Economic Announcements:

- 2:30 PM: Durable Goods Orders

- 7:00 PM: 2-Year T-Note Auction

Earnings Reports:

- Nucor (NUE)

- Brown&Brown (BRO)

- Steel Dynamics (STLD)

- WR Berkley (WRB)

- Alexandria RE (ARE)

Analysis:

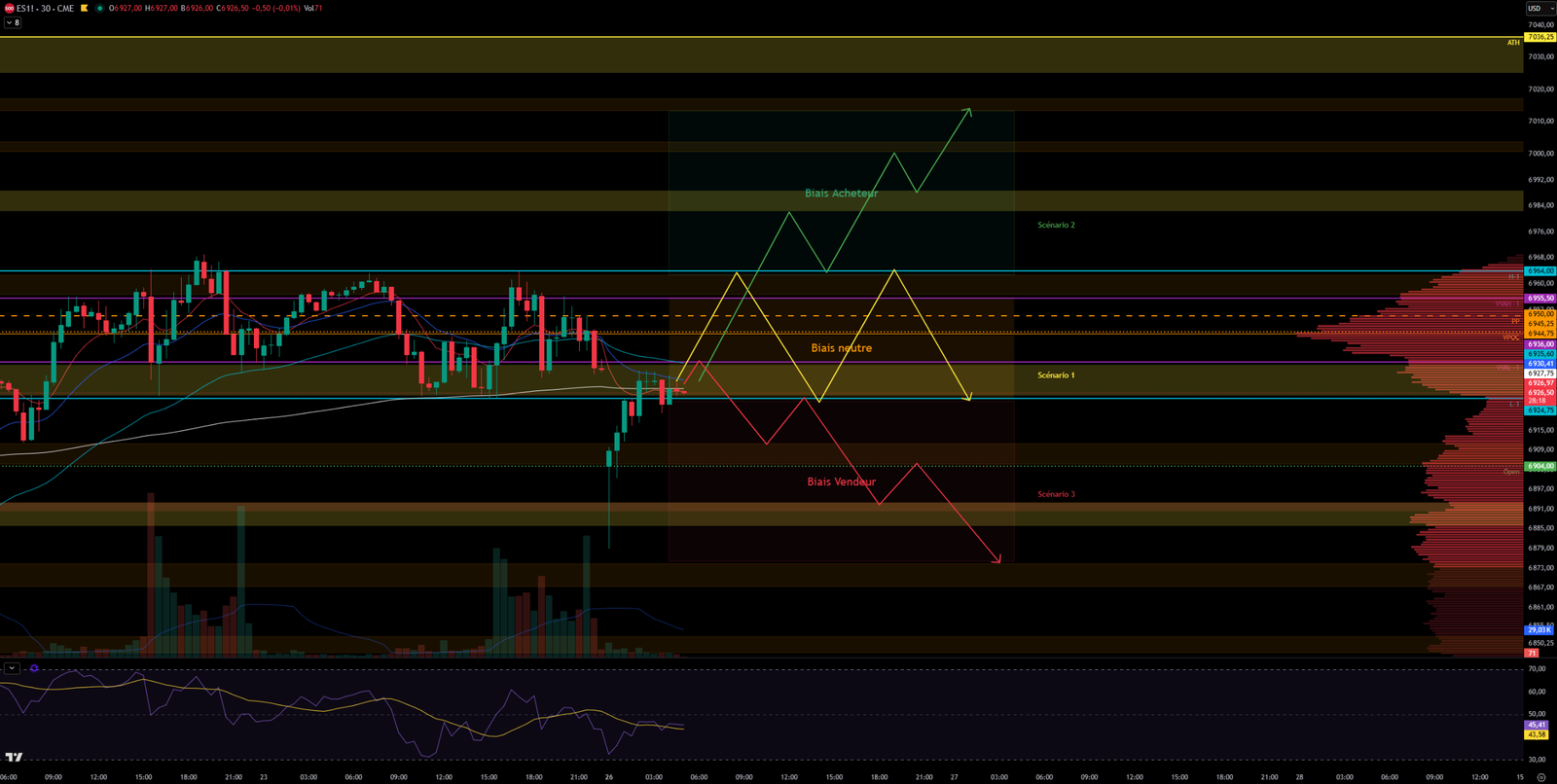

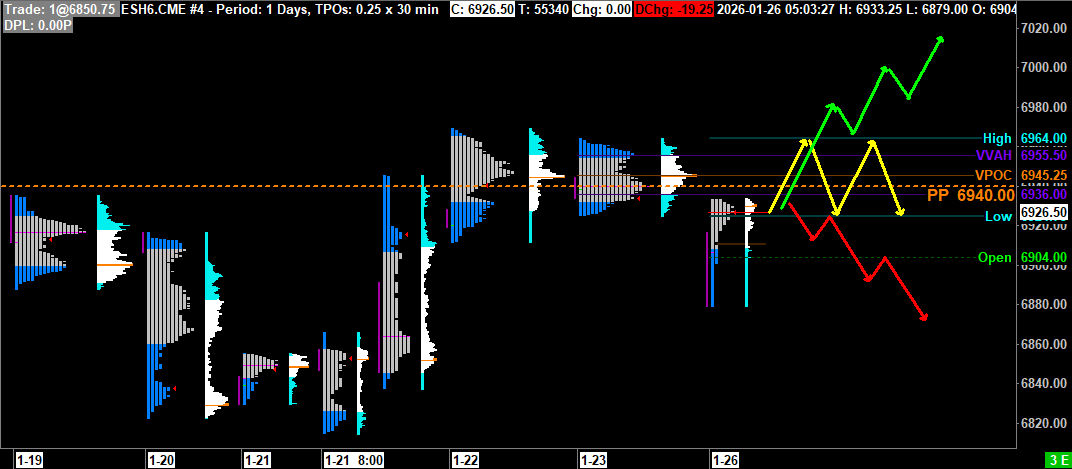

VPOC : 6945.25

VVA: 6936 – 6955.50

PP: 6940

Open: 6904 (Zone 3)

Vix: 16.08

SP500 Trend: Overall neutral sentiment 🟠

On Friday, the S&P 500 continued its sideways movement within the previous day’s value area between 6928 and 6955, with two attempts to break higher in the morning and then at the US open. However, the index remained in this zone until closing at 6933, below the weekly VPOC. PMI figures were released in line with expectations, similar to previous data released during the week, and did not disrupt the markets.

This morning, the S&P 500 opened with a large bearish gap in Zone 3 at 6904, below the VWAP, and was rejected below the 6890-6896 support zone. The price has already filled the gap and is working within the 6924-6933 zone, between Friday’s low and VVAL. Sellers likely sought out trapped liquidity before the significant rally at the end of the week. If the price is to resume its upward movement, it will need to break the 6956-6964 resistance zone, a level reinforced by the VVAH and Friday’s high. The same applies to the downside, where the 6924-6936 resistance is accompanied by the VVAL and Friday’s low.

Today we will have durable goods orders data and 2-year T-note auctions. There will be some company earnings reports, but the serious action truly begins on Wednesday with Microsoft, Meta, and Tesla.

Scenario 1 🟡: Upon rejection above Friday’s high at 6964, the price could consolidate within the 6924-6964 zone.

Scenario 2 🟢: Upon a break above Friday’s high at 6964, the price could resume its upward trend and target 6990, then 7000.

Scenario 3 🔴: Upon a break below Friday’s low at 6924, the price could resume its decline and target 6910, then 6890

Zones of Interest:

- 7025-7038 (Resistance Zone + ATH 7036)

- 6982-6988 (Resistance Zone)

- 6956-6964 (Resistance Zone + Friday’s high + Friday VVAH)

- 6924-6936 (Support Zone + Friday’s low + Friday VVAL)

- 6904-6912 (Support Zone + open 6904)

- 6886-6892 (Support Zone)

60-second Chrono

Stock Market

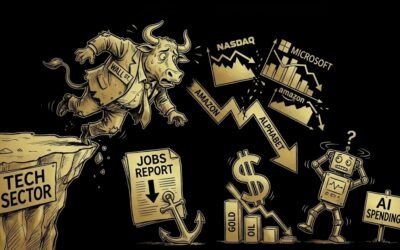

Major Wall Street indices showed mixed results, with a notable drop in Intel shares affecting overall sentiment. The S&P 500 saw a slight increase, while the Dow Jones recorded a decline.

Bond Yields and Dollar

Treasury yields slightly decreased ahead of an imminent Federal Reserve decision. The dollar also lost value, partly due to yen volatility.

Commodity Prices

Oil prices rose following additional US sanctions against Iran, and gold reached record levels due to safe-haven demand.

Economic Forecasts

The U.S. Census Bureau is set to release durable goods data, with expectations for an increase in new orders after a previous decline.

Company Earnings

Many companies, including Apple, Microsoft, Meta, and Tesla, are preparing to release their earnings. Forecasts indicate an increase in revenue for some, while others, like Tesla, might experience a decline.

Upcoming Economic Events

The coming week will be crucial with the Federal Reserve meeting on interest rates, as well as company earnings releases and important economic data.

Geopolitical Context

Geopolitical tensions continue to influence markets, with concerns related to US military intervention in the Middle East and implications for energy supply.

0 Comments