Economic Announcements:

- 2:30 PM: Unemployment

- 2:30 PM : Trade Balance

- 6:00 PM : Atlanta Fed GDPNow

- 7:00 PM : 7-Year T-Note Auction

Earnings Reports:

- Apple (AAPL)

- Mastercard (MA)

- Caterpillar (CAT)

- Thermo Fisher Scientific (TMO)

- KLA Corp (KLAC)

- Blackstone (BX)

- Lockheed Martin (LMT)

- Honeywell (HON)

- Stryker (SYK)

- Parker-Hannifin (PH)

- Altria (MO)

- Comcast (CMCSA)

- Western Digital (WDC)

- Trane Technologies (TT)

- Marsh McLennan (MRSH)

- Sherwin-Williams (SHW)

- Royal Caribbean Cruises (RCL)

- L3Harris Technologies (LHX)

- Arthur J Gallagher (AJG)

- Nasdaq Inc (NDAQ)

Analysis:

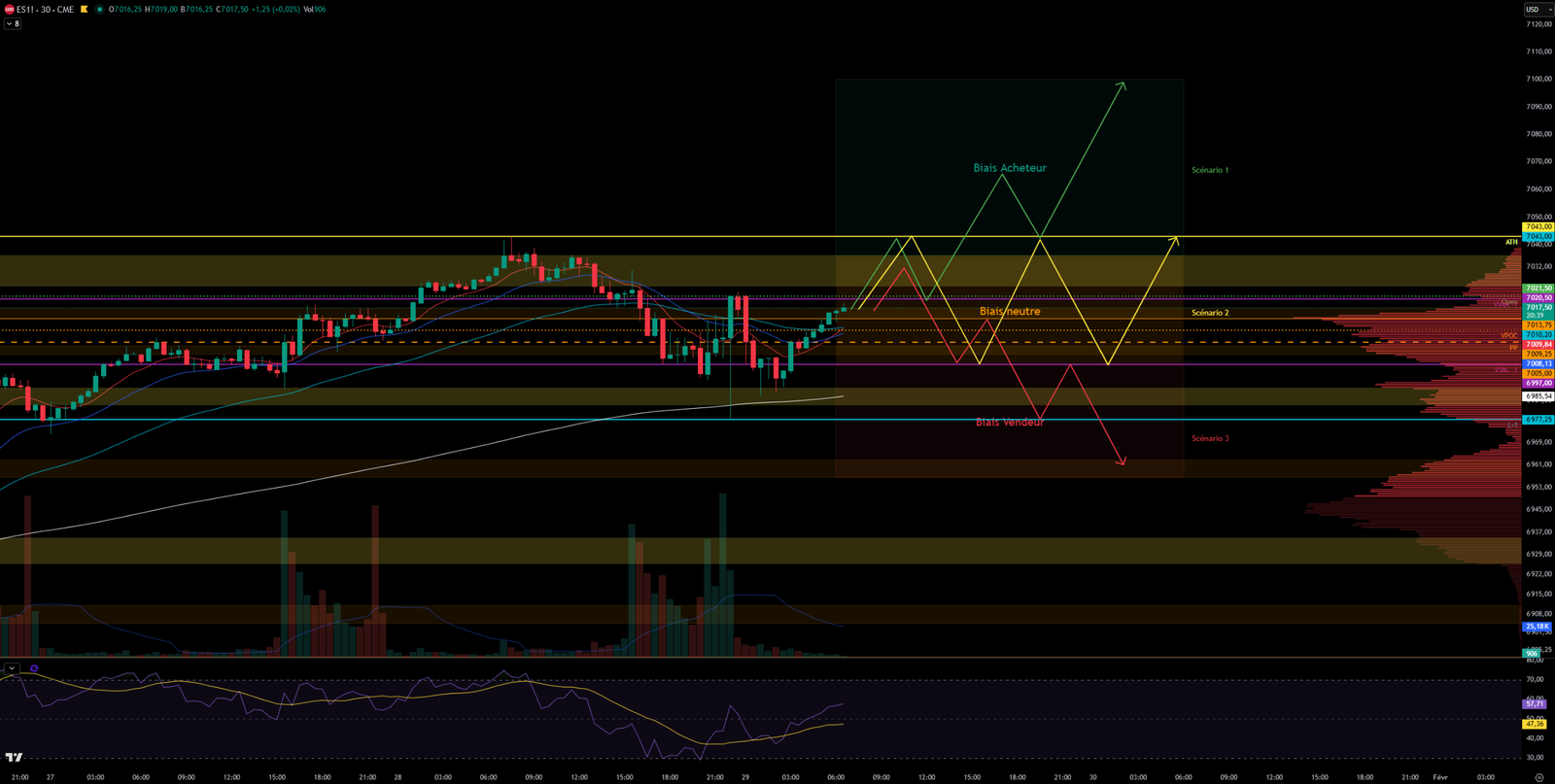

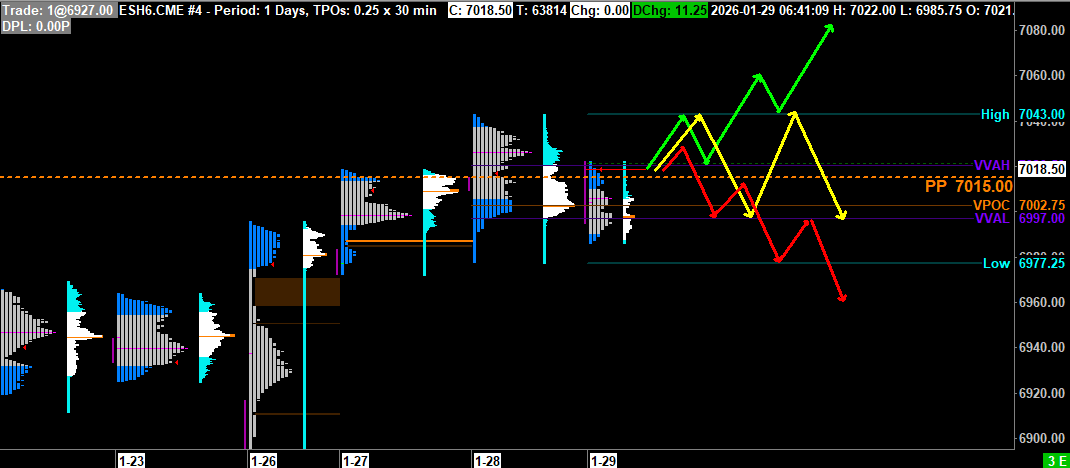

VPOC: 7002.75

VVA: 6997 – 7020.50

PP: 7005

Open: 7021.50 (Zone 2)

Vix: 16.34

SP500 Trend : Overall bullish sentiment 🟢

Yesterday, the S 500 started the day higher. Buyers took control to push the price to the resistance zone of 7025-7036 and reach the previous ATH at 7036. The price broke this level to establish a new one at 7043. At this point, sellers regained control and pushed the price back below the resistance zone before the US open.

At the US open, buyers attempted to reclaim the resistance zone without much conviction. Sellers pushed the price back towards the support zone of 7013-7017 before re-entering yesterday’s VVA. The price remained there for the rest of the day despite some selling pressure attempting to break the VVAL-1. The price closed at 7005 after strong selling pressure tested the support zone of 6982-6988, corresponding to the weekly VWAP level. The subsequent violent rejection created a significant rejection candle on the 30-minute chart, suggesting that below 7000, the price is no longer accepted.

This morning, the S 500 opened in the upper Zone 2 with an immediate re-entry into VVA-1. Selling pressure returned to test yesterday’s rejection zone at the 6982-6988 support level. The price tested this support twice, forming a double bottom before moving higher and re-entering VVA-1, where it currently stands. The scenario could be identical to yesterday’s, namely a range within VVA-1, if the price fails to break through the resistance zone of 7025-7036 and the current ATH at 7043.

Today, markets are expected to react to the Fed’s decision to maintain rates at 3.75% and to Powell’s speech, even if some of the reaction has already occurred. Earnings reports from Microsoft, Meta, and Tesla released last night could also impact the trend, especially as Apple and other major companies will publish their results later today.

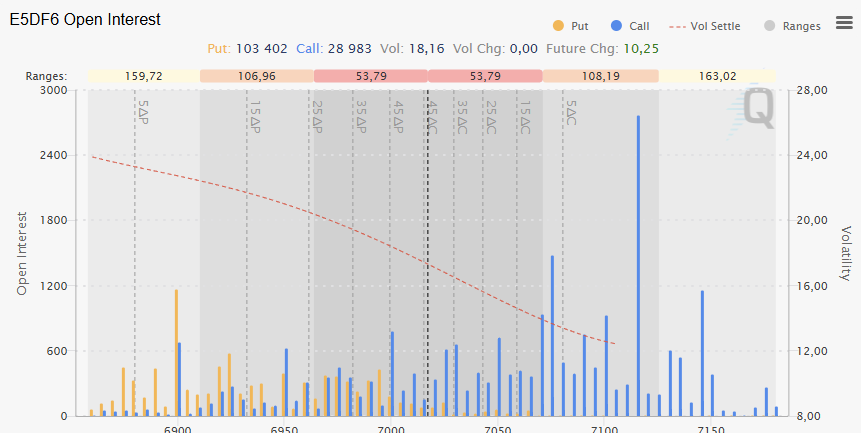

On the options side, we observe open interest above 7050, with a wall of calls at the 7125 level and its vicinity. These levels could act as a magnet during the day, while also forming a major resistance.

Finally, on the macroeconomic front, investors will monitor unemployment figures, the trade balance, and the Atlanta Fed’s GDPNow.

Scenario 1 🟢: Upon breaking the resistance zone of 7025-7036 and confirmation with the break of the ATH at 7043, the price will move higher and establish a new ATH.

Scenario 2 🟡: Upon rejection at the 7025-7036 resistance zone, the price could consolidate within VVA-1 and the ATH, thus between 7000 and 7043.

Scenario 3 🔴: Upon breaking VVAL-1 and confirmation with the break of the support zone of 6982-6988, the price could decline and test yesterday’s low at 6977, then the support zone of 6956-6962.

Zones of Interest:

- 7043 (ATH)

- 7023-7036 (Major Resistance Zone)

- 7013-7017 (Support Zone)

- 7000-7005 (Support Zone + Weekly VPOC)

- 6982-6988 (Major Support Zone)

- 6977 (Yesterday’s Low)

- 6960-6969 (Support Zone)

60-second Chrono

Federal Reserve Policy

The U.S. Federal Reserve decided to keep interest rates unchanged, citing persistent inflation and a stabilizing labor market. This decision led to a slight decline in the SP 500 index, while the Nasdaq showed an increase.

Market Performance

Treasury yields rose, and the dollar gained ground against the euro and the yen. The article highlights that inflation remains high and the labor market is stabilizing, which could influence future Fed decisions.

Company Earnings

Several companies, including Apple and Amazon, are in focus. Apple anticipates a significant increase in revenue due to strong demand for the iPhone 17 series, while Amazon announced the elimination of 16,000 jobs to optimize efficiency.

Upcoming Economic Events

Major company earnings reports are expected, including from Blackstone, Caterpillar, and Mastercard. Analysts will closely monitor comments on economic outlook and earnings forecasts.

Market Trends

The article mentions strong demand for technology stocks, particularly those of the “Magnificent Seven,” which are expected to show higher earnings growth than the rest of the SP 500.

Inflation and Global Economy

Brazil is expected to release inflation data, indicating a rise in prices, while concerns remain regarding the impacts of trade tariffs and geopolitical uncertainties on markets.

Magnificent 7 Earnings

Yesterday, Microsoft, Tesla, and Meta kicked off the earnings season for the Magnificent Seven.

- Microsoft: Shares fell by nearly 6% despite strong financial results, as Azure Cloud revenue growth only slightly exceeded analysts’ expectations.

- Tesla: Exceeded Q4 2025 financial forecasts, while announcing a $2 billion investment in artificial intelligence and a transition towards a physical AI-focused company, despite an 11% decline in its automotive revenue.

- Meta: announced a 73% increase in its capital expenditures for 2026, aiming to develop highly personalized artificial intelligence, while forecasting higher-than-expected revenues for the current quarter.

Macro

FOMC: Powell Maintains Course and Caution

FED Interest Rate Decision

- Current: 3.75%

- Forecast: 3.75%

- Previous: 3.75%

-> The figure is perfectly aligned with consensus, avoiding any immediate monetary shock. This is the scenario “priced in” by the market.

However, the lack of surprise in the figure leaves ample room for interpretation of Powell’s words: the Fed remains restrictive and entirely data-dependent, without offering the rate cut signal that investors secretly hoped for.

This cautious tone favors a strong Dollar, which mechanically puts pressure on risky assets and commodities.

Indices are struggling to find an upward catalyst, and rebound attempts are being sold off, while the bond market remains calm, validating rate stability. Only gold seems to be benefiting from the uncertain global context.

Oil: Massive Drop in Inventories

Crude Oil Inventories (EIA)

- Current: -2.295M

- Forecast: -0.200M

- Previous: 3.602M

-> This is a significant surprise for the energy market. While analysts anticipated an almost negligible decrease, inventories plummeted dramatically (over 2 million barrels). This indicates very robust immediate demand in the United States or a tightening of supply.

This positive figure is a clear bullish signal for crude oil prices. Fundamentally, this strain on energy supply could rekindle inflationary fears just before the FED’s speech, potentially complicating their equation.

0 Comments