Economic Announcements:

- 3:45 PM: PMI index

- 4:00 PM: Michigan index

Earnings Reports:

- Sib NV (SLB)

Analysis:

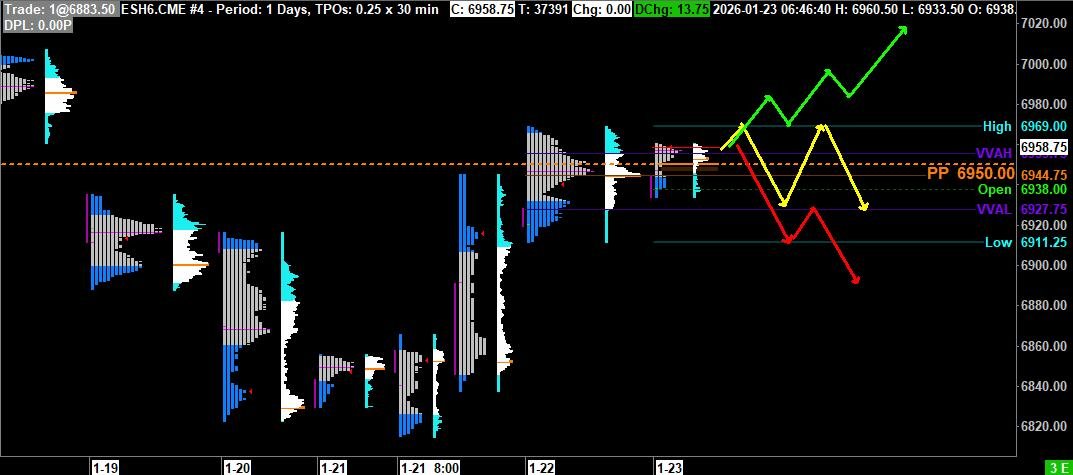

VPOC : 6944.75

VVA : 6927.75 – 6955.75

PP: 6950

Open: 6938 (Zone 1)

Vix: 15.63

SP500 Trend : Overall bullish sentiment 🟢

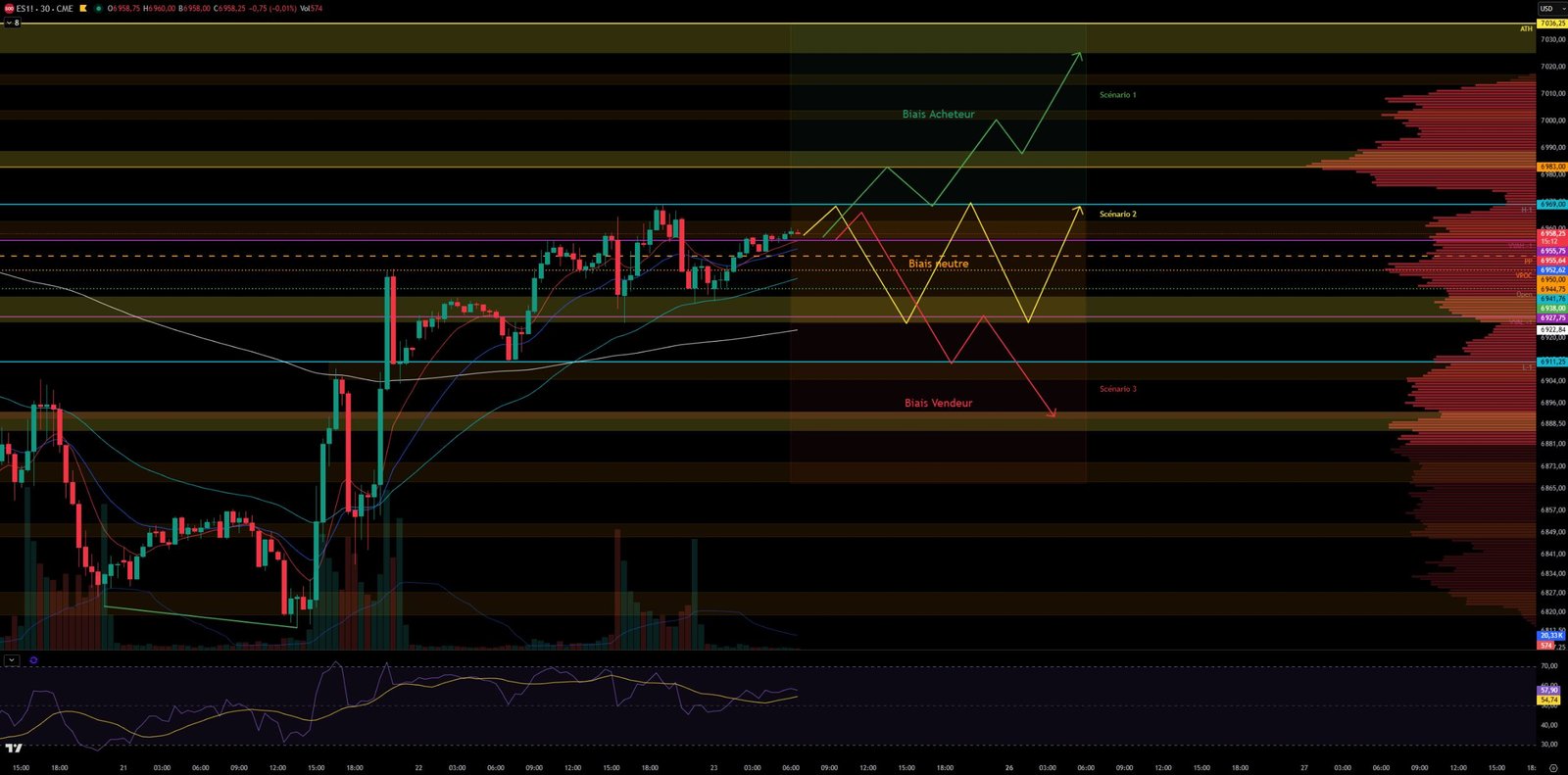

Yesterday, the S&P 500 opened with a slight upward gap at 6920, in an upward imbalance. Buyers took control to push the price towards the resistance zone of 6926-6942, where sellers took over. The index then retested the support zone of 6904-6910 (not far from VVAH-1) around 7:00 AM.

After this retest, the price rose and ended the morning between the support/resistance zones of 6926-6942 and 6956-6963, a zone that contained the price throughout the day, even after the US open and despite several breakout attempts. GDP, PCE, and unemployment data showed an economy that is still robust and had very little influence on the markets, as they were in line with investor expectations, leading to no negative surprises.

The VIX index fell back below 16, confirming a return to Risk-ON. The S&P 500 almost entirely closed Monday’s bearish gap. The US index closed at 6944.

This morning, the S&P 500 opened in Zone 1 at 6938. Sellers attempted to take control right from the open but were pushed back at the support zone of 6936-6941, a level where they had already been repelled last night before the close. Buyers pushed the price up to the resistance zone of 6956-6963. The price is once again trading between these two zones, and one of them will need to be clearly breached for the price to move in either direction.

Currently, forces appear rather balanced, with the cumulative delta being quite neutral. However, yesterday’s bullish divergence has been validated, and for now, the RSI is trading in positive territory.

Today, we will have the PMI figures as well as the Michigan index.

Scenario 1 ;🟢: Upon a breakout of the Resistance zone of 6956-6963 and confirmation with a break of yesterday’s high at 6969, the price could resume its ascent and target the resistance zone of 6982-6989 with the weekly VPOC at 6983, then head towards the ATH.

Scenario 2 🟡: Upon rejection at yesterday’s high of 6969, the price could once again consolidate between the support/resistance Zones of 6926-6942 and 6956-6963

Scenario 3 🔴: Upon a break of the support zone of 6925 and 6934, the price could target yesterday’s low at 6911 and return to the level of 6900

Zones of Interest:

- 7025-7035 (major resistance zone + ATH 7036)

- 6982-6988 (Resistance Zone)

- 6956-6963 (Resistance Zone + VVAH-1 6955)

- 6926-6935 (Support Zone + VVAH-1)

- 6904-6910 (Support Zone + yesterday’s low 6911)

- 6885-6893 (Support Zone)

60-second Chrono

Economic Context

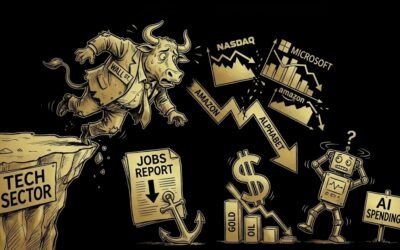

- Stock markets experienced a rise following President Trump’s cancellation of tariff threats against European allies, thereby boosting investor confidence.

- Treasury yields varied, while the US dollar weakened.

Economic Data

- Forecasts for US manufacturing and services activity are expected, showing signs of resilience in the American economy.

- Economic activity figures in Mexico show a slowdown in growth.

Market Reactions

- Shares of companies like Procter & Gamble and GE Aerospace were influenced by disappointing or promising financial results, respectively.

- Gold prices reached new highs due to expectations of Fed interest rate cuts.

Notable Events

- Trump sued JPMorgan Chase for $5 billion, alleging political debanking.

- Elon Musk criticized US solar tariffs at the World Economic Forum in Davos, while announcing ambitious goals for Tesla.

Outlook

- Investors remain attentive to geopolitical developments, particularly tensions surrounding Greenland and Iran, which influence commodity markets.

- Discussions about “de-dollarization” persist, although foreign investments in US assets have remained strong so far.

Macro

GDP and Employment: Remarkable American Resilience

The US economy demonstrates stronger-than-expected resilience, which reinforces the stance of a “generally bullish S&P 500” while providing the Fed with room to maneuver.

GDP Growth (Q3)

Current: 4.4%

Forecast: 4.3%

Previous: 3.8%

GDP Price Index: 3.7% (In line with expectations)

Analysis: The acceleration in growth (4.4% versus 3.8% in the previous quarter) indicates an economy growing faster than anticipated. This is a sign of strong resilience that supports the Dollar, but it could delay the Fed’s interest rate cut timeline.

Labor Market

Unemployment Claims: 200K (Expected: 209K)

Regular Beneficiaries: 1,849K (Previous: 1,875K)

Analysis: The labor market remains very tight with fewer layoffs than expected. This lack of significant deterioration allows the Fed to maintain high rates longer to stabilize inflation without fearing an immediate recession.

Inflation (PCE): Stability Under Scrutiny

The PCE index, the Fed’s preferred measure, holds no negative surprises but confirms that the fight against inflation is not yet over.

PCE Core (Quarterly Q3): 2.90% (In line with forecasts)

PCE Core (Annual – Nov.): 2.8% (Versus 2.7% previously)

PCE Core (Monthly – Nov.): 0.2% (Stable)

Analysis: Inflation is broadly in line with expectations. Although it has risen very slightly year-over-year (2.8%), it remains on a stabilization path, while still staying above the 2% target.

Energy: Crude Oil Inventory Surplus

Energy data shows a notable imbalance between supply and demand.

Crude Oil Inventories:

+3.602M

Forecast: -1.000M

Previous: +3.391M

Analysis: With a surplus of over 3.6 million barrels when the market expected a draw in inventories, the pressure on energy prices is clearly bearish. This supply surplus relative to demand exerts downward pressure on crude prices.

Market Impact Summary

Sentiment: Neutral to Slightly Bullish.

Analysis: The initial impact was neutral as the figures were largely anticipated by investors. The strength of the GDP/Employment pair confirms the “soft landing” scenario, which supports equity indices in the medium term.

0 Comments