Macro

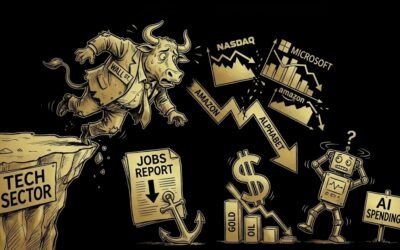

This week was packed with significant macroeconomic data, including GDP and inflation figures. The U.S. economy is showing surprising signs of strength, reinforcing the soft-landing scenario and reducing the urgency for a rapid rate cut by the Fed, which may displease the market.

The labor market remains tight with only 200K new unemployment claims against the 209K expected, indicating few layoffs, further reinforcing the lack of urgency for an upcoming rate cut.

Inflation figures came out in line with expectations and are on a stabilizing path, but they remain above the Fed’s 2% target.

All this data had only a limited impact on the markets, as the results were in line with expectations, with no major surprises.

Gold continues its record-breaking run, having almost reached the symbolic $5,000 per ounce mark. This rise is due to increasing global geopolitical uncertainty, despite the relative easing of tensions between the United States and Greenland at the end of the week.

This week, the FOMC interest rate press conference is scheduled for Wednesday. The market is anticipating a 95% chance of a status quo. Otherwise, macroeconomic statistics should be somewhat calmer, with durable goods orders, consumer confidence, unemployment, and the Chicago PMI.

Summary

- Macro results in line with expectations, with no major surprises for the markets

- Inflation stable but still above 2%

- Gold nearing $5,000 per ounce

- FOMC interest rate conference Wednesday

News

The week was marked by Trump’s geopolitical twists and turns regarding Greenland, shifting markets from Risk ON to Risk OFF in a matter of days. Early in the week, Trump threatened to impose 10% (or even 25%) tariffs on 8 European countries due to a dispute over the purchase of Greenland, significantly increasing market fear. These threats were subsequently canceled following an alleged agreement with NATO.

In the United States, the Supreme Court refused to rule immediately on the legality of Trump’s tariffs, postponing

any decision for at least a month.

The banking sector was also hit hard following Trump’s statements suggesting a cap on credit card interest rates.

Earnings season is in full swing, with releases from companies like Intel and Netflix, which fell following disappointing results.

This week, major tech companies will announce their earnings, including Microsoft, Meta, Tesla, ASML, IBM, Apple…

Summary

- Easing of the situation between the United States and Greenland

- Upcoming earnings from Microsoft, Meta, Tesla, Apple.

Market

Weekly Levels

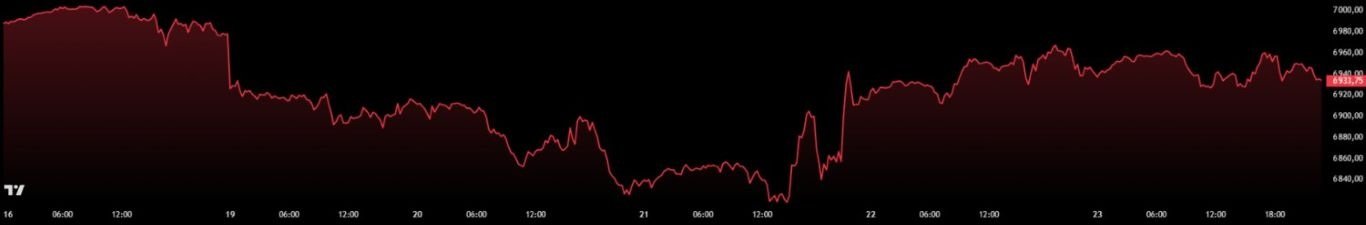

VPOC: 6944.75

VVA: 6872.25 – 6966

Low & High: 6814.50 – 6969

This week, the market opened at 6918 on a Wall Street holiday with a large bearish GAP following Trump’s threats regarding Greenland. The index continued its decline until Wednesday despite some corrections, especially on Tuesday when buyers tried to regain control but were blocked at 6900.

On Wednesday, the asset hit the major support zone of 6815 – 6830 before strongly rebounding at the US open on Wednesday following the cancellation of Trump’s threats. The price then tested 6900 before a significant correction around the weekly VWAP and finally closed around 6920. The end of the week was calmer, with the SP500 consolidating between the support/resistance zones of 6910-6915 and 6960-6970. The price ended the week with a very slight gain of 0.22%, closing at 6933.

This week, we were able to anticipate the index’s bullish rebound thanks to a bullish divergence spotted on Thursday, after a previous one was invalidated the day before due to geopolitical news. By the end of the week, the price stagnated within the VVA, meaning that participants agreed on a price. The bearish GAP was partially filled but not entirely; therefore, the resistance zone of 6982-6988 will need to be broken to hope for a continuation of the bullish movement. The VWAP is in a bullish position, but the RSI is currently in the neutral zone, reinforcing the previously mentioned sense of balance.

On the Daily chart, a bearish divergence was validated then invalidated, even if the invalidation remains timid for now.

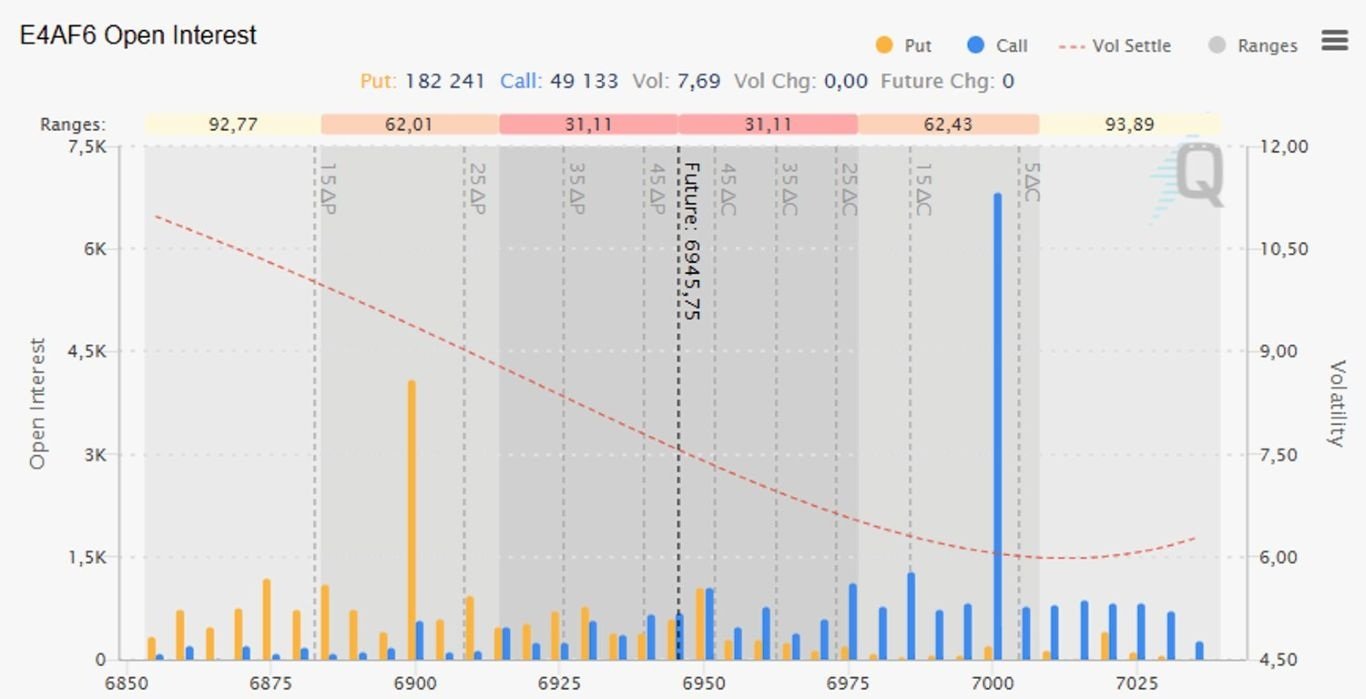

Regarding options, we can observe interest in calls at 7000 and, to a lesser extent, puts at 6900, which could indicate investor interest in a price within this range.

We will have to wait for Monday’s open to glimpse the index’s direction; without a clear direction, we could continue to stagnate until Wednesday during the Fed’s rate announcement.

Points of Interest

- 7020-7035 (Resistance Zone + ATH 7036)

- 6961-6968 (Resistance Zone + Weekly VVAH)

- 6944-6950 (Resistance Zone + VPOC 6944)

- 6924-6930 (Support Zone)

- 6911-6915 (Support Zone)

- 6890-6896 (Support Zone)

- 6865-6874 (Support Zone + Weekly VVAL)

- 6814-6830 (Major Support Zone)

Overall Sentiment: Neutral

0 Comments