Economic Announcements:

- 3:45 PM : Manufacturing PMI

- 4:00 PM : ISM PMI

Earnings Reports:

- Palantir (PLTR)

- Walt Disney (DIS)

- Intesa Sanpaolo (ISNPY)

- Mizuho Financial Group (MFG)

Analysis:

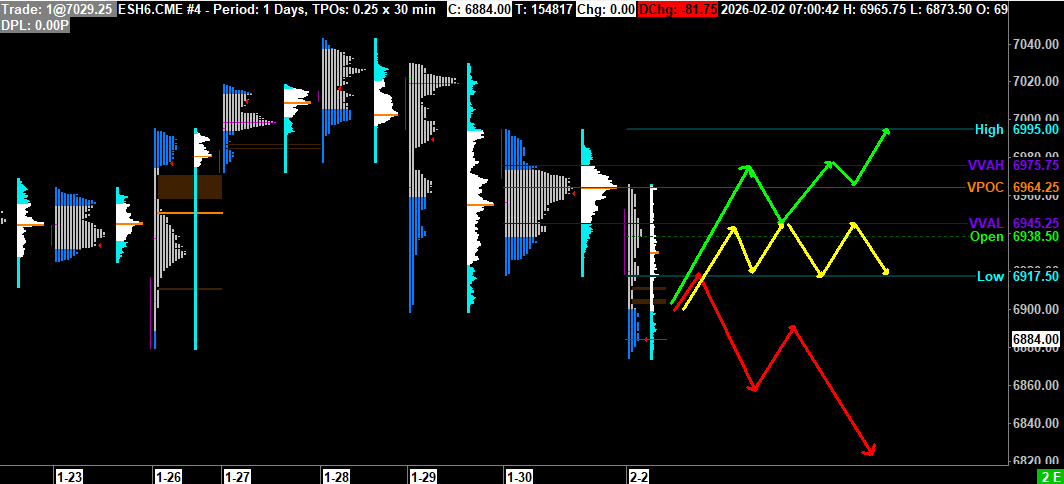

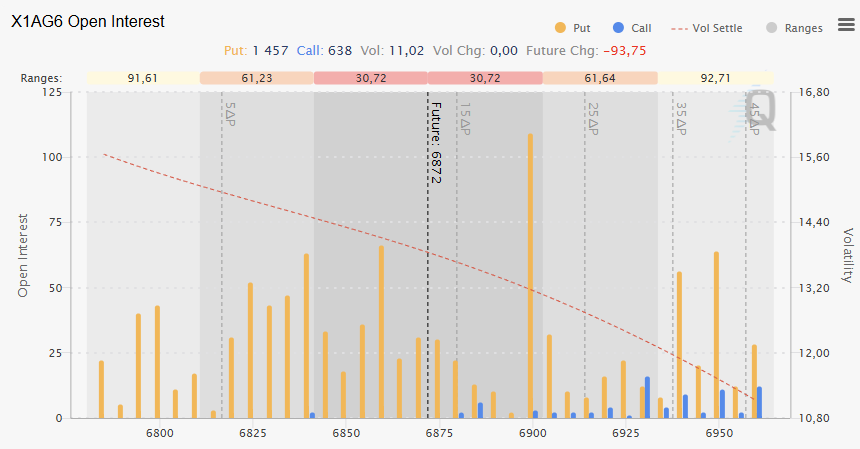

VPOC: 6964.25

VVA: 6945.25 – 6975.75

PP: 6916

Open: 6938.50

Vix: 17.43

S&P 500 Trend: Overall Bearish Sentiment 🔴

On Friday, the S&P 500 opened in Zone 1 very close to VVAH-1. After testing it, the price moved downwards to target 6970. At this level, buyers responded, bringing the price back to VVAH-1. Once again, the price failed to break through, and sellers regained control. Despite an attempt by buyers to rebound from the 6944-6950 support zone, sellers pushed the price down to VVAL-1 at 6923. The price then rallied back to the 6960-6968 resistance zone.

At the US open, the price began to consolidate between the VPOC and the 6982-6988 resistance zone. Sellers then took control, breaking the VPOC and driving the price to VVAL-1 at 6923. Buyers then defended the level as they had in the morning, and the price returned to the 6960-6968 resistance zone. The S&P 500 closed at 6960.

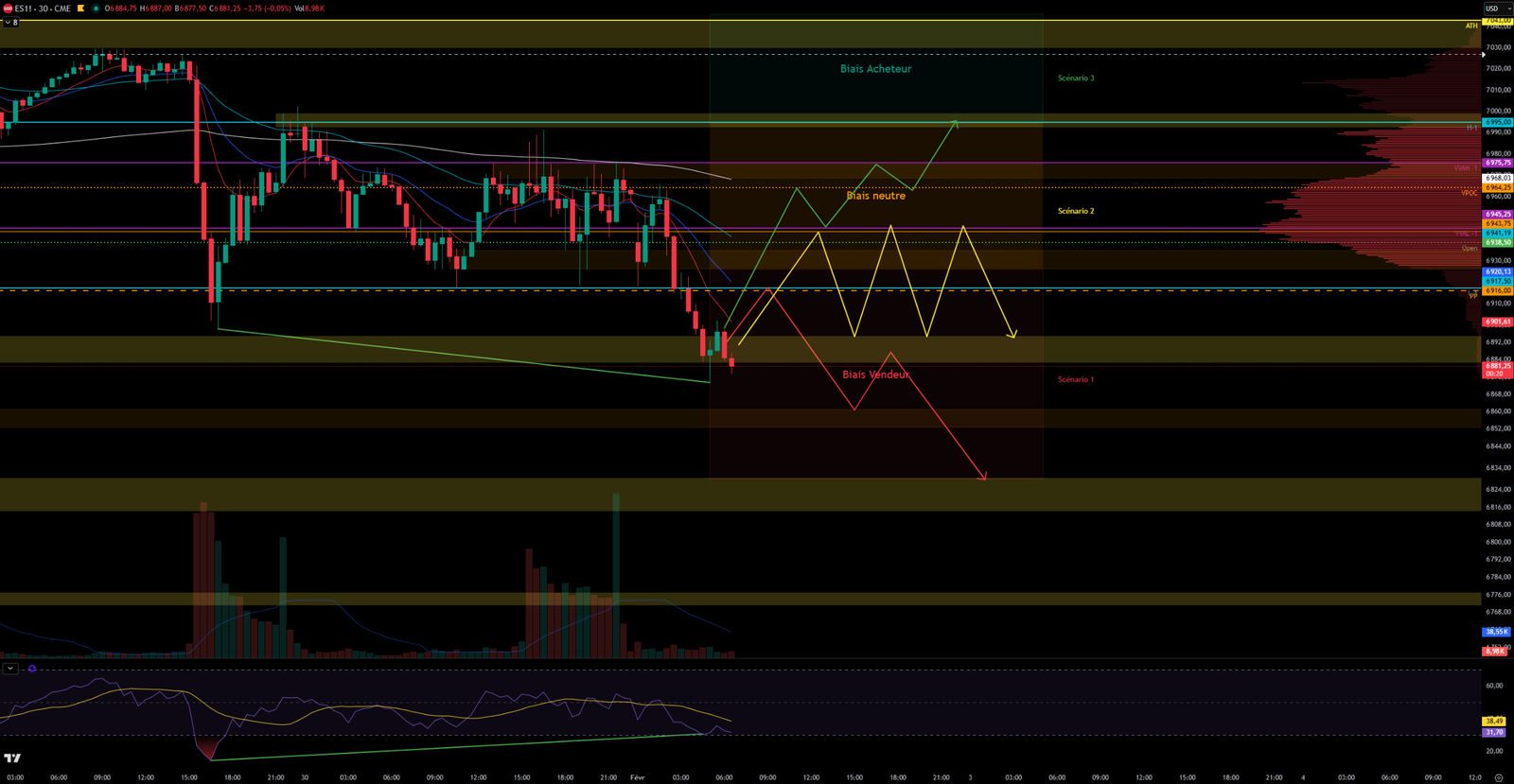

This morning, the S&P 500 opened in Zone 2 with a bearish imbalance at 6938.50, showing a slight bearish GAP. This GAP was, however, quickly filled. Sellers are in control and drove the price to the 6865-6875 support zone, where the price rebounded to retest 6900. The price was rejected at this level and resumed its downward movement.

The S&P 500 is clearly bearish this morning, and volatility is already significant with volumes well above normal. The market is reacting to news from late last week.

On the 30-minute chart, we can observe a bullish divergence on the RSI, but it is far from being confirmed. It will still need to be monitored to see the price’s reaction to the 6853-6860 support. During its decline, the S&P 500 created two single prints at 6902-6905 and 6910-6912, which could act as resistance in case of a rebound.

Today, we will have the ISM Manufacturing PMI data, which could cause the index to react.

Scenario 1 🔴: Upon a break of the 6882-6895 support zone, the price could continue its decline and target the 6815-6830 support zone after breaking through the 6852-6860 zone.

Scenario 2 🟡: Upon a break of Friday’s low at 6917 and rejection at VVAL-1, the price could consolidate within the 6895 and 6917 zone.

Scenario 3 🟢: Upon a break of VVAL-1 at 6945, the price could target Friday’s high at 6995.

Zones of Interest:

- 7030-7043 (Major resistance zone + ATH 7043)

- 6992-7000 (Resistance zone + Friday’s high)

- 6969-6976 (Resistance zone + VVAH-1)

- 6945 (VVAL-1)

- 6926-6935 (Resistance zone)

- 6917 (Friday’s low)

- 6890-6900 (Resistance zone)

- 6852-6851 (Support zone)

- 6815-6830 (Support zone)

- 6,770-6,777 (Support Zone)

60-second Chrono

Futures Decline

S&P 500 futures decreased by 0.2%, while Dow Jones and Nasdaq futures also recorded declines. This trend occurs amidst a decline in technology stocks, partly due to Microsoft’s disappointing results.

Political Developments

The nomination of Kevin Warsh by Donald Trump to chair the Federal Reserve is also a focus of attention. Investors are questioning the implications of this nomination for interest rates and inflation management.

Economic Data

The US employment report for January, scheduled for Friday, is anticipated and could influence interest rate expectations.

Economic Outlook

Forecasts for the US economy include a slight improvement in the Manufacturing Purchasing Managers’ Index (PMI) in January. Earnings reports from major companies, such as Walt Disney and Pfizer, are also expected, which could influence the markets.

Upcoming Events

The article mentions several companies that will release their financial results, as well as key economic events, such as the publication of US employment figures, which could have a significant impact on the markets.

AI Concerns

A Wall Street Journal report revealed that a potential $100 billion investment in OpenAI is on hold, which has heightened concerns about the profitability of AI investments.

Geopolitical Context

Tensions between the United States and Iran continue to influence oil prices, while markets react to economic and political uncertainties.

Macro

Inflation: Unexpected Pressure

PPI – Producer Price Index

- Current: 0.5%

- Forecast: 0.2%

- Previous: 0.2%

-> This figure is an unwelcome surprise for those betting on a rapid decline in inflation. The PPI measures inflation from the “factory/producer” side. A 0.5% increase means that production costs are rising significantly.

This is an early warning sign: if companies are paying more now, they are likely to pass these costs on to final consumers later. This complicates the FED’s task and generally weighs on stock indices.

Manufacturing Activity: An Explosive Rebound

Chicago PMI

- Current: 54.0

- Forecast: 43.5

- Previous: 42.7

-> While a severe contraction was expected, activity surged into a clear expansion zone at 54.0.

The gap between the forecast and reality is massive (+10 points). This proves that the real economy is much more resilient than anticipated. This is excellent news for growth, but combined with the previously high PPI, it reinforces the scenario of an overheating economy that does not require an immediate rate cut.

0 Comments