Continued decline or return of buyers?

Macro

This week was heavy on macro data, notably the NFP employment data from last week which had been postponed following the US government shutdown.

Employment showed unexpected strength, which created a surprise early in the week and complicated the Fed’s reading. The US economy added 130,000 jobs, well above forecasts of 66,000, and unemployment fell to 4.3%. The only dark spot in this report was inflation, with hourly wages up 0.4% (above expectations of 0.3%), maintaining inflationary pressure.

The most significant information was the US inflation data, which showed faster-than-expected disinflation with the CPI falling to 2.4% and a monthly increase contained at 0.2%. These figures reassured markets, strengthening bets on a future Fed rate cut.

Regarding consumption, the latter is showing signs of fatigue, which is concerning as consumption is the engine of the US economy. Retail sales fell to 0% against expectations of 0.4%, showing that households are tightening their belts. The real estate sector also received a cold shower, with a collapse in existing home sales, well below expectations.

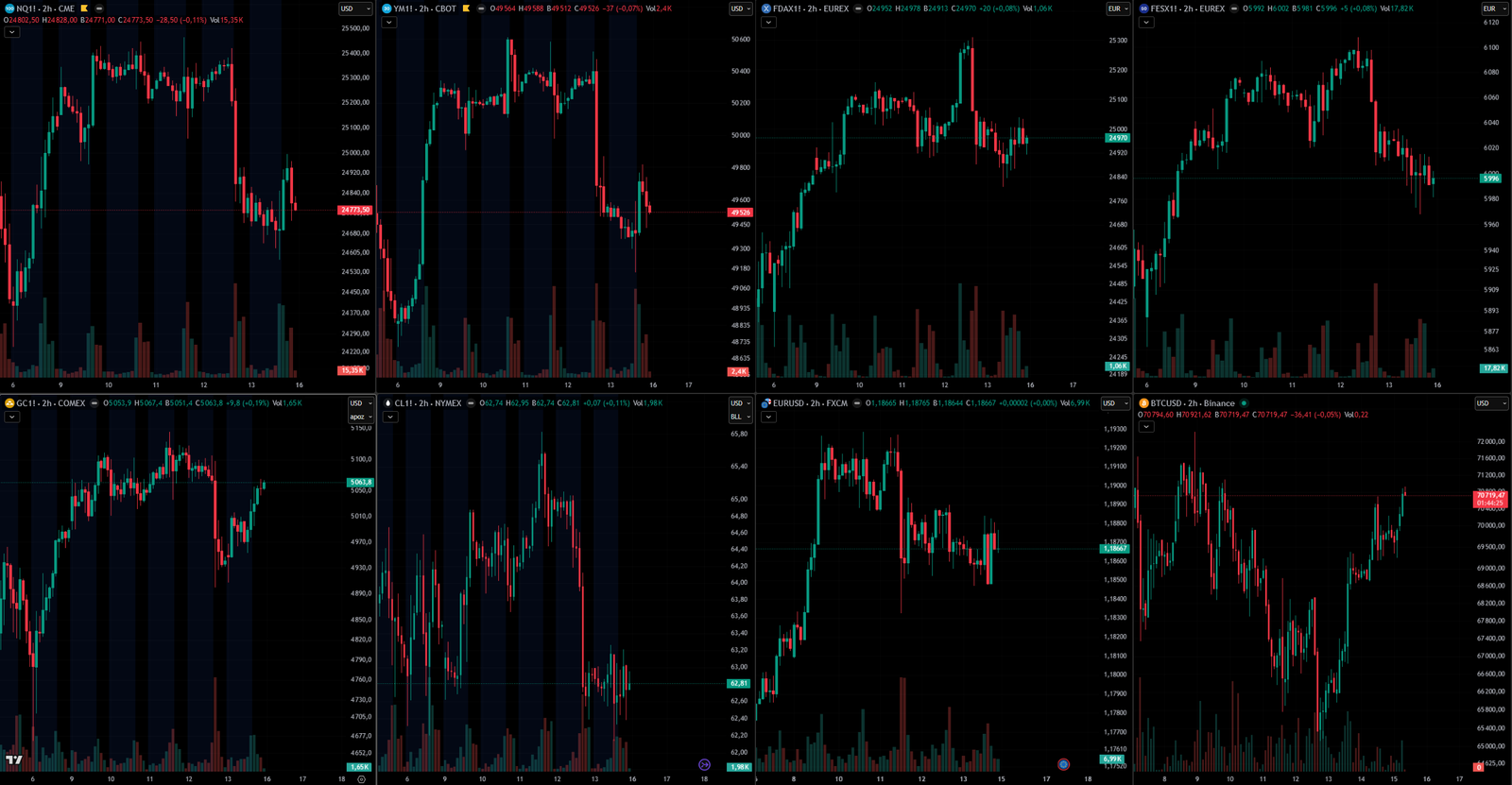

In the commodities sector, oil suffered a massive supply shock. Inventories exploded by more than 8.5 million barrels while a decrease was expected. This weighed technically on prices, although geopolitical tensions are maintaining a certain price floor.

Summary

• Reassuring disinflation

• Stagnant consumption

• Surprise on strong employment figures

News

Tensions between Iran and the United States continue to fuel investor fears. Although indirect negotiations took place via Oman to avoid escalation, Israeli Prime Minister Benjamin Netanyahu met with Donald Trump to lobby for the inclusion of the Iranian missile program in any agreement, beyond just the nuclear issue.

AI continues to sow doubt in the minds of investors, who have massively sold off software and services sector stocks, fearing that AI will destroy their business models. Furthermore, the colossal spending planned by tech giants is raising concerns about their future profitability.

Regarding the climate, the Trump administration has officially repealed scientific findings linking greenhouse gases to health hazards, thereby removing the legal basis for federal climate regulations and vehicle emission standards.

For the Fed, the confirmation process for Kevin Warsh, chosen by Trump to lead the Fed, will move forward in the Senate despite some opposition.

Summary

- AI fear shakes the markets

- Geopolitical situation remains tense between Iran and the United States

Market

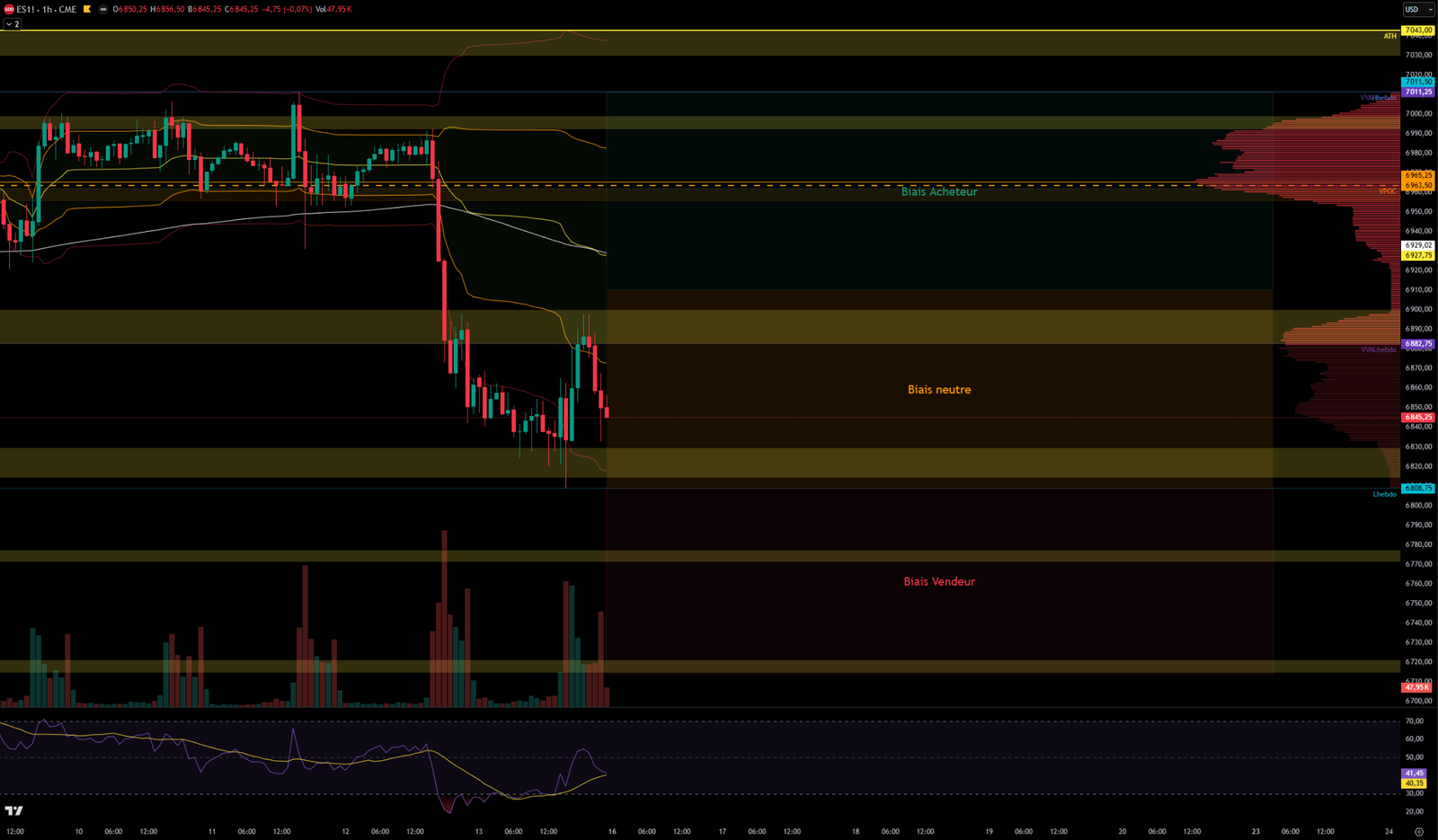

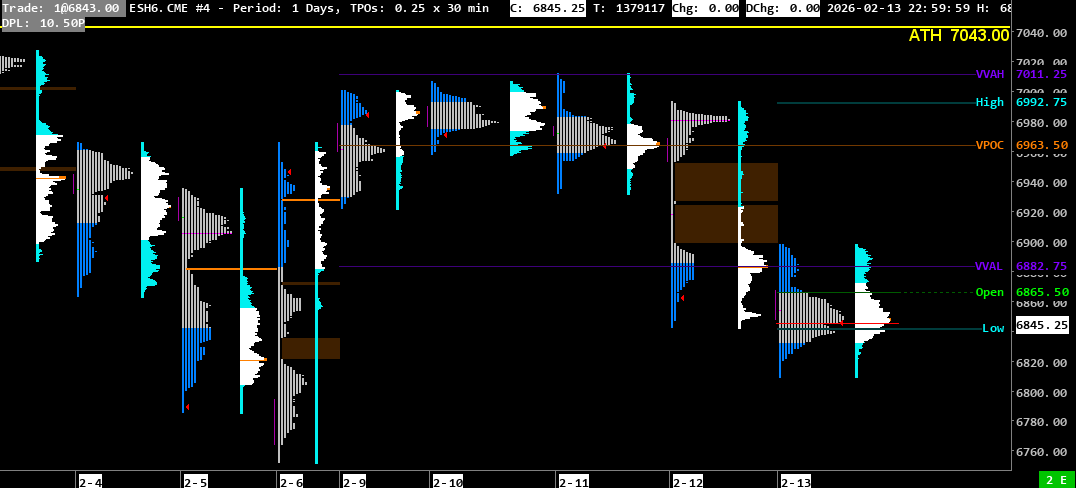

Weekly Levels

VPOC: 6963.50

LOW-HIGH: 7011.50-6808.75

VVA: 7011.25-6882.75

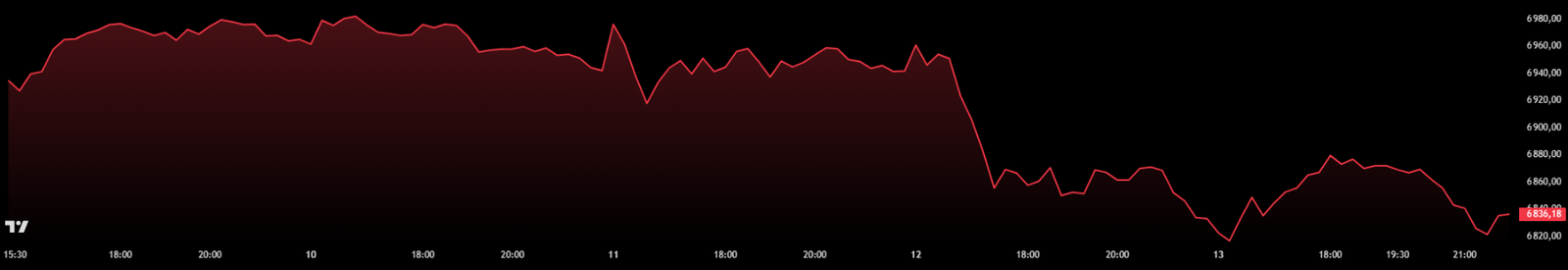

This week, the S 500 experienced a cautious start, with prices lateralizing between support at 6952-6960 and resistance at 6993-7000. The 7000 level was tested three times, each time with a massive rejection from sellers, but with an increasingly higher upper limit reaching a maximum of 7011 points on Wednesday after the employment data.

The price then resumed its consolidation between the aforementioned zones until the US open on Thursday, where the price completely plummeted and fell sharply to 6900, then to 6860. At the end of the week, the index settled on the support zone of 6815-6830 with a rejection below this zone on Friday and an attempted buyer rebound following the good US inflation data, but the price returned to the day’s average levels around 6845 where it closed.

A bullish divergence on the 1h chart RSI was validated on Friday but quickly invalidated, which could be a sign of a continuation of the bearish trend. To hope for a possible rise in the S 500, it is imperative that the price breaks 6900 and fills the two single prints formed at 6900-6923 and 6928-6953 (if the price succeeds, it could rise very quickly). The 7000 zone also remains a major wall that the price seems to have difficulty crossing.

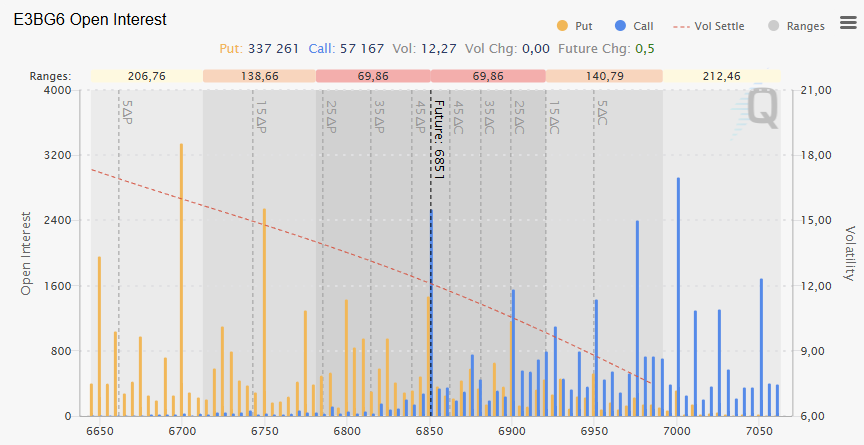

At the start of this week, the S 500 will be between a support zone (6815-6830) below which the price was rejected by buyers and a wall at 6900 formed by a large single print and a major resistance zone (6883-6900). Option zones show large Put clusters at 6700 and 6750 and Calls positioned at 6850, 6900, and 7000. The weekly Lows and Highs could be situated between 6700 and 7000.

For now, indicators and the situation seem to point to a rather neutral, or even bearish, scenario for the start of the week. On Monday, things are not expected to move much due to a lack of volume, as it is a public holiday in the United States for Presidents’ Day (George Washington’s Birthday) and Family Day in Canada.

Points of Interest

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance zone + major 7000 Call option zone)

- 6956-6963 (Resistance zone + weekly VPOC)

- 6900-6923 and 6928-6953 (Single prints)

- 6883-6900 (Major resistance zone)

- 6815-6830 (Support zone)

- 6809 (Weekly low)

- 6,770-6,777 (Support Zone)

- 6750 (Major Put options interest)

- 6715-6720 (Support zone)

- 6700 (Major Put options interest)

- 6625-6640 (Major support zone)

Overall Sentiment

0 Comments