The bears are back!

Can the CPI push back against them?

Economic Announcements:

- 2:30 PM: CPI Index

Earnings Reports:

- Moderna (MRNA)

Analysis:

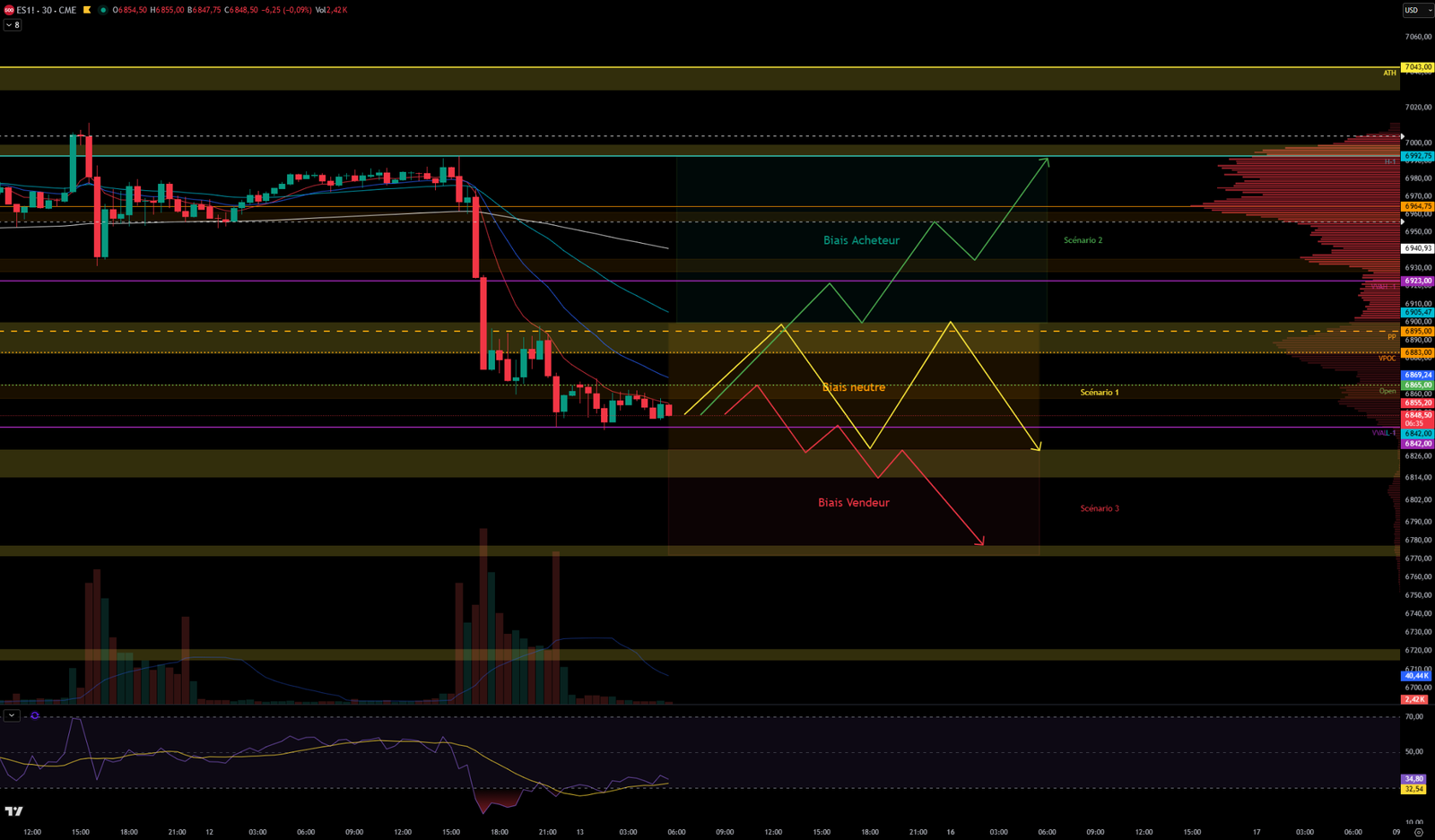

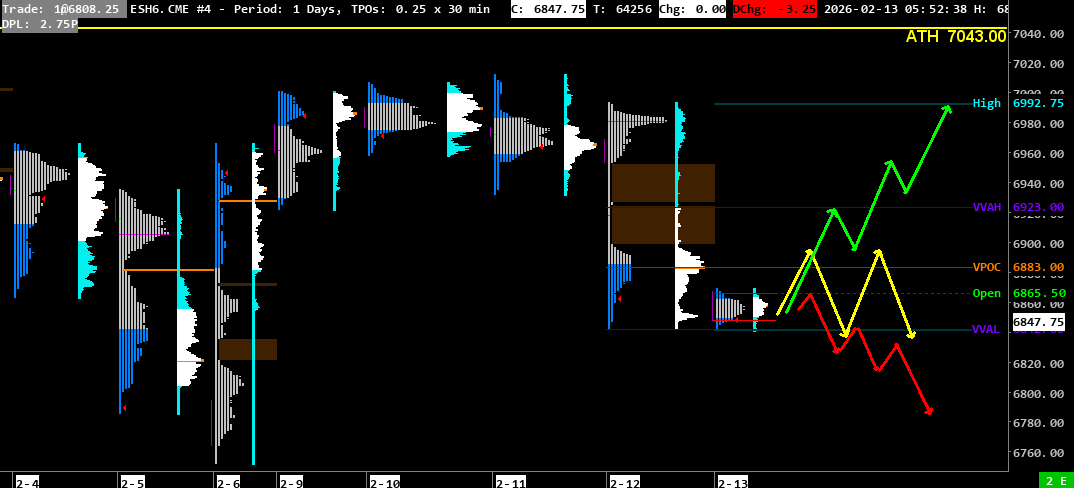

VPOC: 6883

VVA: 6842 – 6923

PP: 6895

Open: 6865 (Zone 1)

Vix: 20.81

SP500 trend: Overall sentiment neutral 🟠 to bullish 🟢

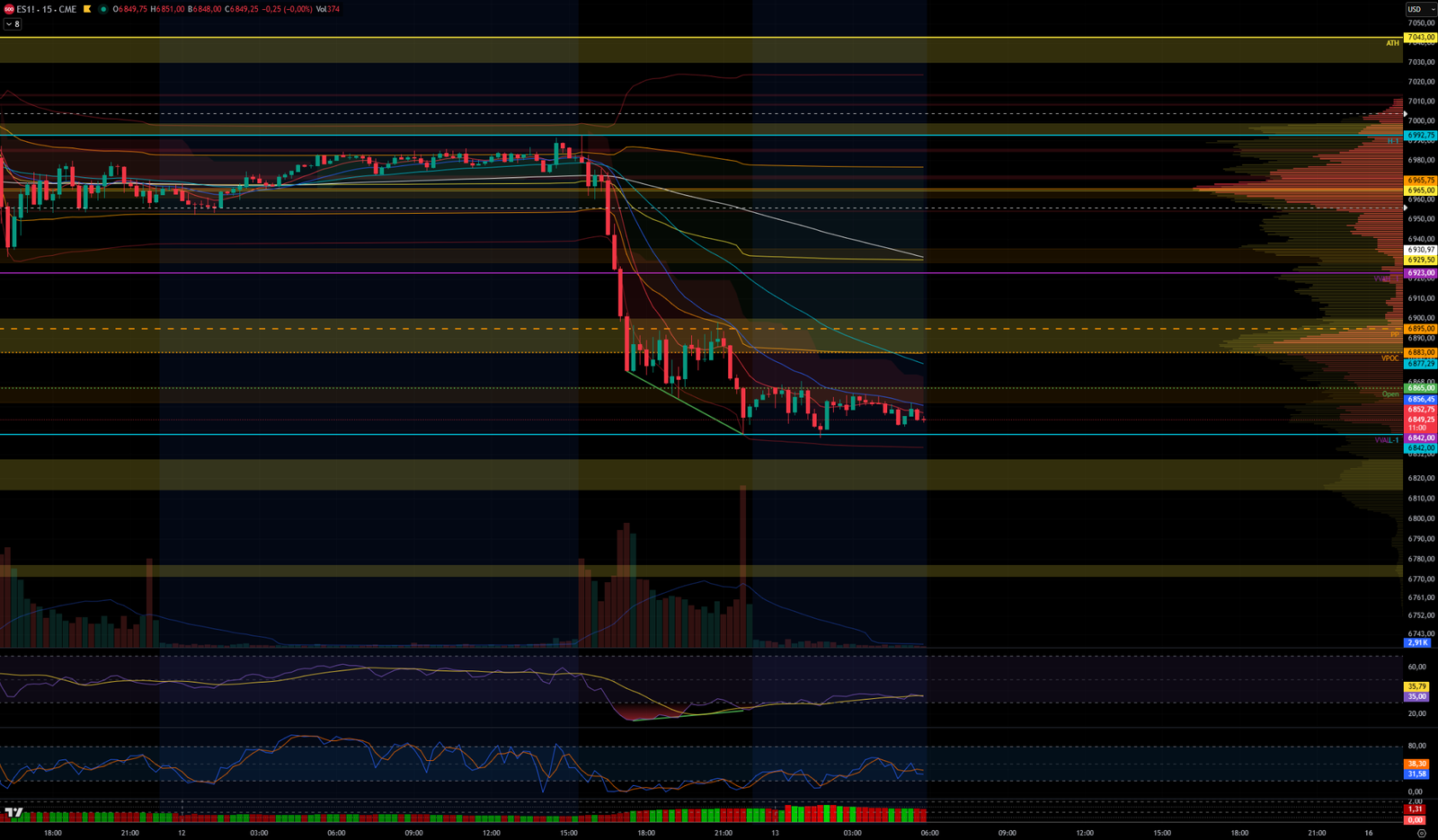

Yesterday, the SP500 had a calm morning, like the previous days this week, moving sideways between the support and resistance zones of 6960-6966 and 6993-7000. When the unemployment data were released at 2:30 PM, the index reacted quietly, without strong conviction.

At the US open, price first attempted to test the 6993-7000 resistance zone, but sellers immediately took control and pushed price lower. Buyers tried to respond at the 6960-6966 support, but quickly gave way, allowing sellers to drive price down toward last Friday’s levels with no real buying opposition. Price paused for a while at the 6883-6900 support, then closed on the 6857-6866 support. Investor concern about the tech and AI sector remains present, and heavy selling weighed on the index.

During the drop, the SP500 left large single prints at 6900-6925 and 6926-6960. They will form a natural resistance area in the event of a rebound.

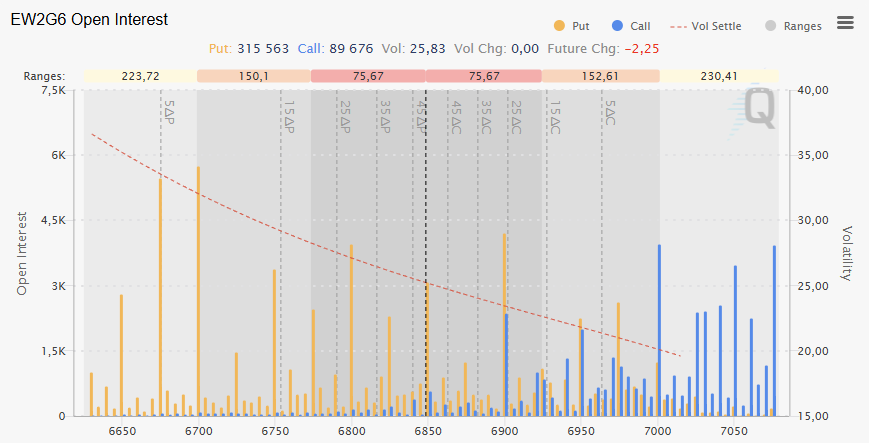

This morning, the SP500 opens in Zone 1 at 6865, on the 6857-6866 support area it is currently working. Price has already tested yesterday’s lows at 6842. Below that low lies the major 6815-6830 support, which corresponds to the level from before the index’s rebound last Friday. Note that at this level, a single print was created during the rally between 6822 and 6835. This area could therefore form solid support to monitor closely. Weekly VVAL is also located at 6831, reinforcing this view. One can also observe a large puts zone at 6800, which could also act as a barrier to break through if the market continues lower.

A bullish divergence is present on the 15-minute chart, but it has not yet been confirmed. It should nevertheless be monitored, as it could be the signal of a reversal and the end of the decline.

Today we will get US inflation data, which could bring strong volatility—especially since the VIX index is already elevated at 20.81. Google announced it is releasing a major upgrade to Gemini 3 Deep Think today, which could also provide a boost to the tech sector.

Scenario 1 🟡: On rejection from the 6883-7000 resistance zone, price could consolidate in the 6830-6900 area, at least until the CPI figures are released at 2:30 PM.

Scenario 2 🔵: On a break above 6900 and confirmation via a break above VVAH-1 at 6923, price could move higher and target the single prints at 6900-6925 and 6926-6960.

Scenario 3 🔴: On a break below VVAL-1 at 6842 and confirmation via a break below the 6815-6830 support zone, price could extend the decline and target 6800, then the 6770-6777 support.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Major resistance zone)

- 6956-6962 (Resistance zone)

- 6926-6960 (Single Print)

- 6900-6925 (Single Print)

- 6883-6900 (Resistance zone)

- 6857-6865 (Resistance zone)

- 6815-6830 (Support zone + single print 6822-6835)

- 6,770-6,777 (Support Zone)

60-second Chrono

Stock market situation

Wall Street saw a sharp decline, particularly in the technology sector, due to concerns about the impact of artificial intelligence (AI) across various industries. Investors are awaiting important economic data, notably on inflation and the labour market.

Employment data

Jobless claims showed a slight decline, indicating a stabilisation of the labour market, which could influence the Federal Reserve’s monetary policy.

Economic Outlook

Analysts expect 2026 to be a pivotal year for AI, with implications for productivity and corporate profitability. Geopolitical tensions and trade policies are also influencing the markets.

Transactions and acquisitions

Nuveen’s acquisition of Schroders for $13.5 billion is a landmark event, marking the end of Schroders’ independence. Other companies, such as Amazon, are facing tax investigations, while results from companies such as Moderna and Burger King are being closely watched.

Commodity fluctuations

Oil prices fell, partly due to lower demand and easing geopolitical fears. Gold also posted significant declines.

Regulations and investigations

Google is facing antitrust investigations in Europe, while Amazon is under investigation in Italy for tax evasion. These developments could impact these companies’ operations.

Companies

Google is releasing a major upgrade to Gemini 3 Deep Think today.

Macro

Employment and Real Estate

Weekly jobless claims: Reassuring stability

- Actual: 227K

- Forecast: 222K

- Previous: 232K

-> The result is very slightly above expectations, but below the previous week. It shows that the labour market is not collapsing, but it is not overheating either. For the Fed, it is a good signal: no panic, but no excessive strain.

Continuing unemployment claims: The start of trouble?

- Actual: 1862K

- Forecast: 1850K

- Previous: 1841K

-> This figure is more important than initial claims. It is above expectations and up compared with last month. This means those who are unemployed are taking longer to find a job. It is an early signal that the job market is starting to tighten up gradually.

Real Estate (A cold shower)

Existing home sales: The sharp drop

- Actual: 3.91M

- Forecast: 4.16M

- Previous: 4.27M

-> This is the big negative surprise of the day. The housing market is falling sharply, with a result well below expectations (3.91M versus 4.16M expected). High interest rates are hitting the sector hard. This is a clear recessionary signal for this part of the economy.

Existing home sales (Monthly): The collapse

- Actual: -8.4%

- Previous: 4.4%

-> The contrast is striking. We go from a 4.4% increase last month to an 8.4% drop. Volatility is extreme and shows that buyers abandoned the market in January.

Summary

A mixed day that shows a two-speed economy.

- Employment is holding up (but showing fatigue): Layoffs remain low, but it is becoming harder to find a new position.

- Real estate is struggling: Home sales are collapsing, proving that the Fed’s restrictive policy is choking demand for big-ticket items.

0 Comments