of economic health.

Macro

Employment: Confirmed Resilience

Weekly Claims and Unemployment Beneficiaries

Weekly Claims:

- Current: 209K

- Forecast: 206K

- Previous: 210K

Regular Beneficiaries:

- Current: 1827K

- Forecast: 1860K

- Previous: 1865K

-> The labor market is sending a signal of strength. While new unemployment claims remain stable and low (few layoffs), the number of regular beneficiaries is falling much more than expected.

This means that current unemployed individuals are finding work quickly. This “tight” dynamic is reassuring for growth (no recession in sight) but supports the Dollar, as it gives the Fed the necessary leeway to maintain high rates if inflation persists.

Productivity: The Goldilocks Scenario

Non-Farm Productivity (Q3)

- Current: 4.9%

- Forecast: 4.9%

- Previous: 3.3%

Labor Cost

- Current: -1.9%

- Forecast: -1.9%

- Previous: 1.0%

-> This is the most powerful signal from this release. Productivity is soaring while labor costs are falling.

This is a fundamentally bullish signal for stocks. Because it allows companies to maintain their profit margins without needing to raise prices. This nips “cost-push” inflation in the bud. The Fed loves these figures because they allow for healthy growth without inflation.

Trade: Deficit Widens Sharply

Trade Balance (Nov.)

- Current: -$56.80B

- Forecast: -$43.40B

- Previous: -$29.20B

-> A big negative surprise here. The deficit is much deeper than expected. Imports significantly exceed exports.

Although this figure is in the red, it reveals a persistently strong U.S. domestic demand. American consumers continue to purchase foreign products despite past inflation. In the short term, this could exert slight downward pressure on the Dollar, as the U.S. must sell dollars to buy foreign currencies to pay for these imports.

0 Comments