Economic Announcements:

- 2:30 PM : Trump Speech?

- 4:00 PM: Crude Oil Inventories

- 8:00 PM : FED Interest Rate Decision

- 8:30 PM : FOMC Press Conference

Earnings Reports:

- Microsoft (MSFT)

- Meta Platforms (META)

- Tesla (TSLA)

- ASML ADR (ASML)

- Lam Research (LRCX)

- IBM (IBM)

- Amphenol (APH)

- GE Vernova LLC (GEV)

- Danaher (DHR)

- AT&T (T)

- ServiceNow Inc (NOW)

- Progressive (PGR)

- Starbucks (SBUX)

- …

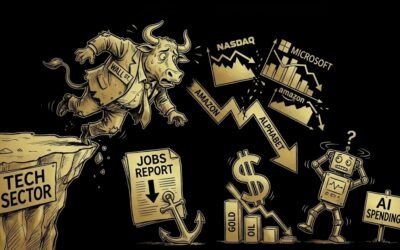

Analysis:

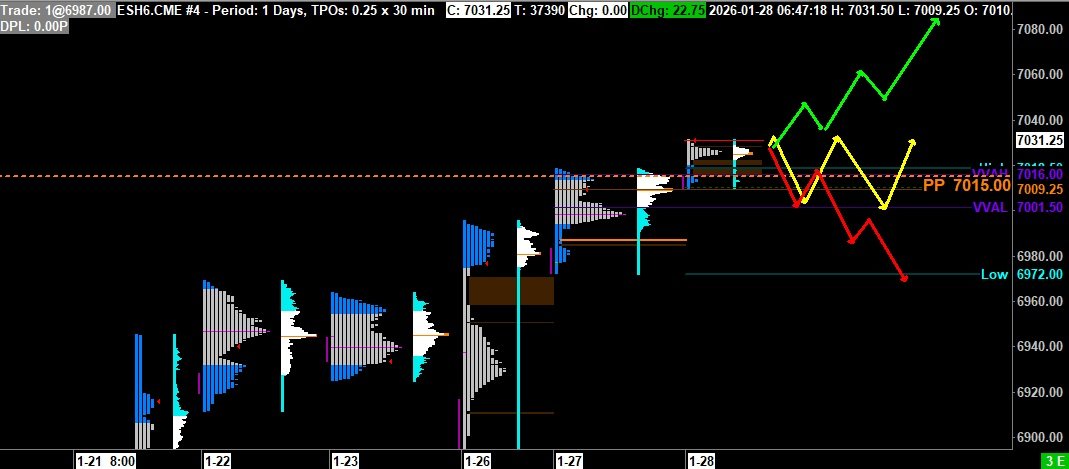

VPOC: 7009.25

VVA: 7001.50 – 7016

PP: 7015

Open: 7010.25 (Zone 1)

Vix: 16.36

SP500 Trend: Overall Sentiment Neutral 🟠 to Bullish 🟢

Yesterday, the S 500 had a bullish day interspersed with consolidation phases. During the Asian session, after a rejection below VVAL-1, the price broke through the 6982-6988 resistance zone, then VVAH-1. It then climbed to the symbolic 7000 level, where it traded sideways between 7000 and the previous day’s high of 6995.

At the US open, despite a strong buying delta, sellers managed to push the price below VVAL-1, but after a significant battle, the price was rejected below 6993, and sellers relented. The price then rose to the 7000-7005 resistance zone, and once broken, moved towards a 7017-7018 resistance zone. The price then settled between these two zones, where it consolidated. The price closed on the VWAP at 7006.

This morning, the S 500 opened in Zone 1 at 7010.25 and has already broken VVAH-1 at 7016 to test the major resistance zone of 7025-7036. This zone will be crucial to confirm a further rise, with the S 500’s ATH located at 7036. Upon rejection above this zone, the price could correct quite significantly, especially if there are negative surprises tonight during the FOMC speech. A status quo on a 3.75% rate is 95% expected by analysts, but the tone of the speech will be of great importance for future prospects.

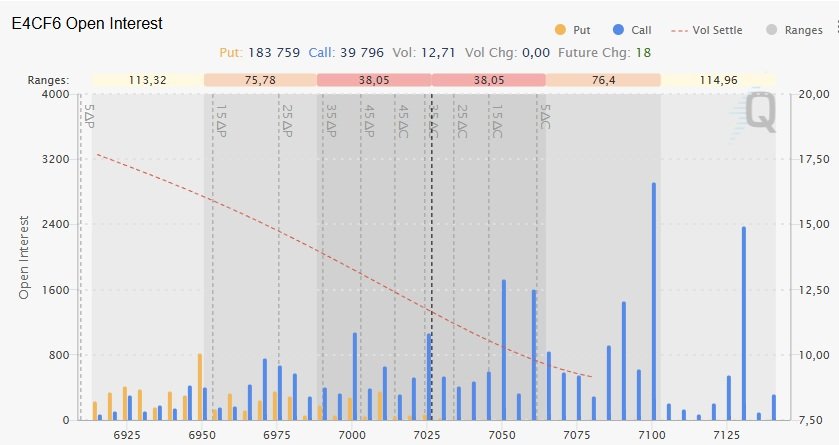

Option levels show significant interest around 7100, which could attract the price but also create a major barrier that could block further ascent in case of a strong rally.

We can observe a small bearish divergence on the RSI on the 5-minute chart, which is still far from being confirmed, but its evolution will need to be monitored closely.

Today, Trump is expected to speak around 4:00 PM, before the FED decision at 8:00 PM. We will also have crude oil inventories. The Magnificent 7 begin reporting their earnings tonight in the post-market. We will have Microsoft, Meta, and Tesla. ASML is also scheduled to release its earnings pre-market, which could influence volatility and indicate the health of the Tech sector.

Scenario 1 🟡: Upon rejection at the ATH of 7036, the price could consolidate in the 7036-7000 zone.

Scenario 2 🟢: Upon breaking the ATH at 7036, the price could target 7080, then 7100.

Scenario 3 🔴: Upon rejection in the 7025-7036 resistance zone and a break of VVAL-1, the price could correct and target the 6982-6988 support zone, then the weekly VPOC at 6944.

Zones of Interest:

- 7025-7036 (Resistance Zone + ATH 7036)

- 7013-7017 (Support Zone + VVAH-1 7016)

- 7000-7005 (Support Zone + VVAL-1 7001)

- 6994-6995 (Support Zone)

- 6982-6988 (Support Zone)

- 6972 (Previous Day’s Low)

Update 7:00 AM:

A strong bullish push occurred to break the ATH at 7036, but the price was strongly rejected above this level. Buyers continue to push, but sellers are defending well. If the price manages to break through, the ATH could form good support. As mentioned previously, this level is crucial to confirm the uptrend.

60-second Chrono

Stock Market:

The Nasdaq and SP 500 closed higher, despite mixed earnings results and a sharp decline in health insurer sales. The US dollar fell, while Treasury yields were mixed ahead of an imminent Federal Reserve interest rate decision.

Corporate Earnings:

- Microsoft : Forecasts a 15.3% increase in revenue, driven by demand for its Azure cloud services.

- Meta : Expects a 20% rise in revenue, boosted by artificial intelligence tools.

- Tesla : Forecasts a 3.6% decline in revenue, indicating a drop in demand.

- UnitedHealth : Announces first revenue decline in nearly four decades, following a lower-than-expected Medicare proposal.

Economic Events:

- The Federal Reserve is expected to maintain interest rates in a range of 3.5% to 3.75%.

- Consumer confidence has reached its lowest level in 11 years, influenced by concerns about the labor market and inflation.

Oil and Precious Metals Sector:

- Oil prices rose due to disruptions caused by a winter storm.

- Gold prices also increased, reaching record highs due to economic uncertainty.

Future Outlook:

Tech companies, including Microsoft and Meta, are under pressure to demonstrate that their artificial intelligence investments can sustain growth. Particular attention is being paid to corporate spending strategies and their ability to adapt to an uncertain economic environment.

Macro

Consumption: A Concerning Deterioration of Sentiment

Consumer Confidence

- Current: 84.5

- Forecast: 90.6

- Previous: 94.2

-> This is a very negative surprise. The figure is not only well below expectations, but it also marks a sharp drop compared to the previous month. This means Americans are concerned about their financial future and are likely to reduce their spending. However, consumption is the main driver of American growth.

This stark red figure is an alarm signal for the American economy (risk of slowdown). Fundamentally, this could prompt the FED to ease its monetary policy to support consumption.

0 Comments