Economic Announcements:

- 2:30 PM: Retail Sales

- 4:00 PM: Business Inventories

Earnings Reports:

- Coca-Cola (KO)

- Gilead (GILD)

- Welltower (WELL)

- S&P Global (SPGI)

- Marriott Int (MAR)

- Ecolab (ECL)

- Ford Motor (F)

- Edwards Lifesciences (EW)

- AIG (AIG)

- Datadog (DDOG)

Analysis:

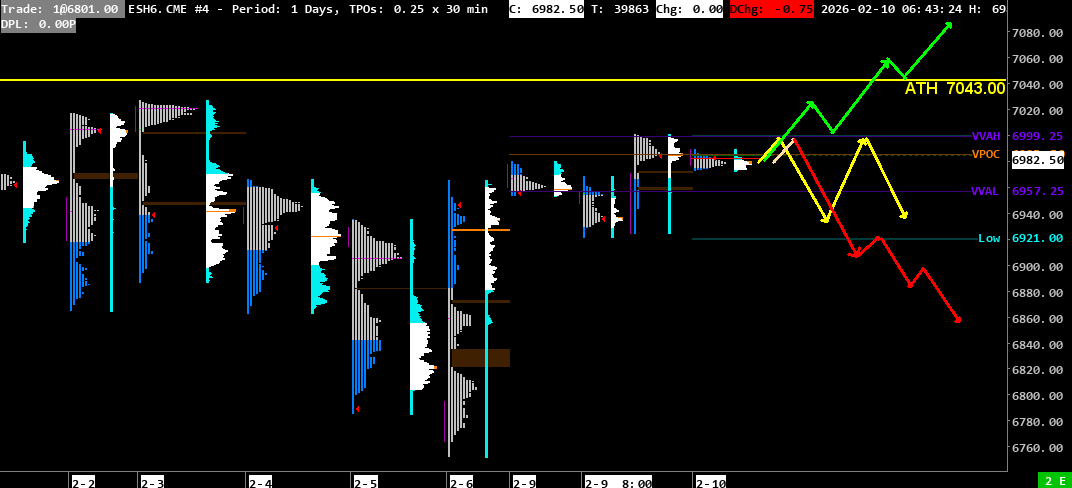

VPOC: 6985.50

VVA: 6957.25 – 6999.25

PP: 6965

Open: 6985 (Zone 1)

Vix: 17.35

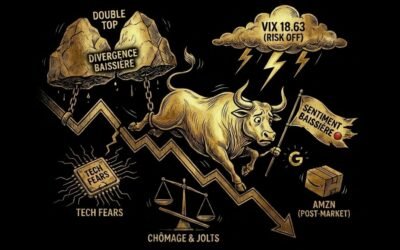

SP500 Trend: Neutral 🟠 to Bullish 🟢

Yesterday, the S&P 500 opened with a bullish gap at 6960, precisely on the VVAH-1. The index moved out of VVA-1 before quickly re-entering it and testing the 6960-6965 resistance zone. This zone was strong, coinciding with the open, VVAH-1, and Friday’s high. At the European open, prices declined to test the 6928-6935 support zone, where the price was rejected after being worked for a long time. Buyers attempted to take control but were blocked at 6950. The price then returned to the support zone for the US open.

At the US open, buyers clearly regained control with only slight pauses at the aforementioned resistance zones. The price then moved directly to the 6993-7000 resistance zone, where it struggled for the remainder of the day, closing around 6985. Throughout the day, volumes were lower than the usual average, leading to sluggish movements and a lack of conviction from various parties despite the rise.

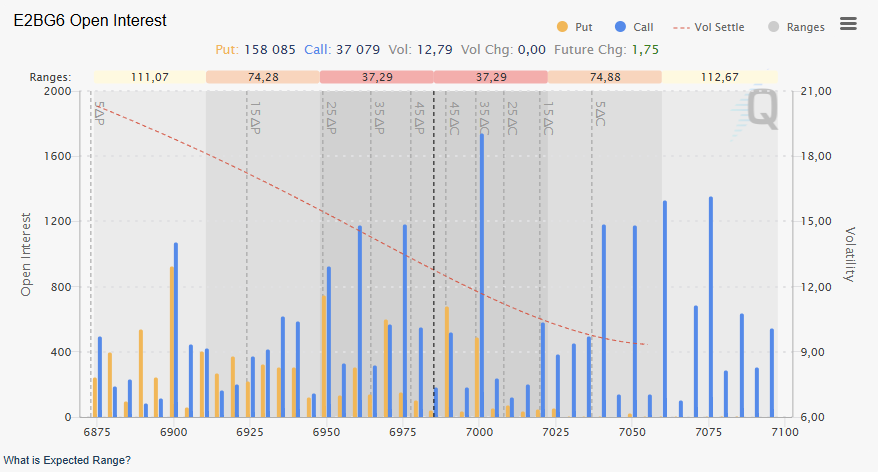

Today, the S&P 500 opens in Zone 1, on yesterday’s VPOC. The price is testing this level just below the 6993-7000 resistance zone that blocked the price yesterday. The delta is very slightly bullish, with volume currently below normal, similar to yesterday. If buyers want to push the price higher, they will need to break the 7000 level, which has held firm since yesterday. The volume of calls at this level acts as a magnet but also represents strong resistance.

We will need to keep an eye on the bearish divergence present on the 30-minute chart and monitor for a potential validation that could signal a reversal of the bullish trend.

This Tuesday, we will have retail sales data as well as business inventories.

Regarding corporate earnings, we are awaiting results from Coca-Cola, S&P Global, and Marriott, among others.

Scenario 1 🟡: Upon breaking the VVAH-1 and the 6993-7000 resistance zone, the price could establish itself sustainably above 7000. This zone is quite strong since yesterday, combining yesterday’s high, the VVAH, and the 7000 level. This level will subsequently form a very good support.

Scenario 2 🔵: Upon rejection at the 6993-7000 resistance zone, the price could consolidate within the 6928-6935 and 6993-7000 zones.

Scenario 3 🔴: Upon breaking the 6928-6935 support zone and validation of the bearish divergence, the price could resume its decline and seek the 6883-6900 support zone, then 6814-6830.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6993-7000 (Resistance Zone + VVAH-1 6999.25 + Yesterday’s High 7000.50)

- 6961-6966 (Support Zone)

- 6957 (VVAL-1)

- 6928-6935 (Support Zone)

- 6921 (Yesterday’s Low)

- 6883-6900 (Major Support Zone)

- 6814-6830 (Support Zone + Single Print 6822-6833)

60-second Chrono

Market Performance

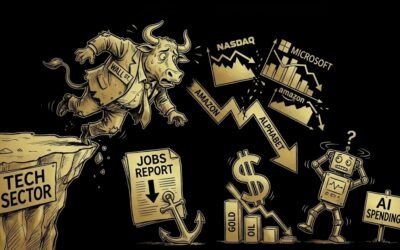

Wall Street saw a rise, particularly in the tech sector, following a recent sell-off linked to artificial intelligence concerns. Treasury yields fell, and gold prices increased due to a weaker dollar.

Company Forecasts

- Ford : Expectation of lower earnings and revenue for the fourth quarter.

- Coca-Cola : Forecast of increased revenue driven by demand for its zero-sugar beverages.

- Lyft : Estimated 13% revenue increase, supported by holiday demand and European expansion.

- Spotify : Forecast of the slowest revenue growth ever recorded in the fourth quarter.

- DuPont : Expectation of lower earnings due to uneven demand.

Economic Data

Retail sales are expected to show a 0.4% increase in December. Import prices are also expected to rise slightly.

Upcoming Economic Events

Several Federal Reserve officials will speak on the economy, and key inflation and employment data are anticipated.

Market Trends

Tech stocks rebounded after a period of selling, but concerns remain about the long-term viability of these companies in the face of the growing impact of artificial intelligence.

Company News

- Novo Nordisk sues Hims for patent infringement.

- Kroger names former Walmart executive as new CEO.

- Apollo Global announces a 13% increase in profit, exceeding expectations.

0 Comments