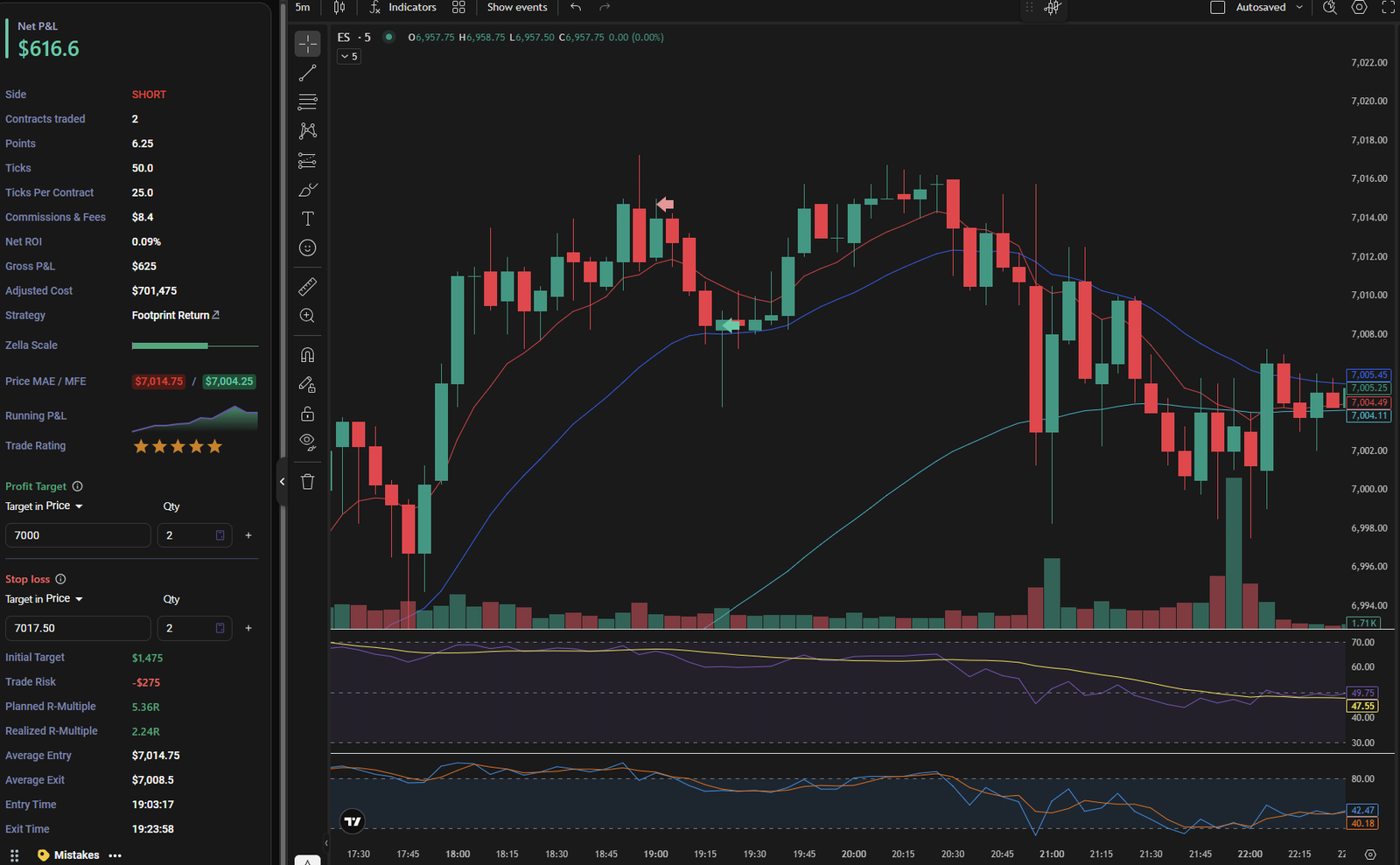

ES Futures Contract

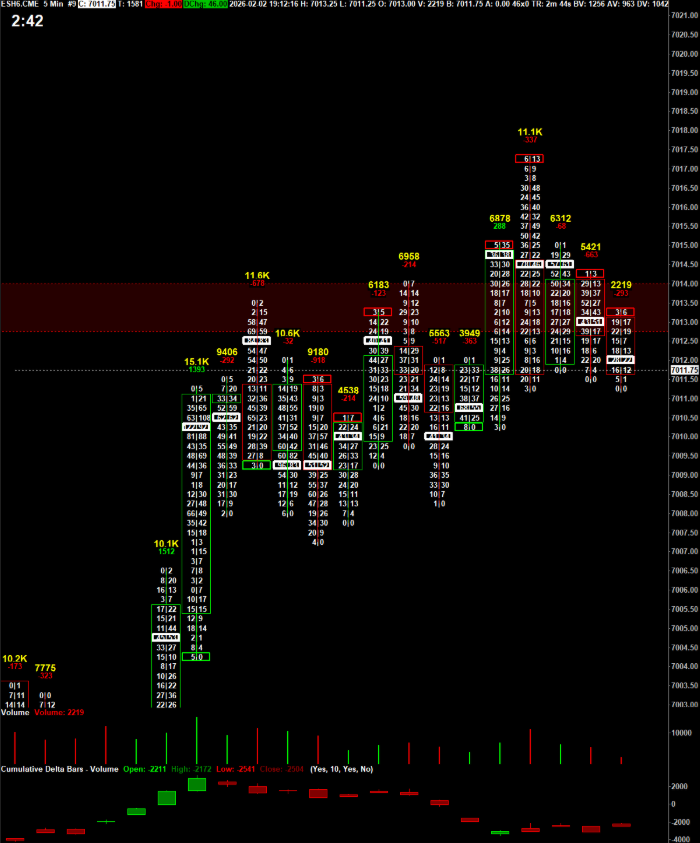

Price is trending up on the SP 500. The price reaches a high, and a reversal candle is observed on the Footprint, showing high volume, a selling delta, and a close precisely on the POC.

Entered a short position with 2 lots at 7014.75, using a limit order placed just below the signal candle’s POC. Stop Loss set above the signal candle at 7017.50.

Price retraces to fill the limit order, then declines to 7008, where another reversal candle forms on the Footprint, displaying high volume, a bullish candle, and a close on the POC.

Position closed at 7008.50.

Trade Risk: 5.36R

Realized: 2.24R ($616)

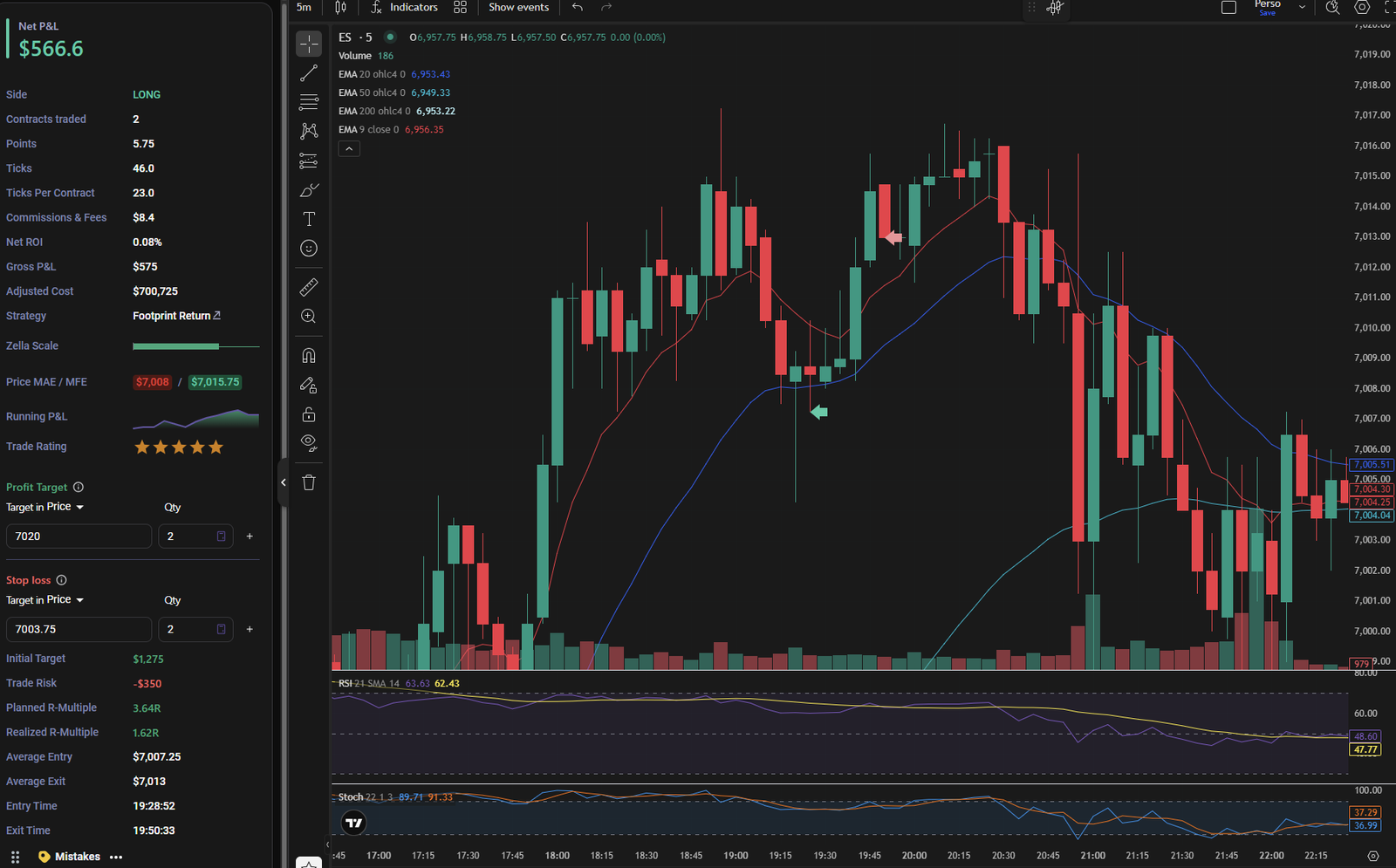

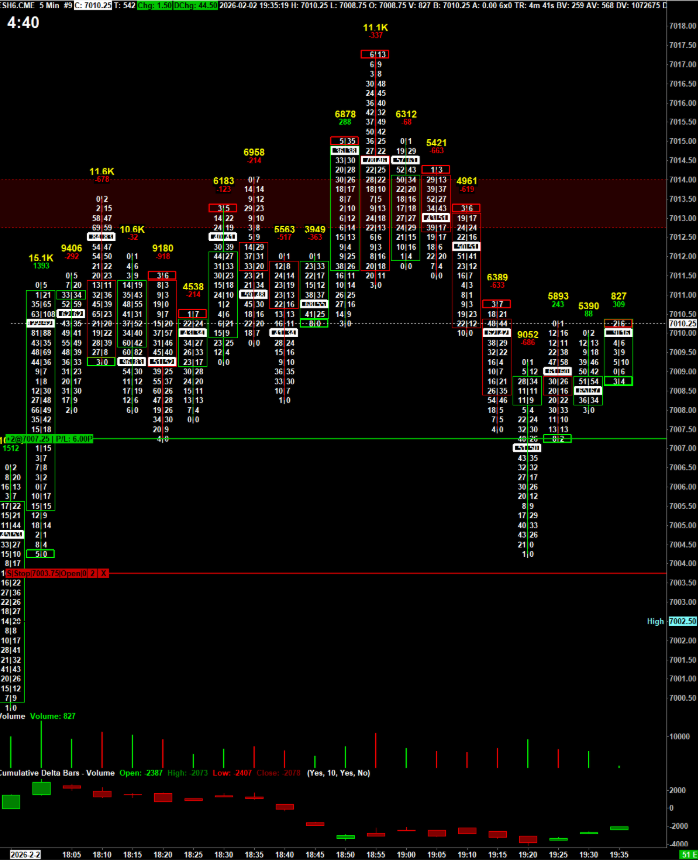

Following the Footprint signal and the emergence of a reversal candle that prompted me to close the previous trade, I entered a long position with 2 lots, using a limit order placed 1 tick above the signal candle’s POC.

Entry at 7007.25, targeting 7020, with a Stop Loss below the signal candle’s previous low at 7003.75.

Price recovers, reversing the previous decline, and forms a ‘Finished Business’ pattern on the Footprint, signaling the probable end of the trend.

Position closed at 7013.

Trade Risk: 3.64R

Realized: 1.62R ($566)

Excellent trades in both directions. This is the first time I’ve encountered such a situation, but the signals were exceptionally clear.

0 Comments