Economic Announcements:

- 2:15 PM: Non-farm payrolls

- 3:45 PM : Services PMI

- 4:00 PM: ISM PMI

- 4:30 PM: Crude oil inventories

Earnings Reports:

- Alphabet A (GOOGL)

- Eli Lilly (LLY)

- AbbVie (ABBV)

- Novartis (NVSEF)

- Novartis ADR (NVS)

- Mitsubishi U… (MUFG)

- Santander A… (SAN)

- Uber Tech (UBER)

- Qualcomm (QCOM)

- UBS Group (UBS)

- Boston Scien… (BSX)

Analysis:

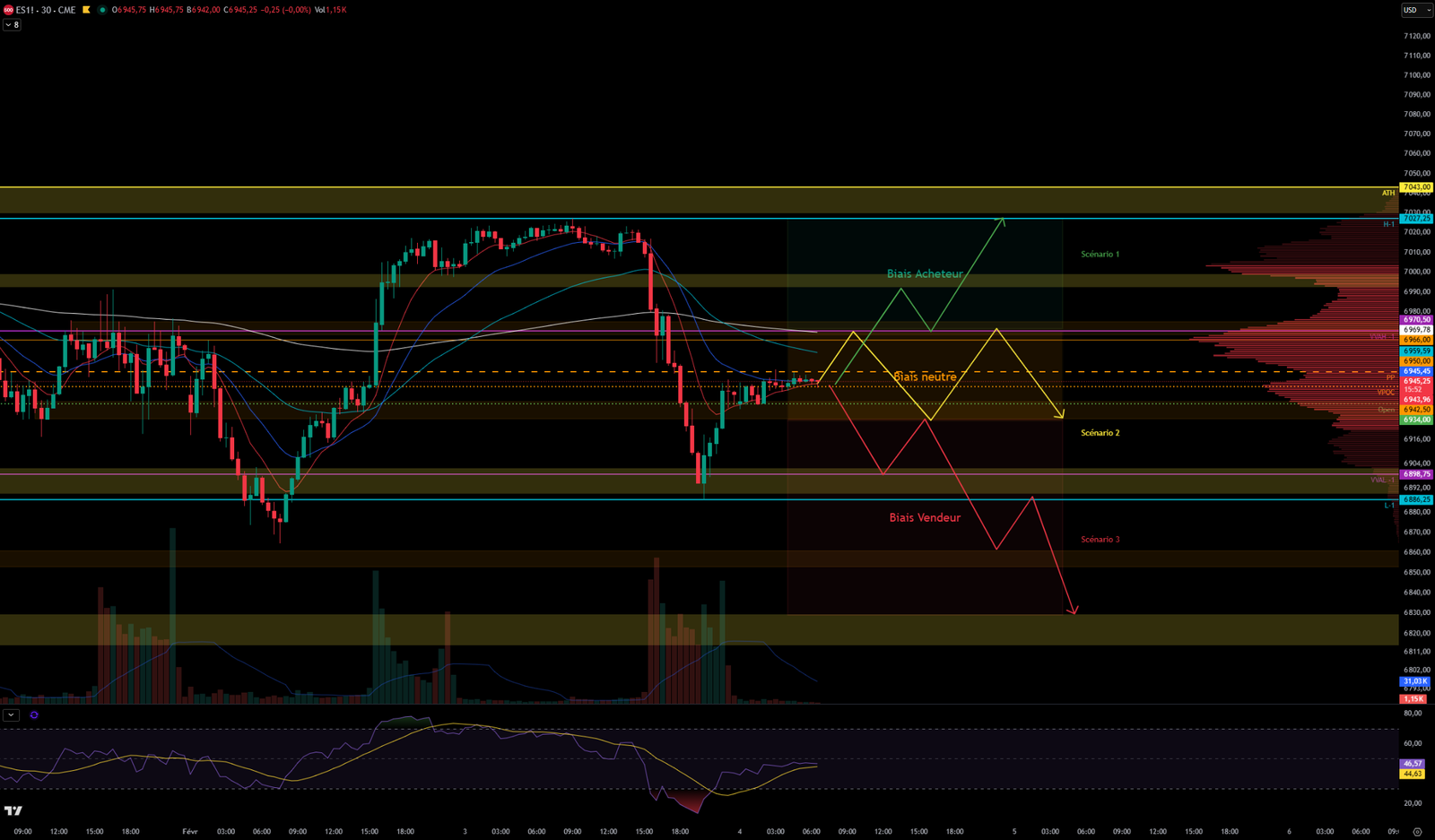

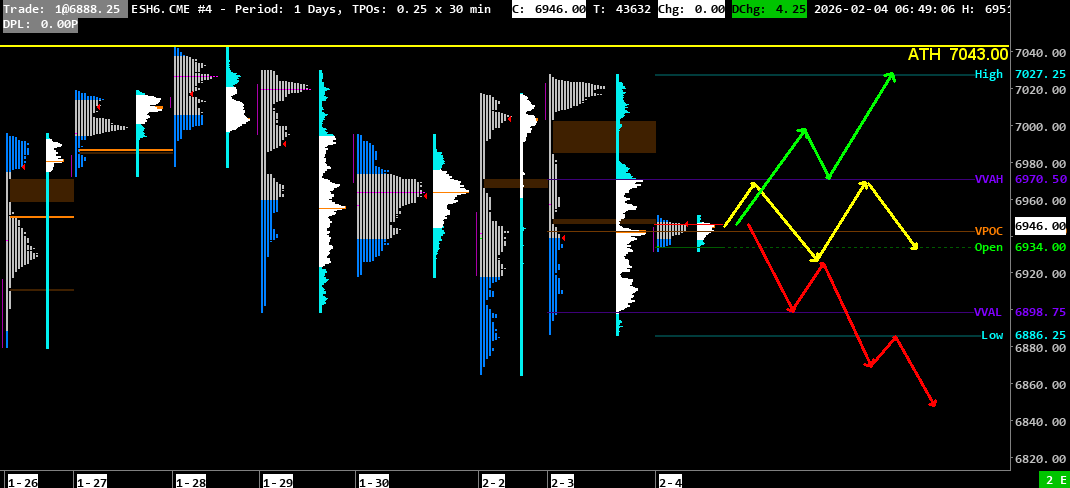

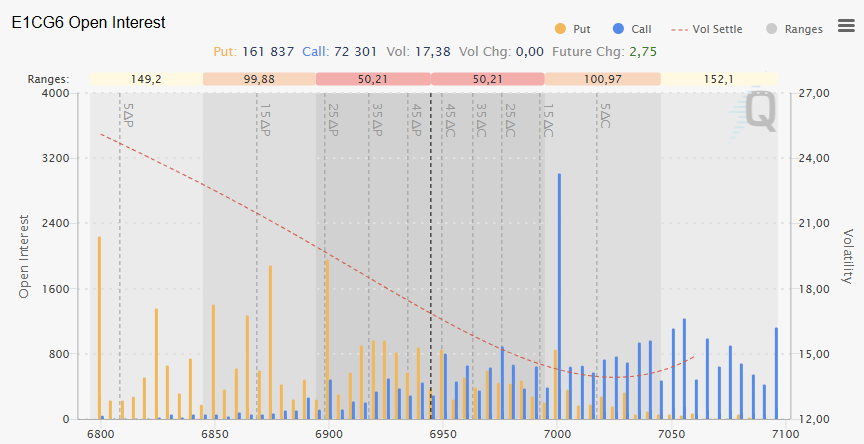

VPOC: 6942.50

VVA: 6898.75 – 6970.50

PP: 6950

Open: 6934 (Zone 1)

Vix: 18.01

SP500 Trend: overall bullish sentiment 🟢

Yesterday, the SP 500 was once again impacted by investor fears regarding the tech sector and the pullback in software companies. The healthcare sector also contributed to the decline. Despite this, the index had opened slightly higher, just below the strong resistance level of 7030-7043, raising hopes for a zone test and a target at the ATH of 7043. Throughout the morning, the price remained stable between this resistance and the support zone of 6993-7000.

At the US open, the price sharply declined with aggressive sellers very active, leaving little room for buyers. The price reacted slightly to the support zones, but without real conviction for a rebound.

The rebound occurred at the 6890-6900 support zone, where the index ended its decline to stabilize at the 6930-6935 resistance zone, the level at which it closed. The SP 500 corrected following the previous strong rally and stopped slightly above yesterday’s low of 6864.

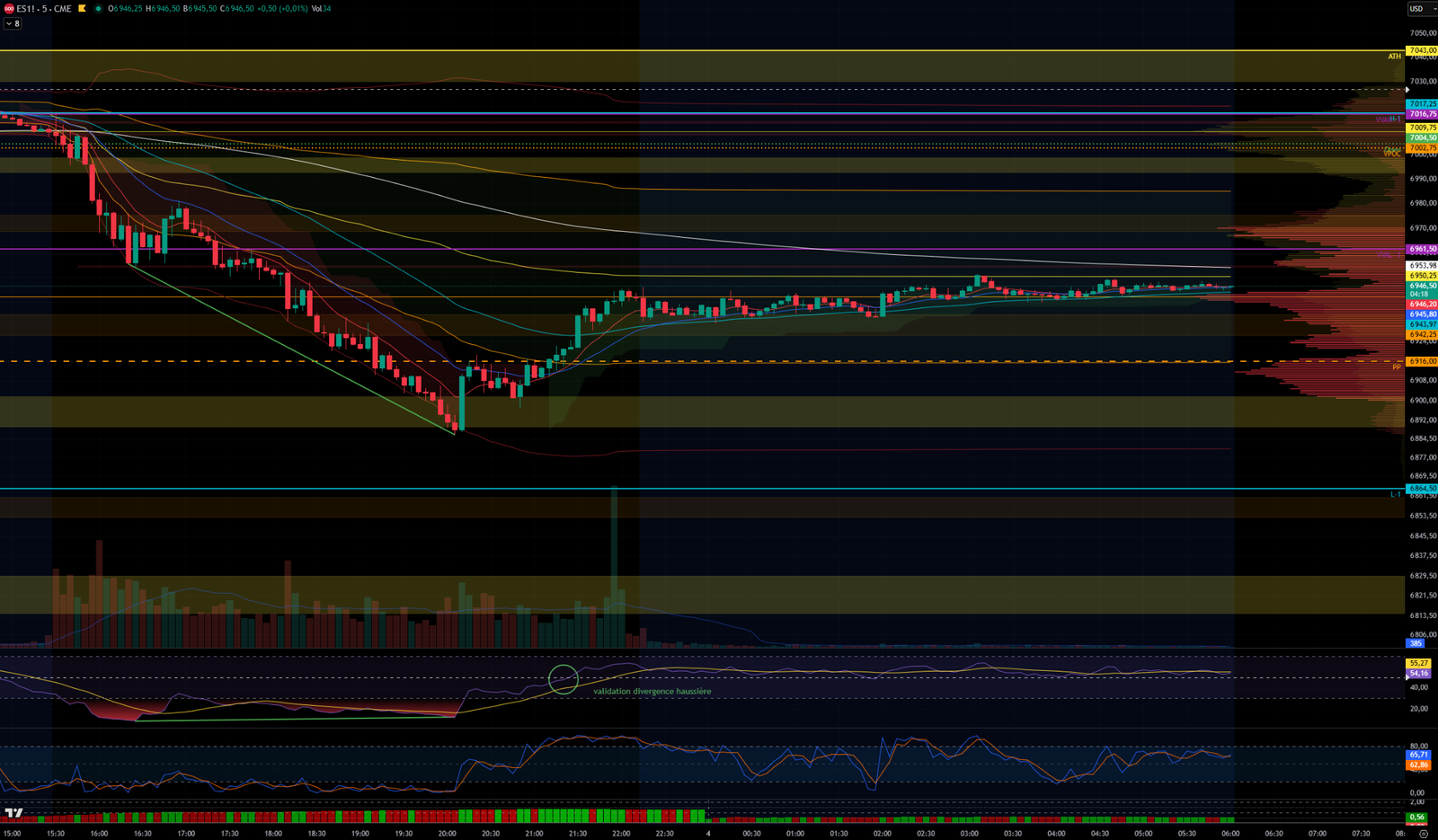

Today, the SP 500 opens in Zone 1 at 6934, above the 6930-6935 support zone. It is slightly up and is working the previous day’s VPOC at 6942. The price is moving within the previous day’s VA and the delta is very slightly bullish. During the descent, the price created several single prints at 6945-6950 (already filled) and a large one at 6985-7003 that will need to be filled to move back above 7000.

On the 5-min chart, we can observe a bullish divergence on the RSI, a sign that the price could resume its upward trend in the short term. We will need to monitor the European and US openings to see if the trend holds.

By consulting the options zones, we can see Put zones at 6900 and Call zones at 7000, which could provide an average range for the day.

Today, we will have the ISM PMI figures, non-farm payrolls, and crude oil inventories. Google and Qualcomm will report their earnings after the close, while Eli Lilly will release theirs before the open.

Scenario 1 🟡: Upon a break of VVAH-1 at 6970, the price could resume its upward movement and target the 7000 zone, before attempting to return to yesterday’s highs at 7027. However, the Single Print at 6985-7003 must be breached for the uptrend to be confirmed.

Scenario 2 🔵: Upon rejection at VVAH-1 at 6970, the price could consolidate between VVAH-1 at 6970 and the support zone of 6926-6935.

Scenario 3 🔴: Upon a break of the support zone of 6926-6935, the price could target the support zone of 6890-6902, then the 6815-6830 zone.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 7027 (Yesterday’s high)

- 6992-7000 (Support Zone) + 6985-7003 (Single Print)

- 6969-6975 (Support Zone + VVAH-1 6970)

- 6926-6935 (Support Zone + Open 6934)

- 6900: (Puts Options Interest Zone)

- 6890-6902 (Support zone)

- 6886 (Yesterday’s low)

- 6853-6861 (Support Zone)

- 6,814-6,830 (Support Zone)

60-second Chrono

Stock Market

Wall Street experienced a significant decline, fueled by concerns about the impact of artificial intelligence on competition in the software sector. The SP 500 fell by 0.84%, while the Nasdaq dropped by 1.43%.

Bond yields and dollar

Treasury yields declined, and the dollar index also fell, linked to concerns about the Federal Reserve’s monetary policy.

Oil prices

Oil prices rose after the US shot down an Iranian drone, raising security concerns in the Strait of Hormuz.

Company Earnings

- Alphabet (Google) : Revenue forecasts up due to AI and increased cloud services.

- Qualcomm : Expectation of over 4% sales increase for the December quarter.

- Uber : Forecasts for a 20% revenue increase in the fourth quarter.

- Eli Lilly : Fourth-quarter earnings report with interest in its weight loss and Alzheimer’s drugs.

- Disney : Leadership change with Josh D’Amaro named CEO of Parks.

Economy

The Institute for Supply Management forecasts a slight slowdown in the services sector, with a moderation in the Purchasing Managers’ Index.

Technology Trends

Concerns about AI disrupting the software sector have intensified, particularly after Anthropic’s tool launch.

Fed Outlook

Comments suggest the Fed might consider cutting interest rates, which could influence markets.

Shutdown ends and race launched to reform Trump’s ICE

Donald Trump signed a bill ending the partial government shutdown, while Congress prepares for negotiations on immigration reform and funding for the Department of Homeland Security, in response to growing tensions related to recent law enforcement incidents.

0 Comments