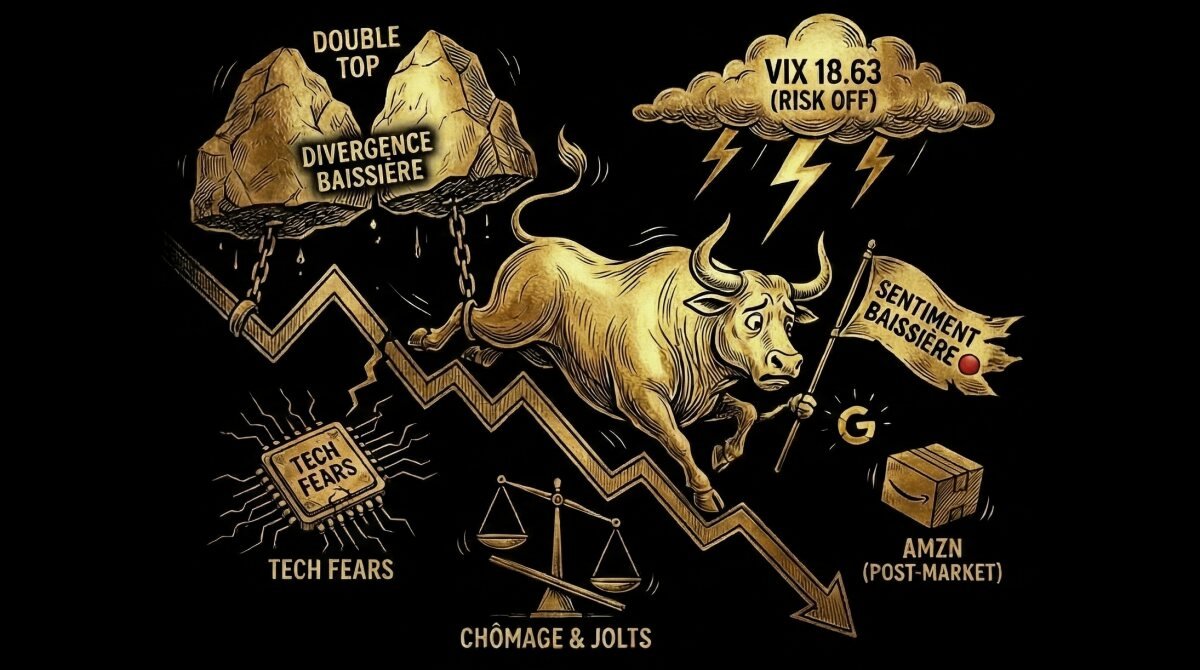

Economic Announcements:

- 2:30 PM: Unemployment Claims

- 4:00 PM: JOLTS Job Openings Report (December)

Earnings Reports:

- Amazon.com (AMZN)

- Royal Dutch … (RYDAF)

- Shell ADR (SHEL)

- Linde (LIN)

- Unilever ADR (UL)

- BBVA ADR (BBVA)

- ConocoPhillips (COP)

Analysis:

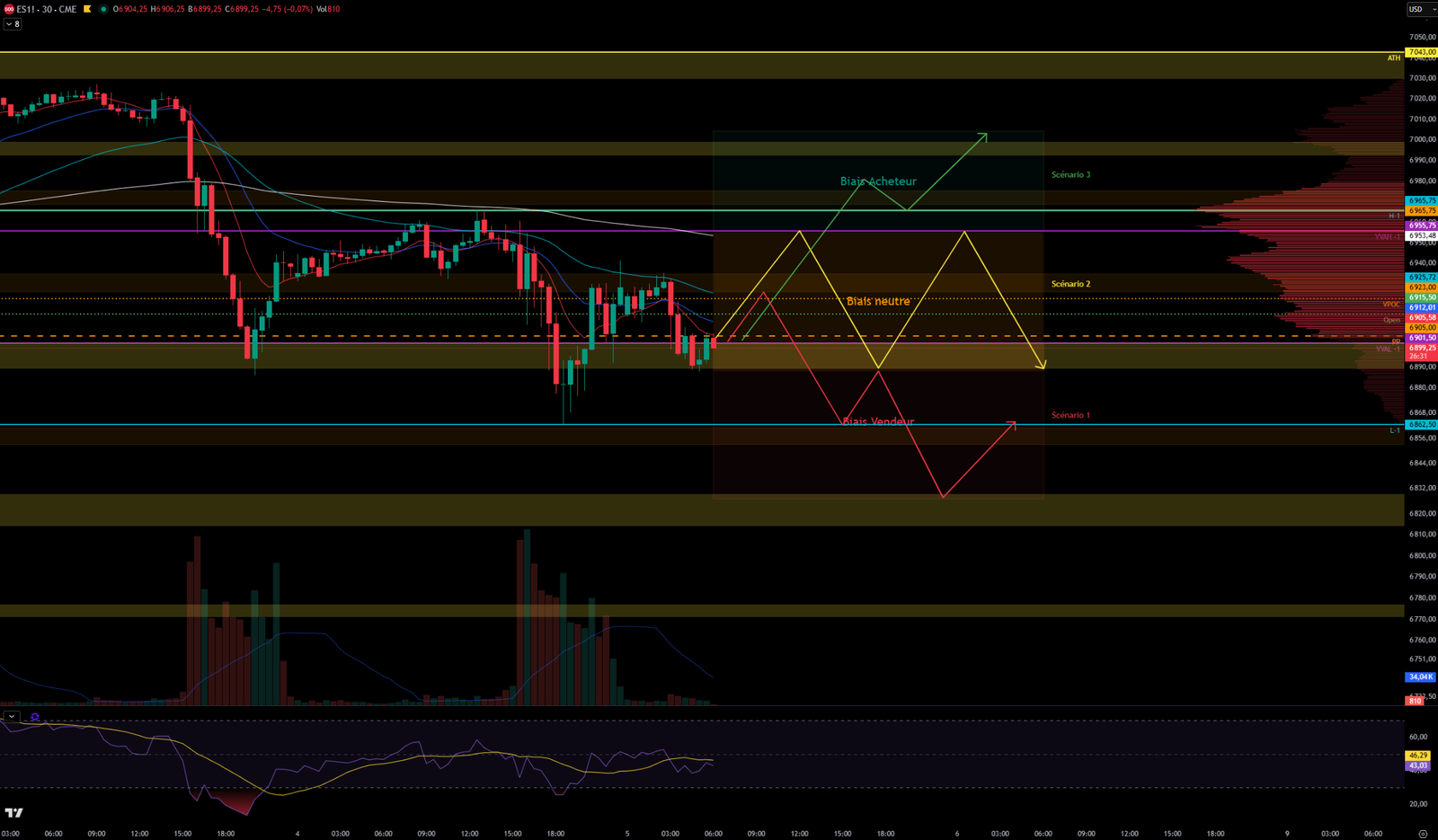

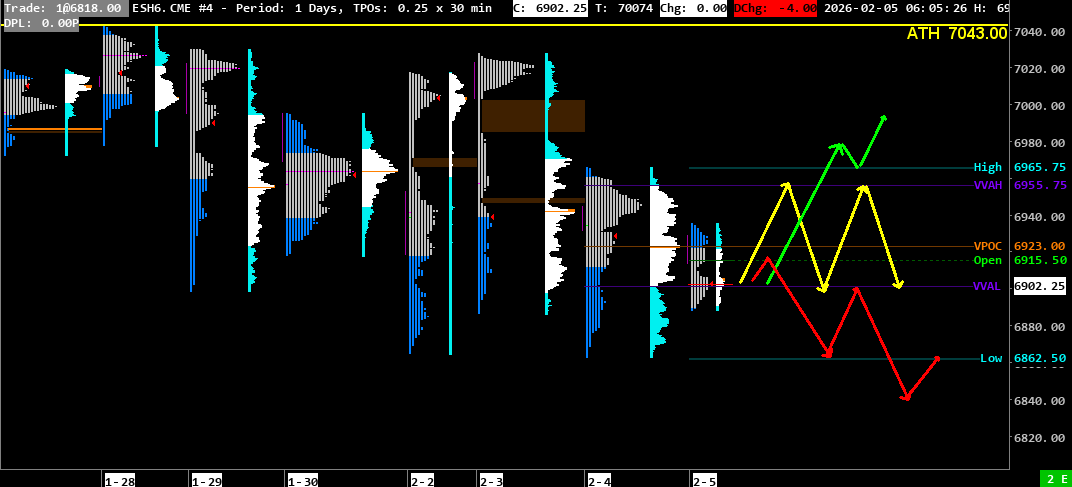

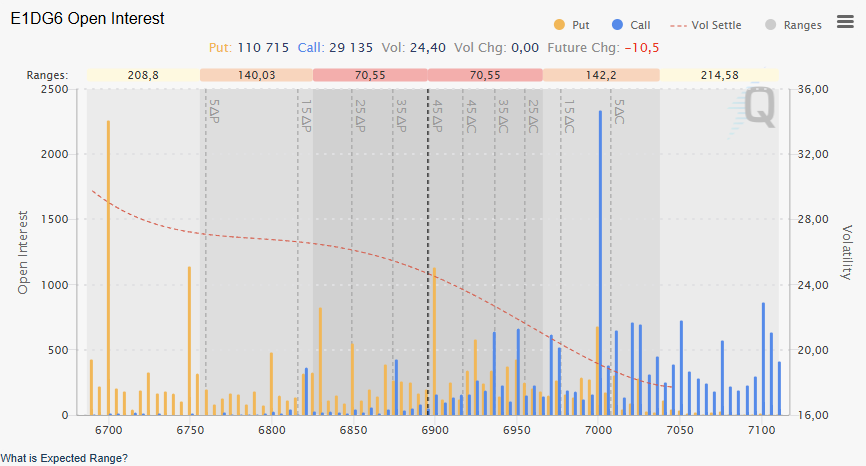

VPOC: 6923

VVA: 6901.50 – 6955.75

PP: 6905

Open: 6915.50 (Zone 1)

Vix: 18.63

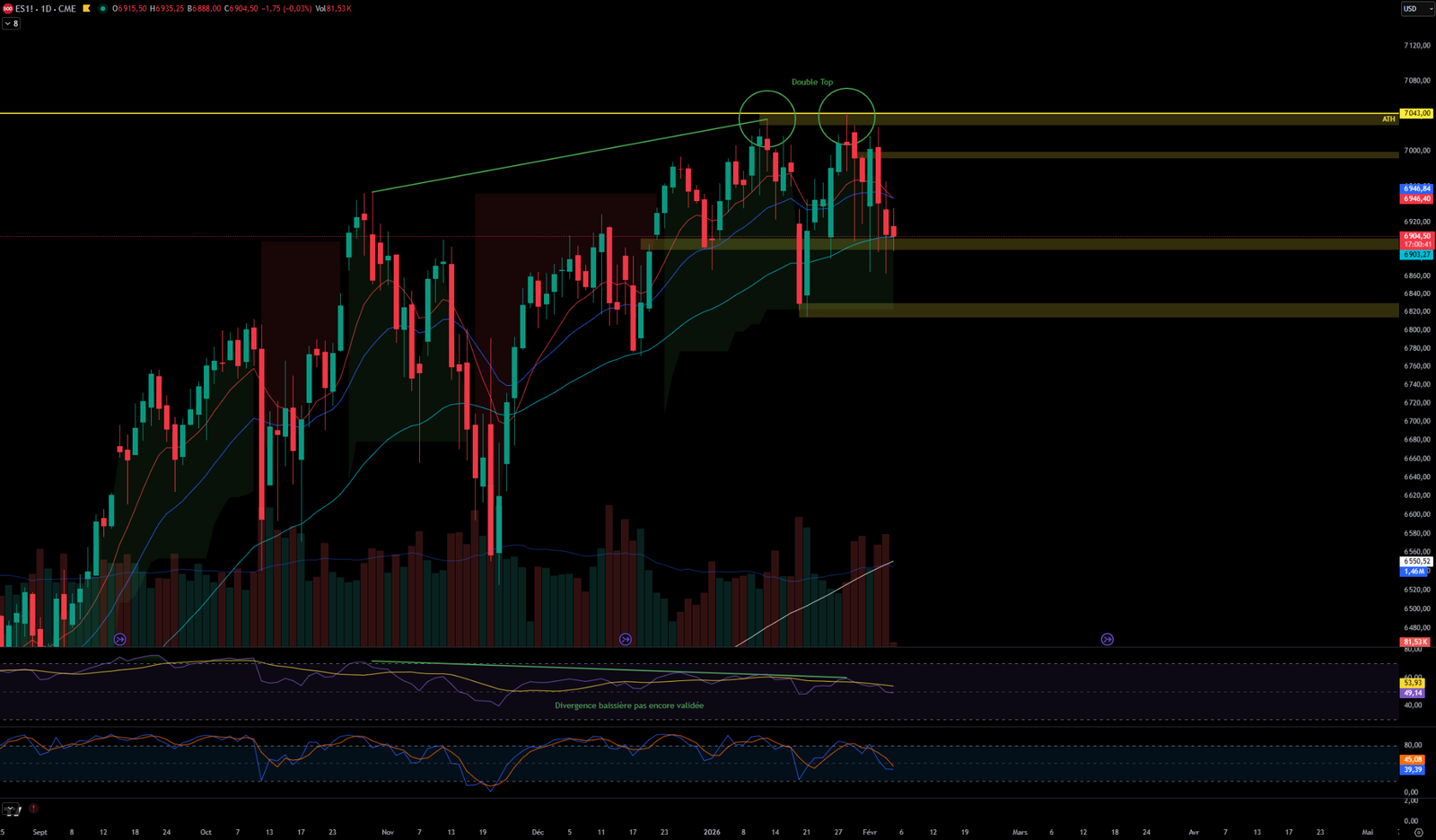

S&P 500 Trend: Overall Bearish Sentiment 🔴

Yesterday, the SP 500 experienced a day similar to Tuesday, with a rather calm morning and even a slight increase. Then, at the US open, a significant correction occurred, followed by a rebound at the end of the day for the close.

In the morning, the SP 500 traded between the 6926-6935 and 6969-6975 zones. At the US open, the price moved downwards, falling to the support zone of 6890-6902, and then to 6853-6861. Buyers then regained control, pushing the price back above the 6890-6902 zone to close around 6905. Investor concerns about tech stocks persist, despite the strong results released by Google (Alphabet) in the post-market. The VIX remained high at 18.63, confirming this RISK OFF sentiment.

This morning, the SP 500 opened in Zone 1 at 6915.50 and has already started to decline after buyers attempted to break the resistance zone of 6926-6935. Sellers defended the zone and pushed the price down to the support zone of 6890-6902, which also corresponds to VVAL-1 at 6902. The price has exited VVA-1 and is currently working within it.

The S&P 500 might only correct further, as several bearish signs are emerging on the Daily chart, such as a double top formed on the 7030-7043 resistance zone, each time with a strong rejection that propelled the price sharply downwards, and a significant bearish divergence that is close to being validated. Upon breaking the 6890-6900 zone and confirming a break of 6815-6830, the SP 500 could experience a substantial decline, potentially pushing the index below 6600. Furthermore, the price is below the 200-day moving average on the 1h chart, and volumes show selling peaks, which confirms this trend.

Today, we will have unemployment figures as well as the JOLTS report on new job openings. Amazon is also expected to release its earnings in the post-market this evening.

Scenario 1 🟡: Upon breaking VVAL-1 at 6901 and confirming a break of the support zone at 6890-6902, the SP500 could move downwards and target the support zone of 6853-6862, then 6815-6830, before returning to yesterday’s lows around 6863.

Scenario 2 🔵: Upon reintegration into VVA-1, the price could consolidate within it between 6901 and 6955.

Scenario 3 🔴: Upon breaking VVAH-1 at 6955 and confirming a break of yesterday’s highs at 6965, the price could target the resistance zone of 6992-7000.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6992-7000 (Resistance Zone)

- 6965 (Yesterday’s High)

- 6925-6935 (Resistance Zone)

- 6890-6902 (Support Zone + VVAL-1 6901)

- 6853-6862 (Support Zone + Yesterday’s Low 6862)

- 6815-6830 (Major Support Zone)

- 6,770-6,777 (Support Zone)

60-second Chrono

Market Trends

The Nasdaq and S&P 500 saw a decline, fueled by concerns about the sustainability of Wall Street’s rally. Treasury yields remained mixed, awaiting important economic data.

Amazon Performance

Amazon’s fourth-quarter revenue forecasts indicate an increase of over 12%, supported by holiday season sales and the growth of its cloud business. Investors are also monitoring its comments on cloud computing demand and its investment plans for 2026.

Google (Alphabet C)

Alphabet C announced earnings per share of $2.82 for the fourth quarter, exceeding analysts’ forecasts by $0.18, with revenue of $113.8 billion, also above expectations.

ConocoPhillips and Other Companies

ConocoPhillips anticipates a decrease in adjusted earnings due to falling oil prices, despite increased production. Other companies like Bristol Myers Squibb and Cigna plan to release their results, with particular interest in their flagship products.

Impact of Artificial Intelligence

Shares of software companies, such as Advanced Micro Devices, fell as investors worried about increased competition and potential disruption from AI. The sell-off in software stocks sparked debates about the viability of companies facing this threat.

Global Economy

Economic indicators in Latin America show forecasts for Mexico to maintain interest rates and a decrease in Brazil’s trade surplus.

Growth Outlook

Eli Lilly anticipates strong growth in 2026, particularly in the obesity drug market, while Novo Nordisk faces declining sales forecasts.

Upcoming Events

Several companies, including Uber and Bunge, are expected to release results and forecasts that could influence the markets.

Geopolitics

Iran is expected to prepare for “significant” negotiations with the United States. US Secretary of State Marco Rubio emphasized that negotiations with Iran must address not only the nuclear program but also ballistic missiles and support for militant groups, while Tehran wishes to limit discussions to its nuclear program and change the location of the talks.

Macro

Employment (Private Sector)

ADP Employment: The Warning Signal

- Current: 22K

- Forecast: 46K

- Previous: 37K

-> This is a huge disappointment. The figure is halved compared to already low expectations. This shows that the private sector has almost stopped hiring this month. It is a leading indicator suggesting a clear economic slowdown.

Activity Indices (Services)

PMI Services (S&P Global): Stability

- Current: 52.7

- Forecast: 52.5

- Previous: 52.5

-> This figure confirms that, despite the lack of hiring, business activity is not collapsing. We are above 50, so the services sector is still experiencing slight expansion.

ISM Non-Manufacturing: Resilience

- Current: 53.8

- Forecast: 53.5

- Previous: 53.8

-> The flagship services sector index is robust and slightly exceeds expectations. The US economy continues to be driven by services consumption. This figure is what prevents markets from completely panicking about growth after the disappointing ADP report.

ISM Sub-Indices

ISM Employment: Confirmation of the Slowdown

- Current: 50.3

- Forecast: 52.3

- Previous: 51.7

-> This figure validates the ADP disaster. The index is hovering near the 50-point mark. This means that service companies are now hesitant to recruit. The labor market is cooling down very quickly.

ISM Prices Paid: The Return of Inflation

- Current: 66.6

- Forecast: 65.0

- Previous: 65.1

-> This is the most dangerous figure in the report. Services inflation is accelerating when it was expected to decline. For the FED, this is a nightmare: employment is falling (so rates should be lowered) but prices are rising (so rates must be kept high). This creates uncertainty and volatility in the markets.

Energy

Crude Oil Inventories: Supply Tension

- Current: -3.455M

- Forecast: -2.000M

- Previous: -2.295M

-> Inventories fell much more than expected (reserves are depleting). This is a bullish signal for the price of crude oil. Demand remains strong or supply is insufficient, which supports oil prices despite economic concerns.

0 Comments