The indecision minute

Economic Announcements:

- 2:30 PM : Philadelphia Fed Manufacturing Index

- 2:30 PM : Unemployment

- 2:30 PM: Trade balance

- 4:00 PM: Pending home sales

- 6:00 PM: Crude oil inventories

Earnings Reports:

- Walmart (WMT)

- Newmont Corporation (NEM)

- Constellation Energy (CEG)

- The Southern Company (SO)

- Quanta Services (PWR)

- Targa Resources (TRGP)

- Consolidated Edison (ED)

- Copart (CPRT)

- Live Nation Entertainment (LYV)

- Insmed (INSM)

- Extra Space Storage (EXR)

Analysis:

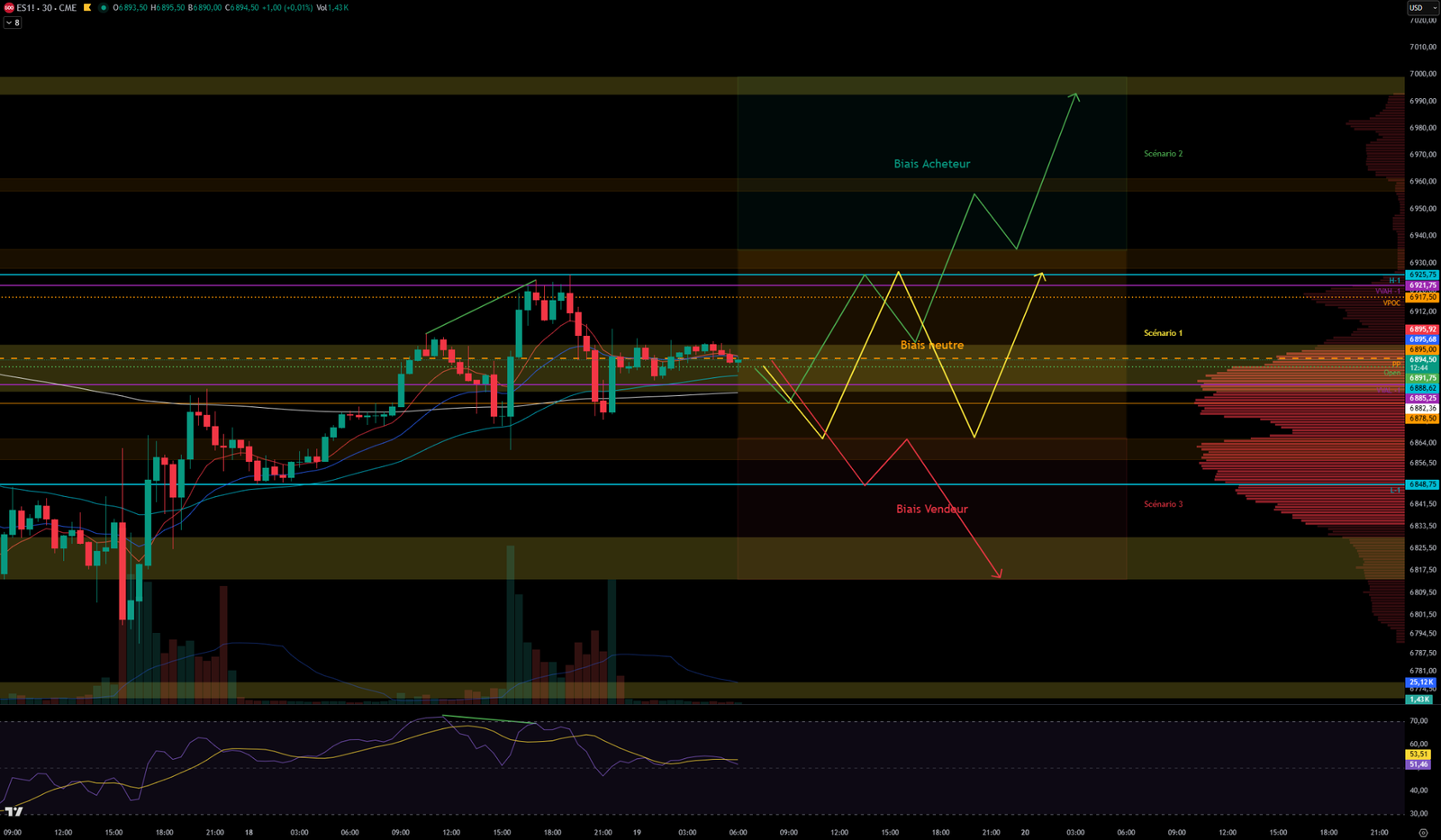

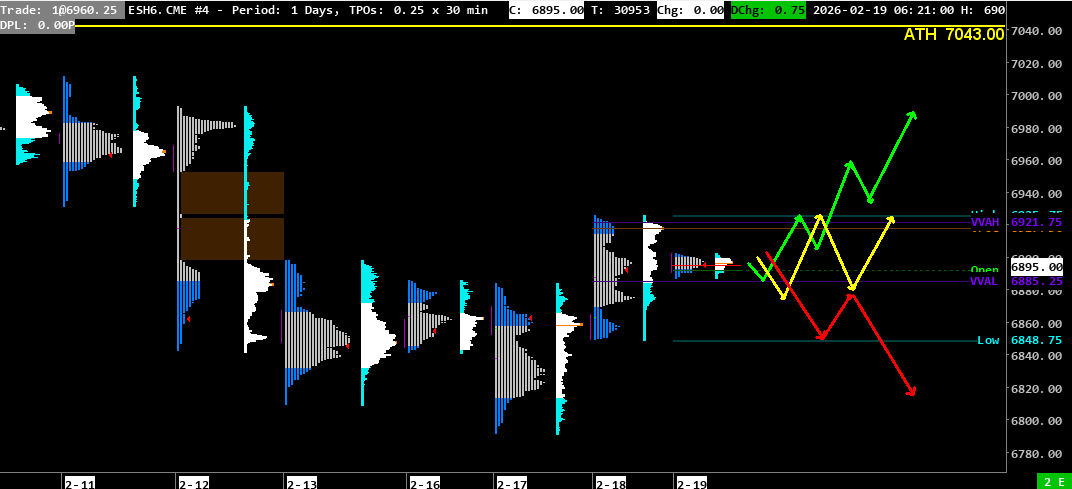

VPOC : 6917.50

VVA : 6885.25 – 6921.75

High-Low : 6848.75 – 6925.75

PP: 6895

Open: 6891.75

VIX: 19.61

SP500 trend: Overall sentiment neutral 🟠 to bullish 🟢

Yesterday, the S 500 opened in the prior day’s value area, near VVAH-1. Price moved sideways around VPOC-1 before breaking VVAH-1 and testing the 6883–6900 resistance zone, but was rejected above 6,900. Price returned to VVAH-1 before the US open after a rejection on re-entering the prior day’s value area, showing some willingness to move higher.

At the US open, buyers took control, led by the Tech sector, pushing price above 6,900 and filling the first single print created last Thursday between 6900–6925. Price then moved sideways below the second single print at 6928–6953. Investors waited for the Fed minute at 8:00 PM, with a slight dip shortly beforehand. The Fed’s comments did not reassure, with a hesitant stance, remaining dependent on developments in inflation and the labor market. Price finished in the 6883–6900 resistance zone. The market closed higher but was fairly volatile, with uncertain and fast moves.

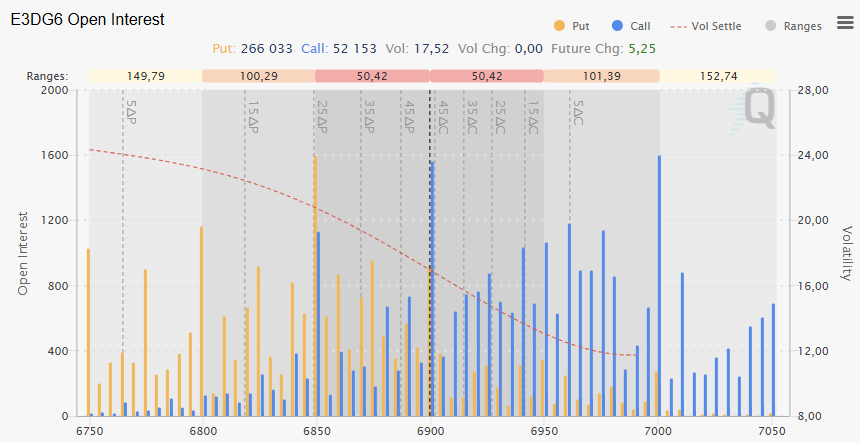

This morning, the S 500 opens in Zone 1 at 6,891, near VVAL-1, and is moving sideways below 6,900 and within the 6883–6900 resistance zone. Cumulative delta is slightly selling, but there is some balance for now. On the 30-minute chart, a bearish divergence can be observed, but it has not yet been confirmed. For the moment, no direction is clearly established. Options show an area of interest that could range from 6,850 to 7,000, with large Put and Call zones at those extremes. The 6,900 area will again be very important today.

The VIX index has moved back below 20, but it can rise quickly.

Today, there will be quite a few macro releases: the Philadelphia manufacturing index, jobless claims, pending home sales, the trade balance, and crude oil inventories. We will also have Walmart earnings, which could influence the market.

Scenario 1 🟡: On a rejection at yesterday’s high at 6925, price could consolidate between 6866 and 6925.

Scenario 2 🟢: On a break above yesterday’s high at 6925 and a fill of the single print at 6928-6953, price could move toward 7000.

Scenario 3 🔴: On a break below the 6857-6866 support zone, price could resume to the downside and target yesterday’s low at 6848 and the 6815-6830 support zone.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance zone + 7000 major Call options area)

- 6928-6935 (Resistance zone + 6928-6953 (Single prints)

- 6883-6900 (Major resistance zone + 6900 major Call options area)

- 6857-6866 (Support Zone)

- 6850 (Major Put options area)

- 6815-6830 (Support zone)

- 6771-6777 (Support Zone)

60-second Chrono

Stock Market

Wall Street posted gains, supported by technology stocks, notably Nvidia, which signed a strategic agreement with Meta. The SP 500 and Nasdaq recorded gains of 0.56% and 0.78%, respectively.

Economic Data

Treasury yields rose, reinforcing expectations that the Federal Reserve will keep interest rates steady. Data on jobless claims and the trade deficit showed signs of improvement.

Oil and gold sector

Oil prices jumped more than 4% amid fears of supply disruptions, while gold also rose, influenced by geopolitical risks.

Company Earnings

Walmart is set to report fourth-quarter results, with optimistic revenue forecasts, while other companies such as Etsy and Targa Resources expect higher profits, linked to rising demand driven by artificial intelligence.

Upcoming Events

Several important speeches are scheduled, notably by Federal Reserve officials, and key economic data will be released, including labor market and housing figures.

Sectoral Trends

The technology sector continues to attract investors’ attention, despite earlier concerns about high valuations. Food companies are also adapting to consumption changes linked to new anti-obesity medications.

Macro

US Economy: Surprising resilience and strength

Real Estate Sector: A clear acceleration

Building permits (Dec):

Actual: 1.448M

Forecast: 1.400M

Previous: 1.388M

Housing starts (Dec):

Actual: 1.404M

Forecast: 1.310M

Previous: 1.272M

-> This is excellent news for underlying economic health. The housing sector is often a leading indicator for the economy: if developers are applying for more permits and starting more projects, it means they anticipate strong demand. Despite interest rates, buyers are there. This reflects strong confidence and a robust economy.

Durable Goods Orders: Businesses are investing

Headline (Monthly – Dec):

Actual: -1.4%

Forecast: -1.8%

Previous: 5.4%

Core (Monthly – Dec):

Actual: 0.9%

Forecast: 0.3%

Previous: 0.4%

-> The headline figure is negative, but better than expected. Above all, the “Core” indicator far exceeds forecasts at 0.9%. This indicates that, fundamentally, US businesses continue to invest heavily in their productive capacity. This is a signal of future growth.

Industrial Production: US factories are running at full speed

- Industrial Production (Monthly – Jan):

Actual: 0.7%

Forecast: 0.4%

Previous: 0.2%

-> Another pleasant surprise. US manufacturing and industrial output is higher than analysts anticipated. Combined with durable goods orders, this confirms that US industry is in an expansion phase, not a contraction.

Summary

A series of extremely strong releases that completely removes the specter of a near-term recession.

- An economy running strong: Whether it is construction, business investment, or factory output, all indicators are green.

- The Fed has no urgency: With an economy this robust, the Fed has absolutely no reason to rush into cutting interest rates. The economy is handling current rates very well.

The Fed minute

The State of the Economy (Growth)

- Assessment: The US economy is stronger than expected. The outlook is better than in December.

- Trend: Growth should remain robust throughout 2026.

- Impact: This is good news for companies (stocks), as it means consumption and activity are holding up.

The Labor Market (Employment)

- Assessment: The market is stabilizing. Fears of an employment collapse (downside risks) have diminished.

- Forecast: Unemployment should gradually decline.

- Impact: A strong labor market supports consumption, but it can also fuel inflation (wages remain high).

Inflation (The Weak Spot)

- The problem: Inflation is more persistent than expected. The return to the 2% target will be “slower and more uneven.”

- Risk: There is a significant risk that inflation remains stuck above the target.

- Impact: This is the point that worries markets. If inflation does not come down, the Fed cannot cut rates aggressively.

Monetary Policy (Rates)

- “Two-sided” approach: The Fed is not committing to a single direction.

- Scenario A (Hike): If inflation remains high, rate hikes are possible.

- Scenario B (Cut): If inflation falls as expected, further rate cuts would be appropriate.

- Uncertainty: The pace and timing are unclear.

0 Comments